Stocks Rise As Reopening Optimism Beats Bad Data

Global stock markets rose on Friday as optimism over the easing of coronavirus lockdown measures and reopening economies outweighed signs that the planet may be headed for its worst downturn since the Great Depression.

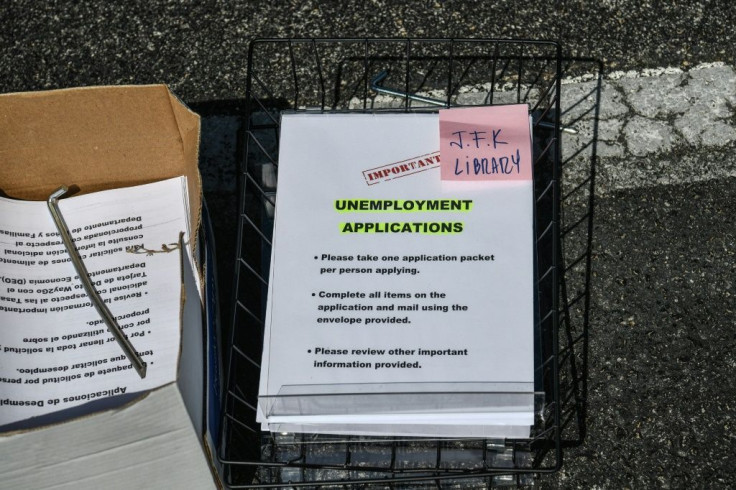

A massive drop in employment in the United States last month, although historic, was not quite as bad as feared and failed to put much of a dent in market confidence.

Nonfarm payrolls fell by 20.5 million in April, the US government reported, which compares to the 21 million market consensus established by data firm Factset.

"Brutal though the numbers are, they are marginally better than economists' expectations and this triggered an initial rally in US equities," said Ulas Akincilar, head of trading at Infinox.

Analysts also pointed to conciliatory statements from Chinese and American officials following talks, which lessened fears of a revived trade war.

Major US indices were in positive territory the whole session, with the Dow finishing up more than 450 points, or 1.9 percent, at 24,331.32.

The gains were the latest instance of markets looking at economic reports that are bad, but not significantly different than expected, and instead focusing on positive news such as the gradual restart of economic activity in some parts of the United States and Europe.

Art Hogan, chief market strategist at National Securities, said investors believe the economy will bottom out in the second quarter and improve after that.

Investors do not anticipate a second wave of coronavirus cases bad enough to lead to widespread lockdowns in the US, he added.

"Markets knew this was coming but it will still go down as the darkest day in the country's economic history," said Ayush Ansal at Crimson Black Capital, calling the data "harrowing."

In Europe, London's closure for VE Day took much of the usual volume out of the trading day, but Paris and Frankfurt were open and up by a percent or more at the close.

But some analysts advised caution against underestimating the depth of the economic crisis, with Michael Hewson at CMC Markets observing that "it almost appears that the worse the US data is, the higher stocks seem to go."

The easing of lockdowns also provided another boost to beaten-down oil markets.

"People are getting back in cars to commute or merely to get out of the house, which is excellent for gasoline demand as that is providing the first phase in a bounce to the oil price recovery," said Stephen Innes of AxiCorp.

New York - Dow: UP 1.9 percent at 24,331.32 (close)

New York - S&P 500: UP 1.7 percent at 2,929.80 (close)

New York - Nasdaq: UP 1.6 percent at 9,121.32 (close)

London - FTSE 100: Closed for a holiday

Frankfurt - DAX 30: UP 1.4 percent at 10,904.48 (close)

Paris - CAC 40: UP 1.1 percent at 4,549.64 (close)

EURO STOXX 50: UP 1.0 percent at 2,908.11 (close)

Tokyo - Nikkei 225: UP 2.6 percent at 20,179.09 (close)

Hong Kong - Hang Seng: UP 1.0 percent at 24,230.17 (close)

Shanghai - Composite: UP 0.8 percent at 2,895.34 (close)

West Texas Intermediate: UP 5.1 percent at $24.74 per barrel

Brent North Sea crude: UP 5.1 percent at $30.97 per barrel

Euro/dollar: UP at $1.0836 from $1.0834 at 2100 GMT

Dollar/yen: UP at 106.73 yen from 106.28 yen

Pound/dollar: UP at $1.2402 from $1.2362

© Copyright AFP 2024. All rights reserved.