Accounting groups KPMG and Ernst & Young have been cleared of responsibility for a $1.7 billion accounting fraud at Japan's Olympus Corp, one of the nation's worst corporate scandals, in a report issued on Tuesday by a company-appointed panel of lawyers.

Accounting groups KPMG and Ernst & Young have been cleared of any responsibility for a $1.7 billion accounting fraud at Japan's Olympus Corp, one of the nation's worst corporate scandals, in a report issued on Tuesday by a panel of lawyers appointed by the company.

Nigerian trade unions called off strikes and protests Monday, ending a major confrontation over fuel prices after President Goodluck Jonathan said he would cut them by one third.

Gold miners expect the price of the metal to continue climbing in 2012, with most respondents expecting a peak around $2,000 an ounce, according to a survey of gold companies by consultants PwC.

Top executives from India's major power companies will meet Prime Minister Manmohan Singh on Wednesday to push for swifter action to improve access to coal and make it easier to get funding, acquire land and get environmental clearances.

India's headline inflation slowed sharply in December to a two-year low as food price pressure eased dramatically, but the Reserve Bank of India (RBI) is still expected to leave interest rates on hold next week as manufacturing inflation remained elevated.

Global leaders and businessmen urged Europe on Monday to take fresh steps to resolve its deepening debt crisis, with a top executive of the IMF warning the continent will see a downward spiral of collapsing confidence if no further action is taken.

Japan's Nikkei average fell to a one-month closing low on Monday after downgrades of nine European countries, including a cut in France's triple-A rating, escalated fears over the region's ability to end its debt crisis.

China's fledgling real estate investment fund market could see a surge of activity in 2012 as property developers launch their own vehicles in a desperate bid to bridge an estimated $111 billion financing gap in the year ahead.

Hulu, the popular online video service, has taken another step to becoming a full-fledged alternative to cable television by commissioning its first scripted original TV show to go live next month.

The euro zone's bailout fund can hold onto its AAA rating with Standard & Poor's through higher guarantees from the euro zone's remaining triple A countries or lower lending capacity, a senior euro zone official said Sunday.

Advanced Micro Devices' (AMD) stock, after meandering at $5 for much of the fall, has pushed above $5. What's that mean for the stock, moving forward?

French haute couture fashion designer Jean-Paul Gaultier has reportedly provided a fashionable way for bullion investors to diversify holdings and hedge against inflation.

Chinese Premier Wen Jiabao pressed Saudi Arabia to open its huge oil and gas resources to expanded Chinese investment, media reports said on Sunday against a backdrop of growing tension centered on Iran and worries over its crude exports to the Asian power.

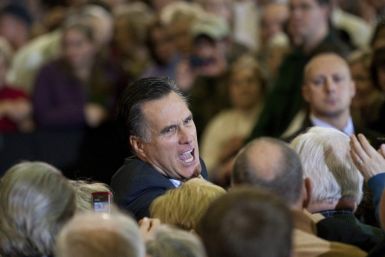

Mitt Romney is being maligned as a vulture capitalist who enjoyed firing workers -- while amassing his own huge fortune -- but rivals' attacks on the former private-equity player's business record may be one of the best things that ever happened to his presidential campaign.

Newt Gingrich might have denounced the errors in a Super PAC (political action committee) advertisement on Mitt Romney and asked them to withdraw it, but the trailer and the documentary titled King of Bain - When Mitt Romney Came to Town is still going viral on the Internet. The ad in the form of a 28-minute documentary was released by Winning our Future, a Super PAC that supports Gingrich.

A Japanese banker who is a key figure in the Olympus Corp. accounting fraud came into public view for the first time since the scandal broke, appearing on Friday at his divorce hearing in a Florida court.

A whopping 44 percent of all mutual-fund shareholders are baby boomers, according to an Investment Company Institute report. As they take withdrawals from their retirement kitties over the next couple of decades, you're looking at a major, potentially market-altering event.

A Japanese banker who is a key figure in the Olympus accounting fraud came into public view for the first time since the scandal broke, appearing on Friday at his divorce hearing in a Florida court.

Standard & Poor's downgraded the credit ratings of nine Eurozone governments on Friday, an unprecedented relegation that included France and Austria but spared Germany.

Art Laffer is named in a lawsuit from a group of investors who say he lent his name to investment funds that ran a Ponzi scheme through a talk radio business.

There has always been economic disparity and there always will be.