Spain may say on Wednesday how it will plug a hole of at least 8 billion euros ($10.21 billion) at Bankia, part of an effort to clean up a banking sector laden with bad debts and stop the country sinking further into the euro zone debt crisis.

Formula 1, the popular global auto racing sport, is on its way to a possible IPO as financial investors such as Waddell & Reed Financial Inc. (NYSE: WDR), Norges Bank Investment Management and BlackRock, Inc. (NYSE: BLK) bought 21 percent of the company, CVC Capital Partners, owner of Formula 1, confirmed Tuesday.

Shares of Facebook (Nasdaq: FB), the No. 1 social network, kept falling Tuesday, three business days after its $16,7 billion initial public offering.

Former Goldman Sachs director Rajat Gupta threw away his duties by divulging bank secrets to hedge fund manager Raj Rajaratnam, a U.S. prosecutor said at the start of Gupta's insider-trading trial on Monday.

Shareholders of Facebook (Nasdaq: FB), the No. 1 social network, are set to get the shares Tuesday, following Friday?s tumultuous first sales after the $16 billion initial public offering.

China's Alibaba Group and Yahoo confirmed Sunday night they have reached an agreement that will allow the two online media giants to eventually go their own ways. Alibaba initially will pay an estimated $7.1 billion in cash and preferred stock to Yahoo.

One value of going public for any company is to raise cash as well as mint new shares for acquisitions. Facebook (Nasdaq: FB)?s $16 billion initial public offering was no exception.

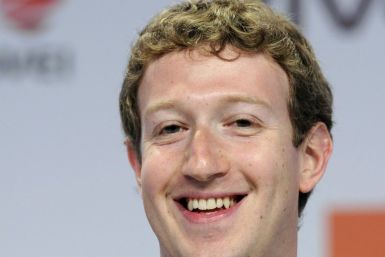

It?s not just Mark Zuckerberg whose shares of Facebook (Nasdaq: FB), the No. 1 social network, became more valuable on Friday. U2's Bono is also smiling.

Well, THAT just happened. The world's most dominant social network, touting some 900 million worldwide users, made its Wall Street debut from home Friday, as Mark Zuckerberg and co. opted to celebrate the beginning of a more open and connected Facebook from the company's headquarter's in Menlo Park, Calif.

The ratio of bad debt held by Spanish banks increased in March and hit an 18-year high of 8.37 percent, or $187.5 billion, the country?s central bank announced on Friday. The number of nonperforming loans with payments that are 90 days overdue is now about 10 times larger than it was during the peak of the property boom in 1997.

Shares of Facebook (Nasdaq: FB), the No. 1 social network that raised $16 billion in its initial public offering, the biggest in Internet history, soared more than 10 percent but closed up by only a fraction.

The moment is finally here: Facebook, the world's most dominant social network with 900 million-plus users, is finally ready to make its Wall Street debut. Zuckerberg will ring the opening bell at 9:30 a.m. ET, but since he will be broadcasting from Facebook remotely, NASDAQ has provided a way to watch all the proceedings occur live.

It's Friday, May 18 and the world's largest social network, Facebook Inc., enters the market raising a whooping $16 billion in one of the biggest initial public offerings in the US history. What makes it even more eye-popping is the amount the company is now valued at - $104.2 billion.

Facebook (Nasdaq: FB), the No. 1 social network, raised $16 billion in its initial public offering, the biggest in Internet history, valuing its shares at $38.

One of the biggest and most anticipated IPOs of the year, quite possibly the decade, is ready to hit Wall Street tomorrow, but if you're thinking about buying shares, you're not alone. Not in the least. If you're looking to get a piece of the stock, we're here to help you. But be warned: It will not be easy.

A day before Facebook (Nasdaq: FB), the No. 1 social network holds its initial public offering, its 33 underwriters boosted the number of shares for sale by 25 percent, potentially valuing the deal as high as $19 billion.

Facebook (Nasdaq: FB), the No. 1 social network, has decided to pitch its initial public offering of 421 million shares at $38, which could raise as much as $18.1 billion, assuming ?over-allotment options.

Surging demand for shares of Facebook (Nasdaq: FB), the No. 1 social network, prompted the company to again boost the number of share for sale in its initial public offering.

Facebook Inc will increase the size of its initial public offering by 25 percent to raise about $15 billion, a source familiar with the matter said, as strong investor demand for a share of the No.1 social network trumped ongoing debate about the company's long-term potential to make money.

Facebook (Nasdaq: FB), the No. 1 social network, announced that it would increase the number of shares in its initial public offering, price them higher and value the company at as much as $104 billion.

Facebook will close the books on its $10.6 billion initial public offering on Tuesday, two days ahead of schedule and a signal that Silicon Valley's largest IPO is drumming up strong demand.

Congratulations, the good guys finally won. You and your team, with help from other institutions, have ousted CEO Scott Thompson, elected three Third Point nominees to the board, removed another handful of management nominees and effectively control the company. Now what?