Mark Zuckerberg Celebrates Facebook IPO With Employees As Nasdaq Starts Trading Shares [PICTURES]

Well, THAT just happened. The world's most dominant social network, touting some 900 million worldwide users, made its Wall Street debut from home Friday, as Mark Zuckerberg and co. opted to celebrate the beginning of a more open and connected Facebook from the company's headquarter's in Menlo Park, Calif.

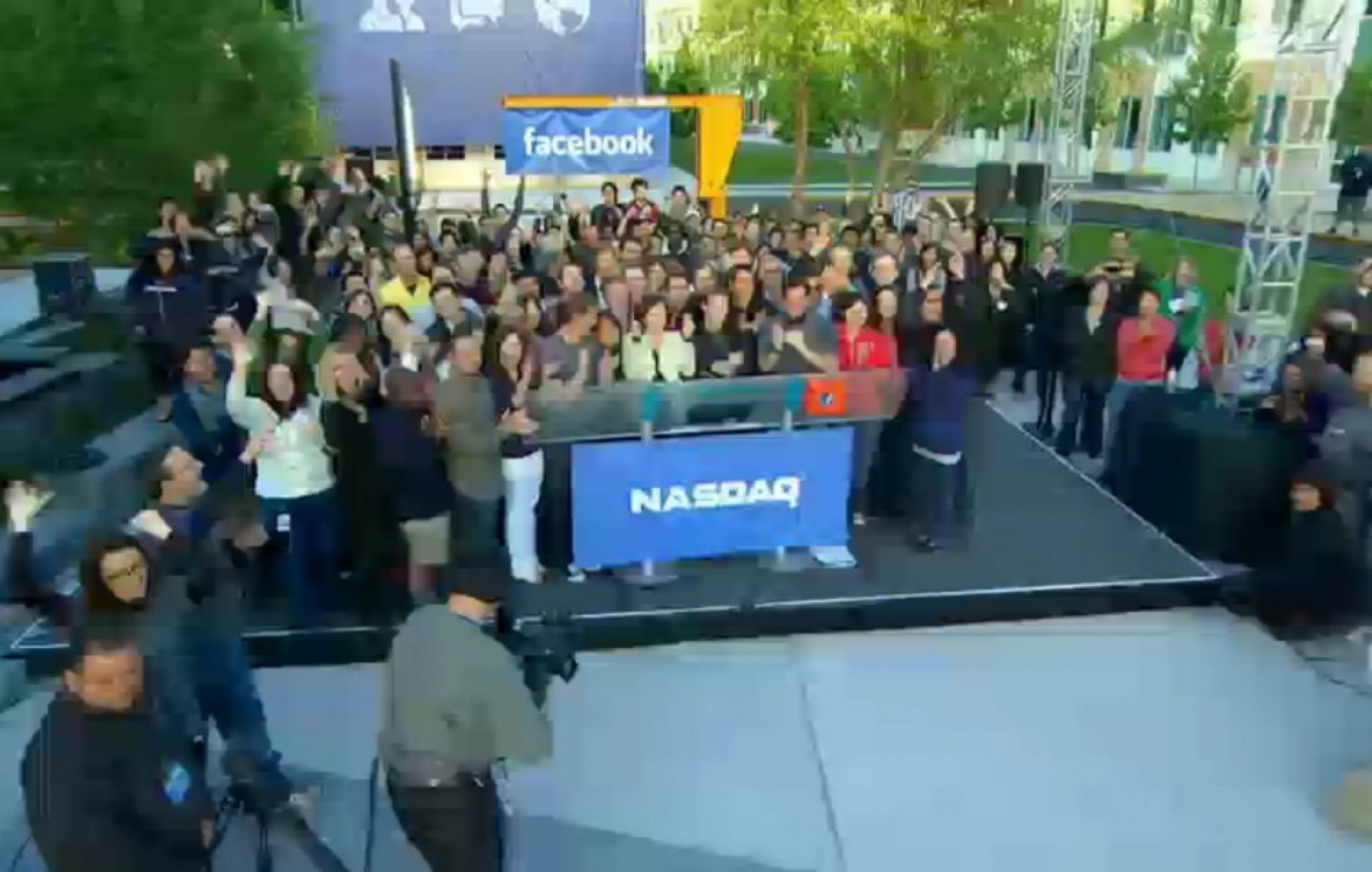

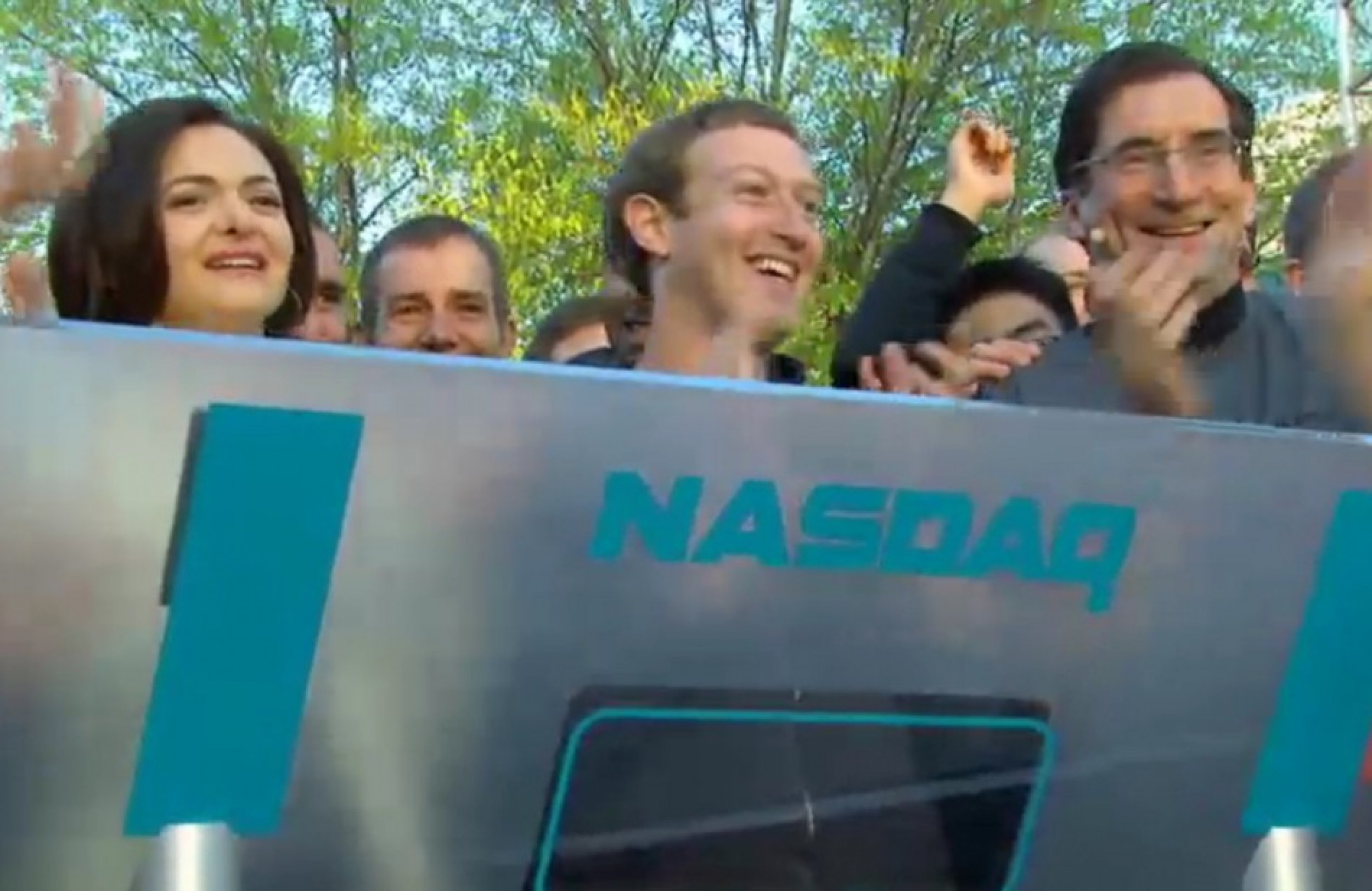

At approximately 9:30 a.m. EST (6:30 a.m. in Menlo Park), Mark Zuckerberg stood in front of a large Nasdaq podium amongst a sea of Facebook executives in Menlo Park. Nasdaq had invited him to ring the bell in New York City, but the Facebook founder opted to ring the bell from his headquarters so he could celebrate with his employees. This move could be perceived as ungrateful towards investors, but it made a lot of sense for Facebook: From Day 1, Zuckerberg has run his company his way, and on the biggest day in his company's life (so far), it would make sense that he'd want to celebrate it out in sunny California with his entire team, not just a handful of tie-wearing, non-hoodied executives.

