Hedge funds posted their worst returns in three years in the third quarter, and the fourth quarter appears to be off to an equally rocky start.

The stock is up on rumors floating around the market that RIMM has retained an investment banker to ponder strategic options.

Gold prices turned lower on Tuesday, surrendering early gains as it was caught up in hefty losses across the financial markets due to heightened concerns over the prospect of a Greek default.

“Europe was, of course, not particularly successful in the last few months.”

Canadian auto sales fell in September, extending a volatile year with Chrysler's strong performance the lone bright spot among the top manufacturers.

Washington Mutual Inc said it could end its three-year bankruptcy by November, allowing it to distribute $7 billion to creditors, if a judge limits the scope of outstanding disputes to be mediated.

As noted earlier, if Sprint (S) snares Apple’s iPhone 5 this autumn, it could give the cell phone service provider a fighting chance versus AT&T (T) and Verizon (VZ). And that would bode well for Sprint's stock.

The Dalai Lama was blocked from visiting South Africa two years ago as well.

Gold prices will rise later this year and into next year, Goldman Sachs said Tuesday, in a note expressing relative optimism about the near-term prospects for the global economy.

Uncertainty over Yahoo may have attracted interest from Russia’s Digital Sky Technologies as well as from China’s Alibaba Group and Silver Lake Partners.

U.S stock futures are down on Tuesday as Eurozone debt crisis fears intensified on authorities’ inability to step up and calm the situation.

The top pre-market NASDAQ Stock Market gainers are: SunPower, SodaStream International, Yahoo, Netflix, and LM Ericsson Telephone. The top pre-market NASDAQ Stock Market losers are: Human Genome Sciences, Savient Pharmaceuticals, ATP Oil & Gas, Century Aluminum, and JDS Uniphase.

Gold prices fell Tuesday, weighed down by panicking investors preparing for the fallout of a Greek sovereign debt default -- damage to European banks and falling business activity on the continent and perhaps the U.S. -- by dumping stocks and abandoning the euro and buying dollars.

The CME Group raised trading margins on platinum and copper futures, hoping to tame volatility in products that have fallen sharply as markets witness what is turning out to be the worst rout since the 2008 financial crisis.

World stocks hit a fresh 15-month low on Tuesday while the dollar neared a nine-month peak on growing doubts over Greece's ability to avert a default that would spark a major banking crisis in Europe and accelerate a global economic slowdown.

A series of emails released by the House Of Representative's Energy and Commerce committee show that Solyndra investors as well as White House officials questioned Solyndra's financial stability as early as December 2009.

Gold rose 1.6 percent on Monday, its biggest one-day gain in a month, as bullion resumed its role as a haven from turmoil following its worst monthly loss since the financial crisis in 2008.

Canada wants its central bank governor, Mark Carney, to become head of the Financial Stability Board, the country's finance minister said on Monday days after a highly publicized clash between Carney and one of the world's most powerful bankers.

Signs of a U.S. recession, if not a global recession, are multiplying daily -- so much so that the cover on the latest issue of The Economist shows a black hole with the words, Be Afraid.

CME Group Inc., the biggest operator of U.S. futures exchanges, said it will more than double the amount of physical gold it can accept from its clearing members as collateral.

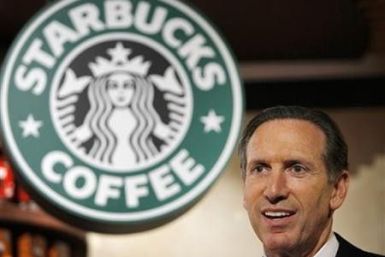

Starbucks CEO Howard Shultz has teamed up with Operation Finance Network to establish the Create Jobs for USA, a fund for job growth.

European Goldfields said an investment deal with Qatar Holdings will enable it to fully finance projects in Greece at a time when its options were narrowing due to fiscal and economic uncertainty in the country.