The Indian economy is expected to have grown a little slower in the September quarter than the previous quarter, mainly due to a drop in capital goods production.

In response to soaring food prices, China announced plans for price controls.

The Bank of Japan (BoJ) Governor Masaaki Shirakawa said on Monday expanding the asset purchase fund could be an option if the economy worsens beyond the central bank's expectations, even as government data showed retails sales in October fell unexpectedly.

The week to November 24 was marked by tensions in Korean peninsula that prompted investors to flee from risky assets to safer avenues like US dollar and gold, helping the yellow metal outshine its colleagues in the precious group. However, silver and palladium remained strong in the month, mainly helped by demand for cheaper alternatives in jewelry and industrial applications.

Performance of the US dollar, Europe's periphery issues, inflation in developing world, consumption by developed ones, and of late, tensions in Korean peninsula- a lot of things are weighing on oil. The net result in recent weeks was positive for the greenback and therefore negative for oil. Still, the commodity is set to end this week with a positive note despite losing more than a dollar from its intra-week high by Friday. So, what is the trend? Where is oil heading?

Japan's economic recovery showed some positive signs as inflation increased in October for the first time in almost 24 months.

Dollar, Korea, Ireland, Asian demand, inventories and technicals - a lot of things are weighing on oil now. But market participants find the question if the commodity has reached its bottom technically and on robust demand in some regions, or will a dollar rally or geopolitical developments force it break below the current range, tough to answer.

British water company Pennon Group reported a 0.7 percent rise in its first-half pretax profit due to higher demand for water from summer usage and asset sale of its water utilities business South West Water but said looking forward, South West Water is well placed to outperform the assumptions for the K5 (2010-2015) period.

Brazil's central bank governor, Henrique Meirelles, will step down from his position, according to a report in the Folha de Sao Paulo newspaper.

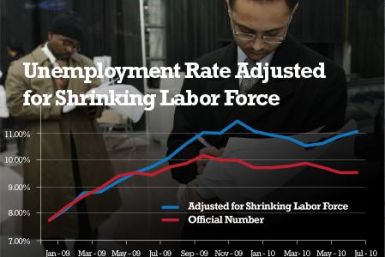

Pessimistic outlook about unemployment from the U.S. Federal Reserve overshadowed reports stating the economy grew faster in the third quarter. The Fed expects unemployment to remain high over the next couple of years, hovering around 8.9 percent to 9.1 percent next year. It had previously forecast unemployment rate between 8.3 percent and 8.7 percent.

According to minutes from the most recent Federal Open Market Committee (FOMC) meetings, policymakers argued over the merits of introducing a $600-billion long-term bond purchase program, but passed the measure anyway.

Minutes of the November 2-3 Federal Open Market Committee meeting.

The U.S. economy grew a little more than expected in the third quarter, helped by a sharp drop in imports and a rise in private inventory investment, according to the second estimate released by the U.S. Bureau of Economic Analysis.

A BIS study found the market judges risks of uncontrolled inflation to be relatively low for the U.S and euro zone, despite the expansion of their central banks' sheets and soaring gold prices.

The U.S. economic growth is expected to remain sluggish over the next couple of years, as inflation heads towards zero and unemployment remains high. Official U.S. GDP figures are due on Tuesday, along with sales information of existing homes.

The Chinese government has announced a slew of measures to combat rising commodity prices, including boosting agricultural production and stabilizing supply of products and fertilizers.

In an eventful week, that passed through uncertainty about Ireland's response to a bailout offer, an unexpectedly higher Chinese inflation number and its policy response and largely mixed US data, investors remained cautious about the changing 'risk-friendliness' of commodities. In a mixed precious metals segment, silver rose 5 percent in the week and palladium was up by 4.4 pct while gold fell 1.1 percent and platinum dropped by 0.9 percent from previous Friday.

Precious metals slid from their day's highs on Friday in New York as fears that China will soon raise rates eroded the investment appeal commodities gained on good news from Europe.

China is intensifying efforts to fight inflation as it raised the reserve requirement ratio for banks on Friday for the fifth time this year and the second time this month.

An Agricultural commodity price rally in the U.S. will help the wobbly recovery in three ways - by boosting inflation a tad and narrowing the worrying trade deficit by a whisker, while not hardening enough to snuff out the fledgling recovery.

A surge in food prices propelled Chinese consumer prices to a 25-month high in October, despite the government's efforts to control inflation. Food prices in the world’s second largest economy went up by 10.1 percent in October year-on-year.

Regional manufacturing activity in Philadelphia improved during November, according to the Philadelphia Fed Manufacturing Index, which touched its highest reading since Dec. 2009.