Central bank action on Wednesday to ease severe funding strains for the world's private sector banks may help cushion a brewing global credit crunch but it only buys some wiggle room for governments trying to resolve the euro debt crisis and keep banks lending.

Lehman Brothers Holdings Inc said on Tuesday it has won overwhelming support for its reorganization plan, including from creditors with $400 billion of claims, an important step toward ending its record bankruptcy.

Lehman Brothers Holdings Inc said on Tuesday that 98.7 percent of creditors representing more than $405 billion in claims had voted to back its reorganization plan, an important step towards ending its bankruptcy.

A German regional court has opened the door to an investor law suit against credit rating agency Standard & Poor's over its assessment of Lehman Brothers securities before the collapse of the U.S. investment bank.

The escape route from risky peripheral euro zone debt into higher-yielding emerging markets is becoming increasingly tortuous, as the debt crisis marries the performance of all assets closer together.

Ever wondered what the U.S. economy might look like should there be another Lehman Brothers-style bank collapse? Well, it would not be pretty.

The Austrian banking system is on fire: getting singed not only by the heat of the Eurozone sovereign debt crisis, but also by the immolation of an Eastern European asset bubble the banks had been underwriting for a decade. Stumbling, contradictory guidance from the management of several banks has not helped either. And a stalling Austrian economy is only likely to make things worse

Latest data on new claims for unemployment sent mixed signals to the market, showing that while the week ended Nov. 19 was the third straight week for initial claims to hold below 400,000, a mark that most economists believe is essential for the economy to add more jobs than it is shedding, application for jobless insurance increased 2,000 to 393,000.

Gold prices broke a four-day losing streak Tuesday as investors worried about a possible liquidity crisis in the Eurozone sought protection for their money in the yellow metal.

When Lehman Brothers Holdings Inc. collapsed in September 2008 and shattered the belief that U.S. money-market funds would never break the buck, Washington rushed to limit the damage.

Negative rumors have turned Jefferies Group Inc. into the latest financial whipping boy. A controversial report from ratings agency Egan-Jones, which the firm has stood by, has spooked the markets. Jefferies is insistent that it remains solid. Who will investors believe?

Asian shares wobbled Thursday as doubts deepened about Europe's ability to stop its sovereign debt crisis from spinning out of control, with Germany and France split over the European Central Bank's bond buying role.

As equity investors play the ups and down of the stock market, fixed income money managers that provide day-to-day financing to the banks, investors in medium-term bonds and the peer banks themselves are scrambling for cover. The result: a dollar financing crunch that could deeply affect the banks and how they do business.

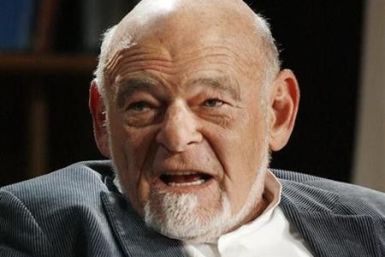

Real estate mogul Sam Zell's Equity Residential is the lead bidder to buy 53 percent of rival company Archstone for over $2.5 billion, the Wall Street Journal reported.

Japan's economy rebounded from an earthquake-triggered recession in the third quarter by expanding 1.5 percent, a pace that is likely to slow down though as a strong yen and weak global growth darken the outlook.

The decision to lay off 1,066 people who worked for MF Global -- effective immediately and without severance -- will give people pause. But it is only the beginning of the nastiness in the MF Global saga

Japanese banks backed by more than $6 billion in spare cash are in talks to buy assets from European banks, sources familiar with the discussions said, as euro zone leaders try to coax foreign capital to help overcome the bloc's debt crisis.

Gold has confounded market watchers by refusing to behave like a safe-haven and instead has tracked equities over the past few weeks, but the escalating European debt crisis could see bullion ditch its risk-asset mantle and return to record highs.

UBS is shutting its asset-backed securities business in the United States, Swiss newspaper HandelsZeitung reported on Thursday without citing sources.

Olympus Corp's use of accounting tricks to hide big losses has raised questions about whether its auditors, the Japanese arms of global giants KPMG and Ernst & Young, should have done more to follow up on red flags.

Former MF Global customers like Koch Industries, who pulled billions of dollars out of the stricken broker's accounts weeks or months before its collapse, have counted their blessings in recent days.

After another week of confusion and turmoil in Europe, investors are ditching whatever hopes they once had for a conclusive solution to the debt crisis.