China maintains yuan's peg to the dollar by continually purchasing dollars in the open market, which means that China has to buy more ad more dollars as the U.S. currency gets weaker. And here is the role of the U.S. Federal Reserve in exacerbating Beijing's concerns.

The pace of economic recovery has reached escape velocity from the worst recession in decades, though the nation may not return to full employment until 2014, a top Federal Reserve researcher said on Friday.

The price of gold is at a critical juncture. What happens in the next couple of weeks can determine whether the metal's spectacular rally will continue or fade.

Canadian job growth surged past expectations in January, with the economy officially recouping all the jobs lost in the recession, underscoring that its recovery is on track even as the U.S. labor market struggles.

U.S. employment rose far less than expected in January, partly the result of severe snow storms that slammed large parts of the nation, but the unemployment rate fell to its lowest level since April 2009.

The central bank of Indonesia predictably raised interest rates on Friday as inflation fears began to spook foreign investors out of the market.

World share prices rose while bonds fell on Friday as investors positioned for the possibility of strong U.S. jobs data, which would bolster the view of a recovering global economy and further boost riskier assets.

India's efforts to calm inflation by allowing easier imports and restricting exports of key foodstuffs are disappointing farmers who are keen to exploit global high prices and say structural reforms are the way ahead.

Experts can argue all they want about the causality relationship between food inflation and QE2. What cannot be denied, however, is the correlation.

Gold rose over 1 percent in choppy trade on Thursday, with a sudden jump by over $20 per ounce within minutes as large buy orders were apparently triggered in the future markets. This comes unexpected to precious metals experts, as the gold price was supposed to be kept low by the usual large Wall Street players during todays speech by Bernanke, and was set to rally on Friday, when unexpectedly bad labor market numbers will come in and drive gold prices higher.

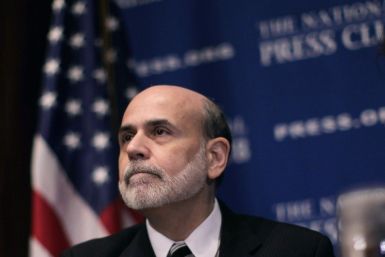

The following are highlights from Federal Reserve Chairman Ben Bernanke's speech to the National Press Club on Thursday.

Sudan's north will continue to use the Sudanese pound after the oil-producing south secedes on July 9, a central bank official said on Thursday, dousing reports that Khartoum may adopt a new currency.

Federal Reserve Chairman Ben Bernanke's speech to the National Press Club on Feb. 3, 2011

The U.S. economic recovery still needs help from the Federal Reserve despite signs of improvement, the central bank's chairman Ben Bernanke said on Thursday.

The U.S. economic recovery still needs help from the Federal Reserve despite signs of improvement, Chairman Ben Bernanke said on Thursday.

Yum Brands Inc forecast rising 2011 labor and food costs in China and said that modestly raising prices in its top growth market would help mitigate that pressure.

China will be more tortoise than hare in its monetary tightening in the Year of the Rabbit, barely nudging up interest rates even as inflation races to new heights.

The European Central Bank kept interest rates on hold at a record low of 1.0 percent as expected on Thursday, despite rising inflation fears.

New U.S. claims for unemployment benefits fell sharply last week while nonfarm productivity in the fourth quarter was stronger than expected, confirmation the economic recovery was strengthening.

The European Central Bank kept interest rates at 1 percent as forecast on Thursday, ahead of its policy statement where it is expected to repeat its recent inflation warning but signal that a rate rise is not imminent.

The European Central Bank is expected to send a strong signal on Thursday that it is ready to tackle building euro zone inflation pressures but refrain from indicating interest rate increases are imminent.

Oil prices surged past $103 on Thursday as pro-democracy protests in Egypt turned violent, while commodities markets raced even higher, adding to worries of mounting inflationary pressures could threaten the global economic recovery.