Stocks jumped to their highest since July on Wednesday as the International Monetary Fund sought to help countries hit by the European debt crisis, while forecast-beating earnings from Goldman Sachs dispelled some worries over bank profits.

Stocks jumped to their highest since July on Wednesday as the International Monetary Fund sought to help countries hit by the European debt crisis, while forecast-beating earnings from Goldman Sachs dispelled some worries over bank profits.

Stocks gained on Wednesday as the International Monetary Fund sought to help countries hit by the European debt crisis, while Goldman Sachs' healthy earnings gave the financial sector another boost.

Morgan Stanley removed General Motors Co as its top pick of U.S. auto stocks on Wednesday, expressing doubts the No. 1 U.S. automaker had the political will to overhaul its European operations.

The top aftermarket NYSE losers on Tuesday were: Tata Motors, BancorpSouth, Targa Resources Partners, POSCO, Computer Sciences, Generac Holdlings, SunCoke Energy, Morgan Stanley, Enerplus Corp and Alliance Data Systems Corp.

As Wall Street waits for Goldman Sachs Group (NYSE:GS) -- the fifth-largest U.S. bank by assets and one of the most powerful banking institutions in the world -- to report fourth-quarter earnings Wednesday, the question most analysts seem to have is not whether the earnings release will be underwhelming, but just how bad the hit will be.

Stock index futures pointed to a higher open on Wall Street on Tuesday following a long holiday weekend, with futures for the S&P 500 up 1.01 percent, Dow Jones futures up 0.95 percent and Nasdaq 100 futures up 1.1 percent at 1027 GMT.

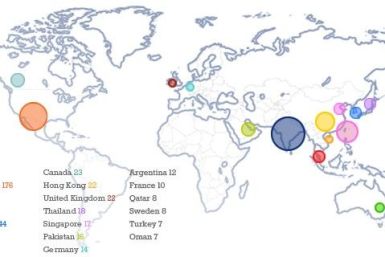

The IBT 1000 List of the fastest-growing public companies in the world -- which debuts today for what its editors hope will be yearly issuance -- is a reflection of the engines driving the world's economic growth.

Investment bank Morgan Stanley plans to tell employees this week that bonuses will drop, with cash payouts capped for now at $125,000, The Wall Street Journal reported on Monday.

Investment bank Morgan Stanley plans to tell employees this week that bonuses will drop, with cash payouts capped for now at $125,000, The Wall Street Journal reported on Monday.

Greece debt talks are at an impasse and concerns are rising that the country will face a hard default within six weeks if a plan is not reached. Greek leaders are set to resume negotiations with private-sector creditors this week with hopes of reaching the base points of a debt deal to avoid national default by a Feb. 23 meeting of Eurozone finance ministers.

Mass Eurozone ratings downgrades are unlikely to shake up investors too much, but with Greek debt talks at an impasse, pressure has been loaded on the bloc to shore up its defenses and glimmers of optimism from last week have been firmly doused.

Financial markets are unlikely to be derailed by mass euro zone downgrades, but with Greek debt talks at an impasse, pressure has been loaded on the bloc to shore up its defenses and glimmers of optimism from last week have been firmly doused.

Thanks to the new touch panel technology, the next generation iPhone, dubbed iPhone 5, will be thinner than the current generation models, a Morgan Stanley analyst said on Friday.

Internet security software maker AVG Technologies NV filed with U.S. regulators to raise up to $125 million in an initial public offering.

Investors have approved a year-long extension of a $4.7 billion property megafund from Morgan Stanley , a company spokesman told Reuters on Friday.

Here's an economic riddle of sorts: Which economy grew faster over the last seven years? A) President Hugo Chavez's Venezuela, famous for its forced nationalizations and 21st century socialism, or B) Chile, long renowned as a capitalist paradise for investors.

A recent rise in loans to businesses is spurring hope that U.S. bank earnings reports, which begin on Friday, will show the outlook for this economically critical industry is better than battered stock prices and weak investment banking volumes suggest.

UBS' Americas wealth management group has hired a team of three veteran Morgan Stanley Smith Barney advisers in California, the firm said on Wednesday.

UBS' Americas wealth management group has hired a team of three veteran Morgan Stanley Smith Barney advisers in California, the firm said on Wednesday.

A recent rise in loans to businesses is spurring hope that bank earnings reports, which begin Friday, will show that the outlook for this economically critical industry is better than its battered stock prices and weak investment banking volumes would suggest.

The futures regulator on Wednesday adopted new protections for customer collateral posted in swap trades, and said it plans a broader look into client safeguards, as the search continues for hundreds of millions of dollars in missing MF Global customer money.