India gold traded flat on Tuesday afternoon as support from firm overseas leads was offset by a strong rupee, though buying remained weak as traders awaited an at least a 1 percent fall in prices, dealers said.

Chinese inflation data helped ease investor concerns on Tuesday that the world's No 2 economy will have to tighten monetary policy more aggressively, but other data releases kept markets in a tight range.

By Zhou Xin and Simon RabinovitchChinese inflation was lower than forecast at 4.9 percent in the year to January, but price pressures continued to build and will force the central bank to stick to its course of gradual monetary tightening.

Asian stocks were broadly steady On Tuesday after traders took China's closely-watched inflation data in their stride, while the euro regained some ground after hitting a three-week low the previous day.

Chinese inflation was lower than expected at 4.9 percent in the year to January, but price pressures continued to build and will force the central bank to stick to its course of monetary tightening.

Chinese inflation was lower than expected at 4.9 percent in the year to January, though price pressures continued to build and will force the central bank to stick to its course of monetary tightening.

Asian stocks rose slightly on Tuesday after China's closely-watched inflation data failed to surprise markets, while the euro regained some ground after hitting a three-week low the previous day.

Chinese inflation was lower than expected at 4.9 percent in the year to January, though price pressures continued to build and will force the central bank to stick to its course of monetary tightening.

Gold rose above $1,360 an ounce on Monday on fears that Egypt's unrest could spread across the Arab world, while silver gained 2 percent on strong industrial demand driven by signs of an improving economy.

Gold rose above $1,360 an ounce on Monday as the dollar's retreat from highs versus the euro took some pressure off prices, with a second consecutive weekly price rise underpinning investors' confidence in the metal.

The U.S. economy is heading in the right direction and will pick up steam over the next two years, but high unemployment and low inflation still paint an unsatisfactory picture, New York Federal Reserve President William Dudley said on Monday.

China's trade surplus fell to its lowest in nine months in January after imports surged, supporting the government's case ahead of a G20 meeting that it is doing enough to spur domestic demand without speeding up currency appreciation.

Inflation eased slightly in January but was still higher than expected, reinforcing expectations the Reserve Bank of India (RBI) will keep tightening policy because price pressures are still above its comfort zone.

Asian stocks rallied on Monday, snapping five straight sessions of losses, as talk of slower-than-expected Chinese inflation helped drive Shanghai's main share index to its best level in seven weeks.

Inflation is likely to rise further in Mauritius, central bank governor Rundheersing Bheenick said on Saturday, reinforcing speculation that the central bank may raise rates at its March meeting.

Nothing like a little revolution to shake up an already turbulent global economy.

Asian stocks rose on Monday as investors greeted news of Egyptian President Hosni Mubarak's resignation with relief, while U.S. crude steadied near $85.50 per barrel after falling to 10-week lows as geopolitical tensions eased for now.

Nothing like a little revolution to shake up an already turbulent global economy.

A top Federal Reserve official said on Friday he believes the U.S. economy is no longer at risk of slipping into a damaging deflationary spiral but that it would be unwise for the Fed to suddenly shift course.

India's annual industrial output in December rose at its slowest pace in 20 months on a higher base last year and stretched capacities at factories, but the Reserve Bank will likely continue tightening monetary policy to tame high headline inflation.

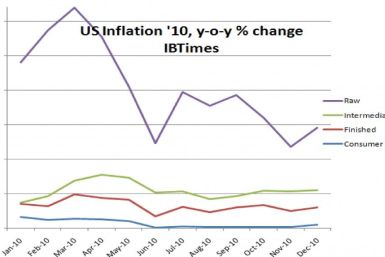

As earnings season gets underway early in 2011, investors should perhaps look at the profit margins of producers, especially those who need to buy raw materials to make their products.

Margin compression is a nasty thing in business. According to government data, this is precisely what UK manufacturers are facing.