Spotify Reports First Operating Profit, Expands Into Podcasts

Spotify (NYSE:SPOT), the largest paid music-streaming service in the world, just hit a major milestone: an operating profit. The Swedish company reported fourth-quarter earnings results this morning, with Spotify topping its own expectations on a number of fronts. Meanwhile, Spotify is also ramping up its efforts to challenge Apple in podcasting, announcing two major acquisitions while setting aside cash for more future purchases.

However, investors aren't overly impressed, likely due to Spotify's timid forecast for 2019.

Approaching 100 million premium subscribers

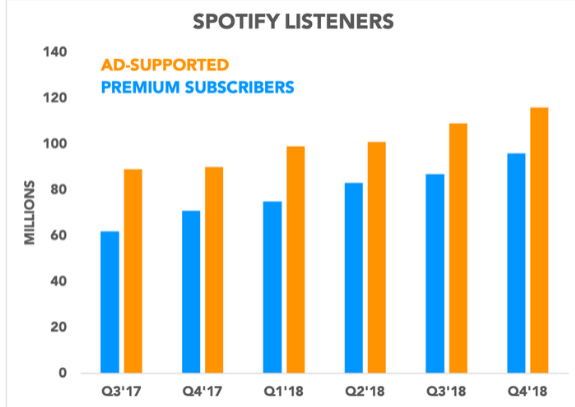

Revenue jumped 30% to 1.5 billion euros ($1.7 billion), driven by strong premium subscriber additions. Spotify added 9 million premium subscribers during the quarter, bringing its total to 96 million. The bulk of those additions (7 million) were added as part of a six-week promotional campaign that the company ran over the holidays. Ad-supported listeners grew to 116 million, with total monthly active users (MAUs) hitting 207 million. Note that those two figures don't add up since some premium subscribers are inactive. The high end of Spotify's outlook had called for 96 million premium subscribers and 206 million total MAUs.

The family and student plans continue to grow nicely, reducing both churn and premium average revenue per user (ARPU). Churn declined 30 basis points to 4.8%, while premium ARPU came in at 4.89 euros ($5.56). Markets with lower ARPU are also starting to represent a larger proportion of the subscriber base, also hurting premium ARPU. Spotify prices its service differently in various countries around the world to accommodate local market conditions, and emerging markets are becoming an increasingly important growth driver for the company.

Gross margin expanded to 26.7%, thanks in part to a few one-time items like a license fee adjustment that was recognized in the fourth quarter. Premium gross margin was 27.3% and ad-supported gross margin was 22.1%. Spotify was able to reduce operating expenses by 17% to 305 million euros ($347 million), resulting in the company's first operating profit of 94 million euros ($107 million). Much like in the third quarter, hiring activity was slower than expected, which bolstered operating margin. Spotify's declining share price also resulted in lower expenses such as payroll taxes related to stock-based compensation. That all resulted in net income of 442 million euros ($502 million).

Betting big on podcasts

Spotify also announced two major acquisitions, Gimlet and Anchor, to beef up its podcasting capabilities. No financial terms were officially disclosed, but Gimlet's price tag is rumored at $230 million. Gimlet is a growing membership-based podcasting platform and Anchor provides various tools for content creators to make, distribute, and monetize podcasts.

In a blog post, CEO Daniel Ek said that Spotify's future wouldn't rest solely on music, but rather all forms of audio content. Podcasting represents what Ek calls "the next phase of growth in audio." On the earnings call, Ek also noted that podcast listeners are nearly twice as engaged as non-podcast listeners. Without royalty expenses, podcasts also represent margin upside.

There's more where that came from: Spotify has allocated a total of $400 million to $500 million toward acquisitions that it plans to make in 2019. Even without knowing how much Spotify is spending on Gimlet and Anchor, it's clear that the company is keeping its powder dry

Mediocre guidance

For the first quarter, Spotify expects total MAUs to hit 215 million to 220 million, with premium subscribers growing to 97 million to 100 million. Total revenue should be 1.35 billion euros to 1.55 billion euros ($1.5 billion to $1.8 billion), with gross margin of 22.5% to 24.5%. The Swedish company expects to swing back to an operating loss of 50 million euros to 120 million euros ($57 million to $136 million).

Spotify also provided a full-year forecast and believes it will finish 2019 with 245 million to 265 million MAUs and premium subscribers of 117 million to 127 million. Total revenue for the year should be 6.35 billion euros to 6.8 billion euros ($7.2 billion to $7.7 billion). That should lead to an operating loss of 200 million euros to 360 million euros ($227 million to $409 million).

The 2019 outlook is likely what's weighing on investor sentiment, as revenue growth is starting to decelerate, reverting to operating losses isn't encouraging, and Spotify still trades at hefty premiums as investors price in growth expectations (Spotify shares are trading at nearly 4.5 times sales currently). That's a recipe for a disappointed market reaction, despite the first operating profit.

This article originally appeared in the Motley Fool.

Evan Niu, CFA owns shares of AAPL and Spotify Technology. The Motley Fool owns shares of and recommends AAPL. The Motley Fool has the following options: long January 2020 $150 calls on AAPL and short January 2020 $155 calls on AAPL. The Motley Fool has a disclosure policy.