The U.S. stock index futures point to a higher open Wednesday as investor confidence was underpinned by expectation that the Federal Reserve will announce stimulus measures this week to invigorate the economy and boost growth.

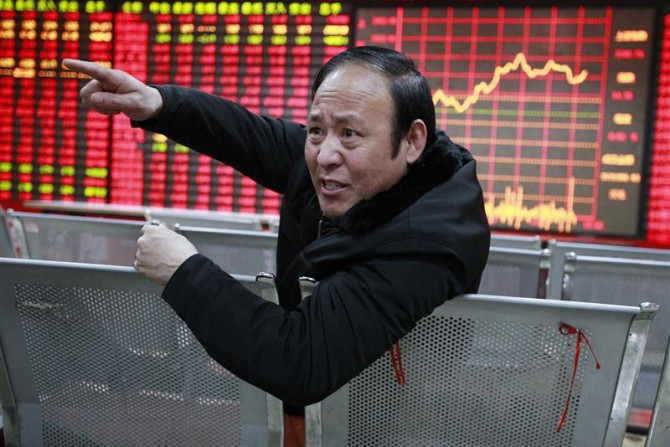

Asian stock markets rose Wednesday as investors remained hopeful that policymakers in the U.S. and China would announce monetary easing measures to boost the global economy and rejuvenate economic growth momentum.

Asian shares edged higher Wednesday as investors remained cautiously optimistic that a German court would approve the legality of the euro zone's bailout fund later in the day and the U.S. Federal Reserve may deliver further stimulus measures this week.

The U.S. stock index futures pointed to a higher open Tuesday as investor sentiment turned positive amid hopes that the Federal Reserve would announce monetary easing measures this week to revive the economic growth momentum.

Asian shares eased Tuesday ahead of a key German ruling on the euro zone's bailout funds and the U.S. Federal Reserve's policy decision.

It's been three years since the Great Recession technically ended, and still, unemployed Americans are struggling to find work.

The U.S. stock index futures point to a higher open Friday ahead of the Bureau of Labor Statistics' nonfarm payrolls and unemployment reports.

Asian shares rose and the euro steadied Friday after the European Central Bank outlined its bond-buying scheme to help calm the euro zone's debt crisis, while firm U.S. data fed speculation of a strong jobs report later in the day.

The U.S. stock index futures point to a higher open Tuesday as market sentiment was underpinned by expectations that policymakers around the world will announce stimulus measures to rejuvenate the economic growth momentum.

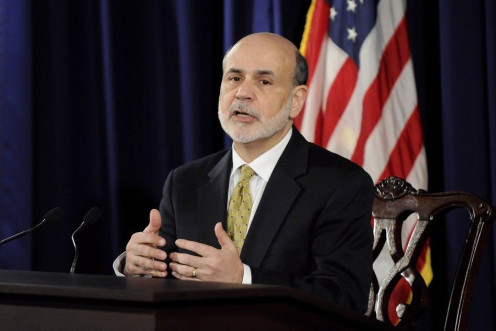

Gold hovered near a five-month peak on Monday, supported by hopes for more stimulus measures after U.S. Federal Reserve Chairman Ben Bernanke gave a grave assessment of the economy last week.

Most of the Asian markets rose Monday as investors remained hopeful that the world's central banks would announce stimulus measures soon to help boost the global economic growth.

It seemed everyone was claiming their crystal ball has been right in anticipation of a much-hyped speech by the world's most powerful central banker, who managed to turn the attention of traders around the world to his podium in bucolic Jackson Hole, Wyo. Friday. They were all right and, as usually happens in such cases, they were also all wrong.

U.S. stock index futures point to a higher open Friday ahead of Federal Reserve Chairman Ben Bernanke's speech at the Jackson Hole symposium where he is expected to announce another round of monetary easing.

Asian stocks declined to a four-week low on Friday as investor sentiment was weighed down by fading optimism on U.S. Federal Reserve Chairman Ben Bernanke to announce more monetary stimulus at the Jackson Hole convention.

Market-watchers continued to use words like "anticipation," "expectations," "disappointment" and "excitement" Thursday, less than 24 hours ahead of a speech by Federal Reserve chairman Ben Bernanke that is being hyped up as a make-or-break moment for economic affairs in 2012.

The U.S. economy expanded slightly faster than initially thought in the second quarter, but the pace of growth is still too slow to create enough jobs and drive down the unemployment. Economists are forecasting even slower growth in the second half of 2012, which will probably keep expectations of additional monetary stimulus from the Federal Reserve intact.

Asian stock markets ended mixed Wednesday as investors remained in a waiting mode ahead of Federal Reserve Chairman Ben Bernanke’s speech at the Jackson Hole symposium.

The euro remained firm while Asian shares steadied Wednesday as investors awaited U.S. Fed Chairman Ben Bernanke's Friday speech.

Will Federal Reserve Chairman Ben Bernanke launch QE3 from the Federal Reserve Bank of Kansas City's annual Jackson Hole symposium, which will take place from Aug. 30 to Sept. 1? Economists doubt it.

Markets from stocks to currencies were caught in ranges Tuesday as investors waited for a gathering of central bankers and economists at Jackson Hole, Wyo., later in the week for clues over the Federal Reserve's potential easing options.

U.S. stock index futures point to a mixed open Monday as investors remained cautious waiting for the Federal Reserve to announce monetary easing measures to revive economic growth momentum.

Most of the Asian markets fell Monday as investors' concerns about the faltering global economy undermined the expectations for stimulus measures from China and the U.S. Federal Reserve.