The State Of Bitcoin, Ether Prices After Fed Cuts – Bull Run In Weeks?

KEY POINTS

- Bitcoin added around $3,000 since the Fed's 0.5% rate cut

- Ethereum and other top cryptocurrencies crossed the green line

- Analysts and Bitcoiners believe $BTC is poised for its 'biggest' bull run yet

Interest rate cuts by the U.S. central bank are known to move financial markets, and in the case of cryptocurrencies, the digital assets seemed pleased with the news as prices have been surging over the last 24 hours.

The U.S. Federal Reserve cut its key lending rate by half a percentage point Wednesday, marking its first cut in over four years and allowing breathing space for American consumers suffering from high prices ahead of the critical 2024 elections.

Bitcoin Reacts, Dragging Other Top Coins Up

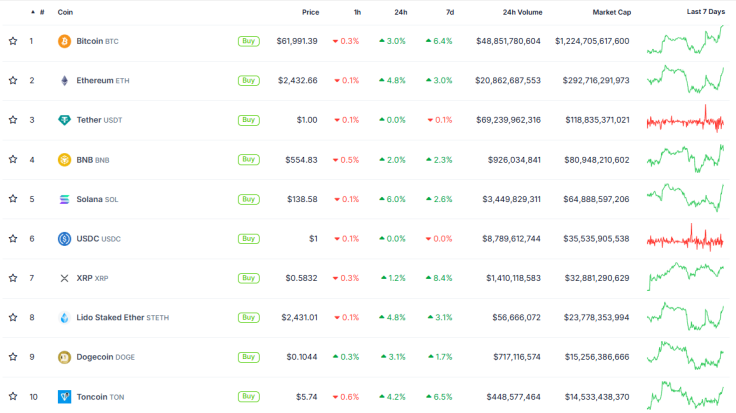

Bitcoin (BTC), the world's largest digital asset by market value, apparently reacted to the news, experiencing a sharp spike from $59,000 to a high of a little over $62,000 in the past day, data from CoinGecko showed.

The digital currency has been rallying by more than 6% in the past seven days and saw a surge of over 3% in the last 24 hours. It isn't the only one celebrating the Fed's rate cuts.

Ethereum (ETH), which is the closest cryptocurrency to BTC in market cap, also hustled Wednesday and as of early Thursday has been on a 4.8% uptrend. Ether's spike comes after weeks of frustration in the Ethereum community, with some fearing that the coin may be sliding toward its doom.

All other coins on CoinGecko's Top 10 list were in the green early Thursday, with BNB spiking by 2% overnight, Solana (SOL) climbing by 6.0%, and top memecoin Dogecoin (DOGE) surging by over 3%.

In the Top 20, the assets that saw the largest gains in the last day were Shiba Inu (SHIB), Bitcoin Cash (BCH), and Avalanche (AVAX).

Leaving the Bloodbaths Behind

The crypto market's recovery comes over a month after a global financial market meltdown that ultimately hit cryptocurrency prices hard. At the time, Bitcoin bled around $6,000 in less than a day, while Ether suffered what some observers said was a free-fall.

Later in August, crypto saw another bloodbath as BTC plunged from $63,400 to $59,000, triggering liquidations across the crypto space that passed $320 million in a single day.

It appears that September is somehow turning to be a kinder month for the crypto industry, with the Fed rate cuts and rising optimism among crypto users and analysts stating that BTC may be nearing a new bull run.

Bitcoiners Look Forward with High Hopes for 'Biggest' Bull Run

In recent days, Bitcoiners and analysts have been projecting what could be the "biggest bull run of all time." Longtime BTC holder Mags posted a chart that indicates the world's first decentralized cryptocurrency can rise as high as $325,000 by next year if history was to go by.

#Bitcoin

— Mags (@thescalpingpro) September 17, 2024

Its going to be the biggest Bull Run of all time 🚀 pic.twitter.com/GyW5Gcww4x

Mags' projection is possible, considering how Bitcoin has historically gone up months after the halving – the latest being in April.

For prominent crypto YouTuber Crypto Rover, a look at history suggests that the next BTC bull run "should start in 15-20 days." Well-followed @TheBTCTherapist agrees, saying the community is "only a few weeks away from starting the next bull run."

As of early Thursday, Bitcoin is trading at around $62,100, while Ether is at $2,400.

© Copyright IBTimes 2024. All rights reserved.