The insolvency of an Islamic mortgage lender in Canada may hinder the growth of sharia-compliant finance in North America, where the industry has struggled to gain traction in the absence of a supportive regulatory framework.

The BCS released its bowl game selections on Sunday night and within hours Las Vegas casinos have released the betting lines on all 35 games.

Investment firm Beacon Capital Partners has closed on an investment in 195 Broadway in Lower Manhattan as part of a $280 million recapitalization of the property, according to city records.

In the financial crisis-era, with its constrained public revenue from a smaller U.S. workforce, almost every government agency is forced to belt-tighten -- including the U.S. Postal Service, which will implement historic cutbacks starting in the spring of 2012.

Nine SEC schools will go bowling in the NCAA's BCS postseason, including six teams from the AP Top 25. Two SEC teams, LSU and Alabama, will also battle for the national championship title.

Here is the complete BCS bowl games schedule for the 2011-2012 season, including the match-ups and where you can watch the games.

The official college football bowl game schedule was released on Sunday night after yet another exciting finish to the regular season.

In the wake of a lawsuit filed by the Massachusetts attorney general, GMAC Mortgage, a subsidiary of Ally Financial, said on Friday that it would stop buying mortgage loans in the state after Dec. 5.

Massachusetts Attorney General Martha Coakley hit five banks with a lawsuit over foreclosure practices in the midst of multistate settlement negotiations.

The Massachusetts attorney general has filed a lawsuit against five large U.S. banks accusing them of deceptive foreclosure practices, a signal of ebbing confidence that a multi-state agreement can be worked out.

The Federal Housing Administration (FHA)'s mortgage insurance fund is threatened by declining home prices and could require a taxpayer bailout, Congress members said at a hearing on Thursday, echoing an earlier report.

Average rates for 30-year fixed-rate U.S. mortgages increased slightly to 4 percent from 3.98 percent in the week ending Dec. 1, according to Freddie Mac.

Fulton County sheriff's deputies and local movers refused to follow orders to evict a 103-year-old woman and her 83-year-old daughter from their longtime home.

Brookfield Asset Management and tenants of Stuyvesant Town and Peter Cooper Village are making a bid to take over the massive apartment complex of over 11,000 units on Manhattan's east side.

U.S. mortgage applications decreased on a seasonally adjusted basis by 11.7 percent in the week ending Nov. 25, according to the Mortgage Bankers Association (MBA).

Private sector job growth accelerated in November as employers created the most jobs in nearly a year, prompting economists to raise their forecasts for Friday's more comprehensive U.S. labor report.

Wells Fargo Securities said the California housing market continues to struggle and is not yet ready to bolster California's economic rebound.

Banks' contribution to the economy may be hugely overstated, underscoring anger about the scale of taxpayer rescues and resultant government cutbacks, but a sharp retreat of banking worldwide looks painful for all and needs calibrating.

The Inspector General of the Federal Housing Finance Agency (FHFA) said in a report released on Tuesday that the regulator did not provide enough oversight of Fannie Mae and Freddie Mac in mortgage repurchases, executive compensation and other transactions.

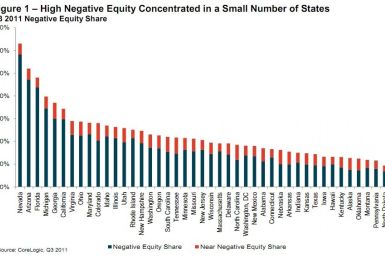

U.S. homeowners with mortgages worth more than the value of their homes decreased slightly in the third quarter, according to a report from CoreLogic.

U.S. District Court Judge Jed S. Rakoff issued an acerbic order blocking the U.S. Securities and Exchange Commission's proposed $285 million deal with Citigroup that is "neither fair, nor reasonable, nor adequate, nor in the public interest."

The planned retirement of Congressman Barney Frank, D-Mass., leaves the Democratic party lacking in the YouTube mojo department. Partisan sniping aside, Frank was a regular source of one-liners and playful harassment of his legislative colleagues and TV talking heads.