Asian shares eased Tuesday as investors cautiously awaited Chinese trade data to gauge whether the world's second-largest economy could achieve a soft landing, after a sharp slowdown in U.S. jobs creation clouded prospects for global growth.

The Dow and the S&P 500 extended losses to a fourth day on Monday, as investors took their cues from last week's disappointing jobs report, which raised new concerns about the U.S. economy's recovery.

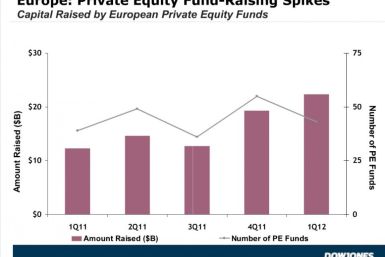

European private equity funds raised 82 percent more capital in the first quarter of 2012 compared to the same period last year, according to Dow Jones LP Source, a research service for the industry.

U.S. stocks fell hard Monday after a surprisingly weak jobs report on Friday left investors hunting for safety rather than big returns.

Major stock indexes were set to open about 1 percent lower on Monday after last week's much weaker-than-expected report on March U.S. job creation.

U.S. stock index futures traded lower on Monday after last week's much weaker-than-expected report on U.S. job creation for March.

Futures on major US indices point to a lower opening Monday after US non-farm payrolls data showed that the world's biggest economy added fewer-than-expected jobs in March.

Stock futures on U.S. indexes, which stopped trading at 9:15 a.m. EDT because of the Good Friday holiday, plunged after the Labor Department reported weaker-than-expected jobs numbers for March.

Global stocks ended mixed Thursday as solid jobs data and better-than-expected results from retailers failed to offset revived concerns about the euro zone’s fiscal stability.

Stocks were little changed on Thursday despite data showing ongoing improvement in the labor market, as a rise in Spanish bond yields renewed concerns about the euro zone's financial health.

Wall Street was set for a lower open despite data showing ongoing healing in the labor market, as a rise in Spanish bond yields renewed concerns about the euro zone's financial health.

Claims for jobless benefits fell to 357,000 last week, building up toward a solid March nonfarm payroll report that is scheduled to come out on Friday. Some economists though still fear that the improvement in the U.S. economy seen so far this year could be just another false start.

Stock index futures fell on Thursday as a rise in Spanish bond yields renewed concerns about the euro zone's financial health, and as investors awaited report on jobless claims.

Stock index futures fell on Thursday as a rise in Spanish bond yields renewed concerns about the euro zone's financial health, and as investors awaited a closely watched report on jobless claims.

Futures on major U.S. indices point to a lower opening Thursday ahead of key weekly jobless claims from the government.

Stock index futures pointed to a slightly higher open on Wall Street on Thursday with futures for the S&P 500 and Dow Jones up 0.3 percent, while Nasdaq 100 futures were up 0.1 percent at 04.08 a.m. EDT.

Stocks and commodities plunged Wednesday after the head of the European Central Bank -- a lynchpin in the euro zone's effort to contain the effects of its sovereign debt crisis -- suggested that some Greek banks will be left to collapse.

Wall Street stocks were looked likely to open lower open on Wednesday, despite good private sector payrolls data, as investors digested minutes from the latest Federal Reserve meeting published Tuesday suggesting further monetary stimulus action is unlikely.

Stock index futures fell on Wednesday after minutes of the Federal Reserve's March meeting released on Tuesday showed policymakers were less inclined to provide more economic stimulus, curbing investors' appetite for risky assets.

Chevron (NYSE: CVX) and Transocean (NYSE: RIG) will soon know which Brazilian court will preside over a criminal trial stemming from a November 2011 oil spill.

Stocks were set to take a breather on Tuesday after the S&P 500 climbed to a 4-year high and ahead of factory orders data and minutes of the latest Federal Reserve meeting.

Stock index futures fell on Tuesday after the S&P 500 climbed to a 4-year high in the previous session as investors awaited factory orders data and minutes of the latest Federal Reserve meeting.