Applications for U.S. home mortgages rose in the first week of the year as demand for both purchases and refinancing perked up, an industry group said on Wednesday.

MetLife will shut down its mortgage operations, the largest U.S. life insurer said on Tuesday, giving up on the unit three months after it said it would seek a buyer.

How do you disguise yourself when you're a bodybuilder boss, with your picture in every hotel of your far-flung company? Answer: A long-haired wig and contacts; guess your employees aren't paying that much attention to the boss's picture.

MetLife Inc. (MET), the largest U.S. life insurer, said Tuesday that it's shutting down the business of originating residential mortgages, three months after the company said it would seek a buyer for the unit. Goldman Sachs upgraded MetLife to "buy" as the company scales back to meet targets for shareholder returns.

Michael Williams, CEO of mortgage giant Fannie Mae, is resigning, the company announced on Tuesday.

Canadian housing starts climbed more than expected in December, fueled by low mortgage rates and a boom in condo construction, even as analysts predicted the once-hot sector would cool further in 2012.

The federal government will soon begin selling government-owned foreclosed properties in bulk to investors as rentals, in a new effort to dispose of its growing portfolio of distressed properties.

Jacob Lew, a former Citigroup executive, reportedly received a $900,000 bonus from the company after it took $45 billion in taxpayer bailout funds in 2008.

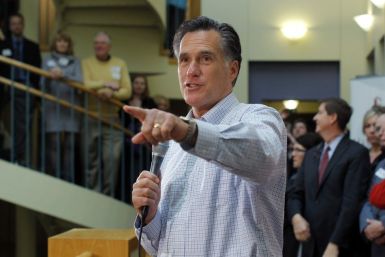

The labels being attached to Republican U.S. presidential candidate Mitt Romney seem to be straight out of the Democrats' playbook.

As the government nears a deal with top banks to resolve mortgage abuses, the Justice Department has begun reaching out to other banks to gauge their interest in joining the wide-ranging settlement, according to a person familiar with the matter.

As the U.S. government nears a deal with top banks to resolve mortgage abuses, the Justice Department has begun reaching out to other banks to gauge their interest in joining the wide-ranging settlement, according to a person familiar with the matter.

The betrayals of real estate magnate Edul Ahmad, though brought to light nearly six months ago, continue to haunt the residents of the Guyanese-dominated Richmond Hill neighborhood of Queens.

Almost 60 percent of the money the big banks of Australia spend each year are eaten up by staff costs.

Freddie Mac, the large federally controlled mortgage guarantor, announced that it would allow unemployed borrowers to delay mortgage payments for up to 12 months under a new plan.

Housing Development Finance Corp, India's largest mortgage lender, expects the RBI to cut the cash reserve ratio, rather than interest rates, at its monetary policy review on January 24, Chief Executive Keki Mistry said.

Signs the recovery is gaining strength suggest the Federal Reserve may not need to buy any more bonds to spur growth, a top policymaker said.

Signs the U.S. recovery is gaining strength indicate the Federal Reserve may not need to buy any more bonds to spur growth, James Bullard, president of the Federal Reserve Bank of St. Louis, said on Saturday: I don't think it's very likely right now because the tone of the data has been pretty strong recently.

Federal Reserve Governor Sarah Bloom Raskin on Saturday said the Fed must impose monetary penalties on banks who entered into an April agreement with regulators over how to fix problems in their mortgage servicing businesses.

Federal Reserve Gov. Sarah Bloom Raskin said on Saturday the Fed must impose monetary penalties on banks that entered into an April agreement with regulators over how to fix problems in their mortgage-servicing businesses.

Three top Federal Reserve officials aggressively pushed on Friday for more stimulus for the U.S. housing market, saying the government should be looking at ways to help the sector for the purpose of speeding the country's economic recovery.

Hedge fund manager John Paulson lost more than half of the capital in one of his firm's biggest funds, people familiar with the number said Friday.

The times and trends are always changing, and some benefit consumers while others do not. But the shopping Web site dealnews did a good job in recent days noting things that will be less expensive and more expensive in 2012. Among the items that will get cheaper in 2012, according to dealnews, is wine and homes.