The crowd counted down the seconds until Zuckerberg finally rang the bell, really by pressing a button on the podium. The crowd erupted into noise, and the Facebook staff on stage began hugging, clapping and celebrating. It was a joyous moment, and for good reason: By ringing that bell, a few lucky Facebook staffers became billionaires, and quite possibly up to 1,000 employees became millionaires.

The company has experienced plenty of controversy throughout its first eight years of existence, from the Winklevoss lawsuit to questionable redesigns and privacy breaches to hoodiegate, and yet, Mark Zuckerberg's social experiment continues to attract users and investors. It's been a very big week for Zuckerberg, who celebrated his 28th birthday on Monday, and who could easily make more than $20 billion today alone.

Facebook began trading its shares Friday at $38 to achieve a $104 billion valuation, which would make it the second-biggest IPO of all-time after Visa's IPO in 2008, which raised $19 billion and traded its initial shares at $44 apiece. It looks to be the biggest IPO since 2004, when Google went public.

Facebook chose Goldman Sachs, Morgan Stanley, and JPMorgan Chase, among other banks, to be the underwriters for the IPO; after some subtle jockeying, Morgan Stanley won the fight to become Facebook's lead underwriter, followed by JPMorgan Chase, and Goldman Sachs claimed the third underwriter spot. The banks stand to make $40 million from their deals with Facebook, and they could make even more if other tech companies like Twitter decide to include them in their own future IPOs.

Facebook's shares break down like this: COO Sheryl Sandberg owns 1.9 million shares (0.1 percent of the company), seed investor Peter Thiel owns 44.7 million shares (2.5 percent), and co-founder Dustin Moskovitz owns 133.8 million shares (7.6 percent). While Mark Zuckerberg only earns $1 in salary from his own company, don't worry about Zuck: He is still the social network's biggest stakeholder with 533.8 million shares (28.4 percent of the pot), representing a $28 billion stake.

[Facebook] wants to be taken seriously and viewed as a blue-chip company, said one bank official close to the situation. The banker could not offer his name because he is not authorized to make public statements.

Facebook has matured greatly in the last several years, but particularly in the last few months, Facebook has proven to investors that it has finally grown up. Recognizing how its platform was a hotbed for bullying, the company launched a suicide prevention program in December that allowed users to instantly connect with real crisis counselors through Facebook's chat messaging system. Then in March, Facebookannounced a new suite of tools at the White House Conference for Bullying Prevention, in an effort to protect users from bullying and create a culture of respect among users.

Facebook is now also starting to realize its potential as an important service for connecting people with needs: Earlier this month, Zuckerberg announced a new lifesaving feature for Facebook: A new platform for organ donors. Even though the U.S. Department of Health says more than 7,000 people die each year while waiting for an organ transplant, Facebook's social network of 800 million-plus will certainly help raise awareness of the issue.

The company has also matured when it comes to business. In September, the company introduced a controversial but important change to its social network: The Timeline Profiles. It showed investors that Facebook is still experimenting with itself, but it is looking for better and better ways for people to share their own life stories. More recently, Facebook gobbled up popular photo-sharing app Instagram for $1 billion, demonstrating how the company can seek out good talent and incorporate it without necessarily assimilating it. Now, Facebook has proven it has the leverage to make big deals with smaller tech companies.

Facebook has proven to be an incredibly worthwhile investment. You don't go from being a project in a Harvard dorm room to the biggest social network in the world with just luck: Zuckerberg is a genius, and he is consistently finding the right people to carry out his message. While his network has fallen in and out of favor with worldwide audiences on a regular basis, the bottom line is this: People do leave, but they almost always come back. That's a very powerful message for one company to boast.

If Facebook goes on to the biggest IPO in history, it won't ultimately matter for the company. From Zuckerberg on down, Facebook's employees will be much richer later this month than they were in April, but this should be a time to celebrate for Facebook: The company continues to grow, and more importantly, learn from its mistakes. It would be vastly different without Zuckerberg at the helm, but hopefully, we won't have to imagine a Zuckerberg-less Facebook -- like we now deal with a Jobs-less Apple -- for some time. Zuckerberg is young and healthy, and so is his eight-year-old company. With so many users and so much potential, it's going to be exciting to see what Zuckerberg's team does next.

© Copyright IBTimes 2024. All rights reserved.