Stock index futures were higher on Friday as bargain hunters entered the market after a string of declines, putting equities on track to record their strongest quarter in more than two years.

Futures on major US stock indices point to a higher opening Friday ahead of a wave of economic data including core PCE price index and Chicago PMI.

Wall Street was set for a third day of losses Thursday as jobless claims data failed to meet heightened market expectations, leaving investors to wonder if the economy can sustain a rally.

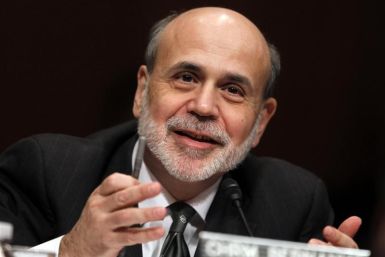

Claims for jobless benefits fell to 359,000, but Federal Reserve Chairman Ben Bernanke warned this week that recently improved employment data seem out of sync with the pace of U.S. economic growth.

Futures on major US stock indices point to a lower opening on Thursday ahead of economic data including final estimates for fourth quarter GDP and initial jobless claims.

Stocks fell Wednesday as investors were disappointed by a weaker-than-expected reading on durable goods orders, while a plunge in oil prices dragged energy and material shares lower.

U.S. stocks opened flat Wednesday after durable-goods rose less than expected in February and a key barometer of future business spending missed estimates.

Stock index futures rose on Wednesday with large-cap shares looking to pierce 52-week highs, but the major indexes were not seen making big moves before the end of the quarter.

Investors wonder if Research In Motion Ltd., which reports quarterly results Thursday, can rebound from recently anemic performance due to falling sales of its BlackBerry device. RIM's turnaround is being led by Thorsten Heins, who took over as CEO in January.

With release of the new 4G-ready iPad earlier this month, Apple cold-shouldered Sprint, as it is yet to launch its own LTE network. Although many believe that Apple's upcoming iPhone with 4G LTE could indeed be a threat to Sprint, the Kansas-based operator seems least bothered about it. Read on to know why Sprint ignores the predicted debacle.

US stocks closed lower on Tuesday, following poor consumer confidence data and a fall in the property value index.

Window dressing, the practice of stock fund managers buying up top performers as the quarter ends to boost the appearance of success, failed Tuesday to lift the major indexes into positive territory.

Stock index futures were flat on Monday as investors found little reason to keep pushing shares higher after a 1 percent rally in the previous session.

Futures on major US stock indices point to a flat opening on Tuesday ahead of reports on home prices and consumer confidence.

Stock index futures pointed to a higher open on Wall Street on Tuesday, with futures for the S&P 500 up 0.25 percent, Dow Jones futures up 0.29 percent and Nasdaq 100 futures up 0.36 percent at 0920 GMT.

Stocks surged Monday after Federal Reserve Chairman Ben Bernanke suggested the U.S. central bank would continue its present monetary policies and keep interest rates low, offsetting soft readings on the domestic economy.

After calling the recent recovery a puzzle, markets reacted enthusiastically to Fed Chairman Ben Bernanke's pronouncements

The Fed chairman said U.S. job market conditions remain weak despite three months of strong hiring and that the improved employment data seem to be out of sync with the overall pace of economic growth.

Futures on major U.S. stock indices point to a higher opening Monday ahead of pending home sales data and a speech by Federal Reserve Chairman Ben Bernanke.

Wall Street's gains came after positive remarks on the U.S. labor market by Federal Reserve Chairman Ben Bernanke and upbeat economic data from Germany that offset a soft reading on the U.S. housing market.

Stocks mostly inched higher on Friday as rising energy shares offset early weakness, though the S&P 500 remained on track to break a five-week streak of gains.

Stocks took a big step back Thursday after more signs pointing to weakening economic conditions in China and Europe spooked investors to make a run for safety.