Stocks edged lower on Monday as investors found little reason to extend a five-week rally on lingering uncertainty over whether Greece would accept the terms of a bailout.

Shares of Facebook were auctioned Thursday on the private site SharesPost that would value the entire company at $94 billion.

As pro-business groups clamor to convince regulators to overhaul their draft of the controversial Volcker rule, fault lines are emerging within the opposition over just what a revamped draft should look like.

Assuming the $100 billion initial public offering by Facebook proceeds as planned, investors will likely clamor for shares and snap them up, just as in earlier Web frenzies for Netscape Communications, Yahoo and Google. But there are dangers.

Facebook filed a $5 billion IPO on Wednesday, meaning that the social media giant will become a publically traded company, and anyone will be able to buy shares of Facebook starting this spring. But what is an IPO?

Depending on who you ask, Facebook is either the best company to go public since Google or the hallmark of another tech bubble.

The job cuts, if they go through, would be part of thousands of other cuts which financial institutions plan to make in the near future.

Facebook filed for an initial public offering with the U.S. Securities and Exchange Commission Wednesday, for the first time doing a public financial strip tease.

Now that the Facebook filing is available, it's pretty clear that before he turns 28, CEO Mark Zuckerberg will be a billionaire. Maybe, if the IPO is as successful as hoped, he'll be worth about $28 billion.

Facebook unveiled plans for the biggest ever Internet IPO that could raise as much as $10 billion, but made it clear CEO Mark Zuckerberg will exercise almost complete control over the company, leaving investors with little say.

JPMorgan Chase & Co surprised Wall Street by winning a leading role in Facebook's much anticipated public offering, besting other banks that have competed for months for the coveted position.

Anti-virus software maker AVG Technologies NV priced its initial public offering at $16 per share, at the low end of the expected range, according to a market source.

Anti-virus software maker AVG Technologies NV priced its initial public offering at $16 per share, at the low end of the expected range, according to a market source.

Stocks extended January's rally on Wednesday after upbeat global manufacturing data boosted sentiment and as Greece neared a long-delayed deal with private creditors.

JC Penney's new Chief Executive Ron Johnson thinks shoppers have dropped the coupon-hounding, sale-chasing era when department stores reigned. Retail territory has been ceded to bargain sellers such as Walmart and Target. The former Apple retail executive offered a much-hyped solution last week, mixing branding, a new pricing structure and a buoyant ethos.

Stocks rallied on Wednesday as upbeat economic data out of China and Germany eased concerns about the global economy and Greece neared a long-delayed deal on a debt swap.

Facebook is expected to submit paperwork to regulators on Wednesday morning for a $5 billion initial public offering and has selected Morgan Stanley and four other bookrunners to handle the mega-IPO, sources close to the deal told IFR.

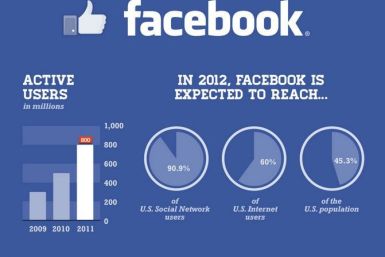

Facebook Inc. will list a preliminary fund-raising goal of $5 billion on Wednesday, which is smaller than some earlier estimates of the offering. The public stock offering will probably value the company at $80 billion to $100 billion. But how did simple status updates and random photos of users help create what will likely be the biggest tech IPO in till date? Let's try to find out here...

Facebook is expected to submit paperwork to regulators on Wednesday morning for a $5 billion initial public offering and has selected Morgan Stanley and four other bookrunners to handle the mega-IPO, sources close to the deal told IFR.

Morgan Stanley is all set to trump Goldman Sachs in a deal to buy a brokerage seat in Indonesia from PT Tiga Pilar Sekuritas, five sources said, as the race to tap the growing financial market in Southeast Asia's biggest economy intensifies.

Within days, Facebook is expected to file for an initial public offering with the U.S. Securities and Exchange Commission, for the first time doing a public financial strip tease.

BSkyB, Britain's dominant pay-TV group, is to launch an online offering to enable it to better take on the likes of Lovefilm and Netflix, following some signs of slowing growth at its main satellite business.