Investors have approved a year-long extension of a $4.7 billion property megafund from Morgan Stanley , a company spokesman told Reuters on Friday.

Goldman Sachs said it expected upside in prices of oil, gold and copper this year, citing greater supply risks and stronger fundamentals.

Stock index futures pointed to a mixed open on Wall Street on Friday, with futures for the S&P 500 down 0.05 percent, Dow Jones futures down 0.1 percent and Nasdaq 100 futures up 0.16 percent at 1039 GMT.

Shares in Research In Motion climbed nearly 4 percent on Thursday on market speculation the BlackBerry maker had hired investment bank Goldman Sachs to explore strategic options.

JPMorgan Chase & Co Chief Executive Jamie Dimon announced on Thursday that long-time colleague Jay Mandelbaum is leaving the company and that he is shifting the responsibilities of several operating executives.

Royal Bank of Scotland Group Plc (NYSE: RBS), Britain's biggest state-owned bank, has became the latest major bank to succumb to the global squeeze on financial institutions trying to juggle shareholder pressure and worsening economic prospects.

It’s question that dominates the suburban dinner-party set these days, or so it seems: where are U.S. home prices headed?

Few companies embody the highs and lows of turbo-charged modern finance better than Ferretti.

While reports that the world's largest wind turbine maker was firing thousands of workers globally shook the renewable energy industry Thursday morning, the bad news did not seem to diminish investor appetite in solar energy stocks, which has picked up considerably over the past week.

Global investment in clean energy hit a record $260 billion in 2011, up 5 percent from the previous year as investment in solar grew by more than a third despite shrinking profit margins, some bankruptcies and flagging share prices, a report said.

Danish wind turbine maker Vestas (VWS.CO) will cut 2,335 jobs in a bid to restore profitability after rising costs wiped out its 2011earnings.

Europe's markets closed mixed on Thursday after a profit warning from retail heavyweight Tesco and weak U.S. retail and labor data more than offset relief from successful Spanish and Italian debt auctions.

Global PC shipments declined 1.4 percent in the last quarter of 2011 mainly due to weak demand in Western Europe and the United States, according to research firm Gartner.

Royal Bank of Scotland abandoned ambitions to be a top global investment bank and said it would cut another 4,450 jobs as it bows to pressure from the UK government to shut down risky operations and prepare for tougher international regulations.

South African miner Gold Fields has signed an agreement with Kyrgyz villagers that will enable it to resume drilling at a prospective copper deposit three months after an arson attack by horsemen on its geologist camp.

Royal Bank of Scotland is to axe 3,500 investment bank jobs and sell or shut equities and advisory business under a 3-year plan to further reduce risk and focus more on domestic retail and corporate banking.

Bill Gross, the manager of the world's largest bond fund, said on Wednesday that the "demise" of PIMCO's flagship fund is exaggerated.

The price of U.S. Treasuries has nowhere to go but down. Smart investors should take advantage of a market that is underestimating the possibility of a sudden drop in the price of those securities. They should also seek to sell off euros, a Wells Fargo strategist said Wednesday.

Ford CEO Alan Mulally and Xerox CEO Ursula Burns both decried the state of U.S. higher education Wednesday and said it wasn't producing enough engineers to ensure U.S. technology leadership.

President Barack Obama plans to introduce a series of incentives to bring outsourced jobs back to America and increase domestic investment.

Since Deepwater Horizon, a longer permitting processes and the drilling moratorium in the Gulf of Mexico is projected to cost the U.S. more than $24 billion in lost investment, says a report from the American Petroleum Institute.

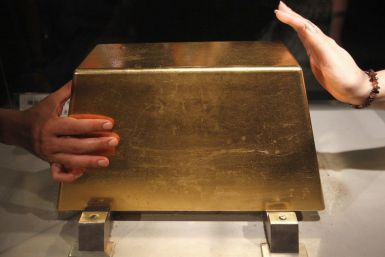

Gold prices extended gains into the second day on Wednesday, rising above the closely-watched 200-day moving average. The yellow metal is trading at around its highest level in a month, supported by strong physical demand from India and China.