The interbank silver market [in Asia] is dysfunctional says one Hong Kong dealer's note. Liquidity is getting worse while the price action is getting more exaggerated as a result.

Wall Street stocks were set for a lower open on Thursday as worries about higher inflation and signs of job market weakness kept investors cautious.

China's foreign exchange reserves soared to a record of more than $3 trillion by end-March, while its money supply growth blew past forecasts, threatening to aggravate the nation's inflation woes and trigger more policy tightening.

Stock index futures fell on Thursday before U.S. data that could shed light on the impact of rising commodity prices and as concerns grew over Chinese inflation.

Stock index futures fell on Thursday as investors awaited data to assess the impact of rising commodity prices amid growing concerns over Chinese inflation.

The dollar sank to a 16-month low against a basket of currencies on Thursday as investors bet U.S. monetary policy would continue to be loose, while a report that Chinese inflation will rise dragged on equities.

The president's reforms may have a major impact on the U.S. economy and the housing market in particular.

Rising U.S. bond yields have more to do with improving economic growth prospects and market concerns about inflation rather than Washington's deteriorating fiscal position, the International Monetary Fund said on Wednesday.

Price of gold will exceed $1600 a troy ounce before year-end on strong growth in investment demand, according to the precious metals research consultancy firm GFMS.

Japan's government has downgraded its assessment of the economy for the first time in six months to reflect last month's devastating earthquake and tsunami, while wholesale prices rose at the fastest pace in more than two years in an ominous sign for company profit margins.

China reported a surprise trade deficit for first quarter 2011 on Saturday -- which may have triggered a correction to the global risk-on trade.

The European Central Bank's interest rates are very low and a scaling down of its support measures is warranted, a senior ECB policymaker said on Tuesday but another played down the risk from inflation.

British inflation eased in March for the first time since last summer as grocers cut food prices, reducing the chance of a Bank of England rate hike in May and giving it leeway to support the still shaky economy.

Wholesale Gold Bars slipped to a 3-session low in London trade on Tuesday, finally bouncing higher from $1455 per ounce - some 1.5% below yesterday's new Dollar high - as world stock markets fell and major-economy government bonds rose.

Consumer prices in Britain slowed for the first time in eight months in March, dampening expectations over interest rate hike by the Bank of England in the near term.

Soaring oil prices and inflation in emerging economies pose new risks to global recovery but are not yet strong enough to derail it, the International Monetary Fund said on Monday.

Soaring oil prices and inflation in emerging economies pose new risks to global recovery but are not yet strong enough to derail it, the International Monetary Fund said on Monday.

Two of the Federal Reserve's most powerful officials said on Monday the U.S. central bank should stick to its super-easy monetary policy, arguing inflation is not a threat and unemployment remains too high.

Expectations of another rise in European Central Bank interest rates by July kept the euro close to recent highs on Monday and pushed euro zone government bond prices lower.

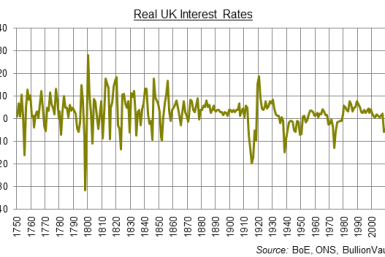

Backing money with gold isn't the problem for the legion of policy-makers and economists running the official monetary system. Raising interest rates is.

Hitting $1472.50 for US investors today, the Gold Price also rose sharply against the British Pound - hitting its best level since New Year at £900 per ounce - but was in flat against most other major currencies. Silver Prices, in contrast, rose to new multi-decade highs across the board.

Silver is a very different market to gold. Most crucially, there's no commonly accepted benchmark value - such as a suit of men's clothes for an ounce of gold - against which to measure silver across time.