Strong Flying Demand Cushions MAX Earnings Hit At US Carriers

Continued strong demand for travel boosted airline earnings Thursday even as US carriers struggle with the grinding Boeing 737 MAX crisis that has clouded their outlook.

American Airlines said a strong flying public helped it to notch record revenues in the fourth quarter, but executives said they will need to again push back their expected date for returning the MAX to their fleet.

Earlier this week, Boeing extended to mid-2020 the target date for winning regulatory approval to allow the MAX back in the skies after two deadly crashes.

That announcement came after Boeing's optimism was dashed several times and after the company endorsed simulator training for MAX pilots as the Federal Aviation Administration weighs requirements for a resumption of service.

In light of those announcements, American Chief Executive Doug Parker said a potential timeframe would be "late summer, early fall" -- which means the carrier could not count on using the MAX during the key summer travel season.

Southwest Airlines, which is the biggest customer of the MAX, reported a dip in fourth-quarter earnings on slightly higher revenues.

And while executives also pointed to strong consumer demand, they rued how the MAX had forced it to cancel thousands of flights and crimped its growth strategy.

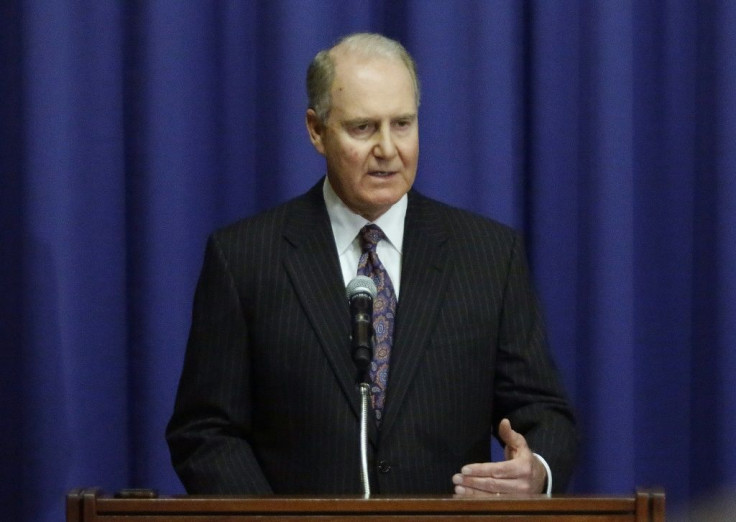

"That is frustrating," Southwest Airlines Chief Executive Gary Kelly said in an interview with CNBC, who said 2019 earnings would have been 28 percent higher without the MAX drag.

"We weren't able to grow... had we maintained our normal pace, we would have earned another six or seven million customers in 2019," he said, adding "we don't want this to go on indefinitely. We'll get the MAX back."

American and Southwest reached settlements with Boeing to cover 2019 losses connected to the grounding and said they expect the aerospace giant to cover the financial hit from the MAX in 2020.

At American, fourth-quarter earnings rose 27.4 percent to $414 million on a 3.4 percent rise in revenues to $11.3 billion.

American previously estimated that the MAX crisis would cost it $540 million in pre-tax profits in 2019 due to thousands of flight cancelations.

Earlier this month, American announced it reached a confidential settlement with Boeing to cover those losses.

Executives declined to elaborate on the settlement on Thursday but Parker said "we'll continue to hold Boeing accountable."

Meanwhile, American said it has taken positive steps in customer service, an area in which the carrier has lagged rivals, especially when it suffered flight cancelations over the summer due to a dispute with mechanics unions.

In August, a US court ordered the unions back to work. The parties are currently before the National Mediation Board.

American has invested in Wi-Fi on more planes, as well as upgrades in airport gates.

Parker said on an earnings conference call that the company had made "enormous improvements" in customer service, adding that "we know we can perform better and we will."

At Southwest, fourth-quarter earnings were $514 million, down 21.4 percent, while revenues inched up 0.4 percent to $5.7 billion.

Analysts have noted that Southwest's business is more reliant on the MAX than rival US carriers, likely increasing its marketing costs to worried customers once the plane is cleared to fly.

Kelly told CNBC Boeing "needs to step up and communicate" and the FAA also will need to reassure the public.

"Of course we'll rely heavily on our pilots as part of that communication campaign, but we need to get the airplane back in the air," Kelly said.

"We need to convince people by performance that they can be confident in it," Kelly said. "We are not going to operate the airplane unless we are confident. We've established a lot of trust with our customers over 50 years and we're not going to squander that now."

Shares of American Airlines gained 5.4 percent to $28.80, while Southwest rose 3.6 percent to $55.40.

© Copyright AFP 2024. All rights reserved.