Industry experts say there could be chaos in six months when Americans are looking to restart mortgage payments.

The housing sector is facing uncertainties this year and next because of the market conditions caused by the coronavirus pandemic. Home sales could slump as much as 15%, some estimates show.

Millions of American households have fallen behind on their mortgage payments

U.K. mortgage market has been severely crimped by the coronavirus impact

A lawsuit filed by two former lobbyists revealed a secret plan to buy Freddie Mac from government control hatched between 2016 and 2018.

A fall in mortgage rates partly attributed to fear of global economic slowdown because of the new coronavirus epidemic that began in China's Wuhan is driving current mortgage holders to lenders seeking to refinance their loans.

US stocks jumped on Wednesday after Donald Trump assured the public Iran’s missile attacks did minimal damage.

Low mortgage rates are one reason why home sales are increasing.

Australia's banks have not passed on recent interest rate cuts to consumers in full

Freddie Mac has reported a notable increase in the average 30-year, fixed-rate mortgage.

JPMorgan CEO Jamie Dimon said banks would have to come up with new fees to protect profitability should interest rates go to zero or lower.

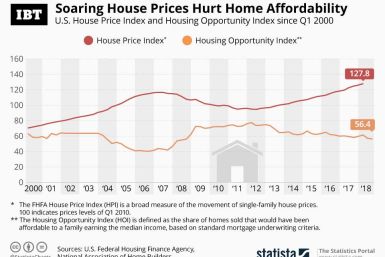

US home prices remain high as falling interest rates increase demand

It costs $13,153 a year because of home improvements, among other expenses.

Casey Anthony's parents, George and Cindy Anthony, are continuing to fight to keep the home where their granddaughter was last seen alive, despite going into foreclosure.

It'll get you to that milestone sooner.

Cautious home buyers, rising interest rates, tax law changes and a mountain of student loan debt are holding back the housing market. But analysts told the International Business Times that there is no bubble building up, unlike in 2008.

Will fintech help banks or help startups conquer the market?

Everyone from homeowners to banks and lenders stand to benefit from the rise of mortgage tech.

SoFi wants to completely change the way millennials think about financial services, from wealth management to credit card rewards. Could SoFi's mobile app become a one-stop shop for handling money?

Here are today's average mortgage rates compared to where they stood a month ago.

Some are tougher to achieve than others, and you'll need to weigh the necessary sacrifice against the return.

Here are today's average mortgage rates across the U.S., along with where they stood a month ago.