Stocks Buoyed By Plans To Lift Lockdowns

European and US stock markets mostly climbed on Thursday as investors shrugged off weak economic data and focused on plans to ease some coronavirus lockdown restrictions.

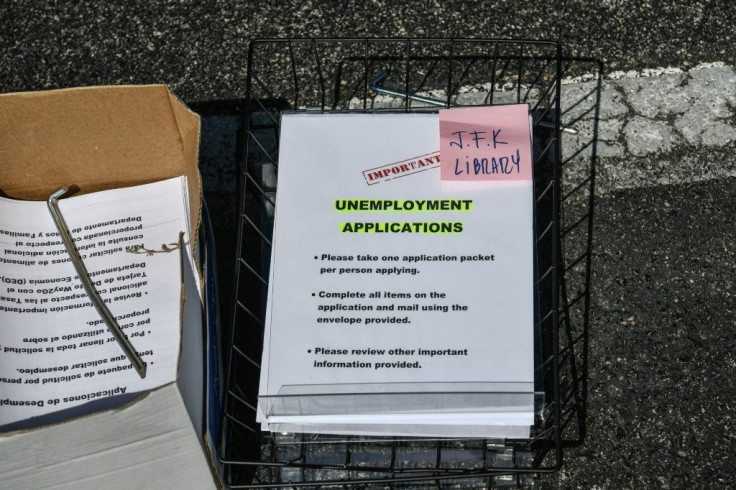

The US reported another big spike in unemployment claims, taking the number of jobs lost since mid-March to 22 million, while British retail sales data slumped amid shelter-in-place orders in the country.

The reports, the latest to paint a dark picture of the economy, were not unexpected, analysts said.

"The market is looking ahead and understanding this is what we have to deal with, and looking forward to at least an attempt to open the economy," said Quincy Krosby, chief market strategist for Prudential Financial.

AvaTrade analyst Naeem Aslam agreed, saying "investors are shrugging off the pessimism and (are) willing to focus on more positive things."

US President Donald Trump was expected later in the day to outline his steps to bring the economy back online, saying on Twitter, "We are having very productive calls with the leaders of every sector of the economy who are all-in on getting America back to work, and soon."

But business leaders have said more widespread testing for coronavirus is essential before the economy can move significantly towards normalcy.

Frankfurt stocks added 0.2 percent after German Chancellor Angela Merkel late Wednesday unveiled the first steps towards undoing coronavirus restrictions that have plunged the eurozone's biggest economy into recession.

"Markets in Europe appear to be stabilizing a touch on some limited relaxation of lockdown restrictions across the region," said CMC Markets analyst Michael Hewson.

"Germany has become the latest European country to say it would be loosening some measures on its lockdown over the coming weeks, which is clearly helping European sentiment for now.

"Reports that the UK has seen a peak in its infection rates is also helping," he added.

London stocks gained 0.6 percent even as a British Retail Consortium survey showed total March retail sales plunging 4.3 percent from a year earlier as the deadly virus outbreak kept British shoppers away from traditional stores.

"The crisis continues; the retail industry is at the epicentre and the tremors will be felt for a long while yet," said BRC chief Helen Dickinson.

Milan stocks rose 0.3 percent after the Lombardy region, the nation's industrial heartland, signaled it wants to get back to work from May 4.

On the downside, Asian markets fell following overnight woes on Wall Street as more negative US economic data fueled worries about the full impact of the coronavirus pandemic.

There had already been a spate of grim economic forecasts this week, with the IMF warning of the worst global downturn in a century, while poor US economic figures on Wednesday also spooked investors.

New York - Dow: UP 0.1 percent at 23,537.68 (close)

New York - S&P 500: UP 0.6 percent at 2,799.55 (close)

New York - Nasdaq: UP 1.7 percent at 8,532.36 (close)

London - FTSE 100: UP 0.6 percent at 5,628.43 (close)

Frankfurt - DAX 30: UP 0.2 percent at 10,301.54 (close)

Paris - CAC 40: DOWN less than 0.1 percent at 4,350.16 (close)

Milan - FTSE MIB: UP 0.3 percent at 16,768.14 (close)

Madrid - IBEX 35: DOWN 1.1 percent at 6,763.40 (close)

EURO STOXX 50: UP 0.2 percent at 2,812.35 (close)

Tokyo - Nikkei 225: DOWN 1.3 percent at 19,290.20 (close)

Hong Kong - Hang Seng: DOWN 0.6 percent at 24,006.45 (close)

Shanghai - Composite: UP 0.3 percent at 2,819.94 (close)

Brent North Sea crude: UP 0.5 percent at $27.82 per barrel

West Texas Intermediate: FLAT at $19.87 per barrel

Euro/dollar: DOWN at $1.0830 from $1.0910 at 2100 GMT

Dollar/yen: UP at 107.81 yen from 107.46

Pound/dollar: DOWN at $1.2448 from $1.2518

© Copyright AFP 2024. All rights reserved.