Gold prices will likely average $1,925 an ounce in the fourth quarter of 2013.

The Bank of Japan Tuesday kept its key policy rate unchanged and refrained from announcing any monetary easing measures in spite of the political pressures to pursue aggressive stimulus steps for reviving the economic growth momentum.

Diversification of reserve assets remains the driving force behind gold demand by central banks.

The Bank of Japan has assured that it will continue to ease the monetary policy to help the country overcome deflation and return to a sustainable growth path.

The Federal Reserve on Wednesday stuck to its plan to keep stimulating the U.S. economy until the job market improves and repeated its vow to keep rates near zero until mid-2015.

The Reserve Bank of Australia, the country's central bank, lowered its benchmark interest rate on a sudden -- and unexpected -- gloomy labor market view.

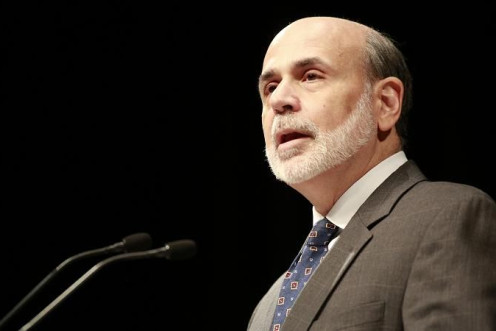

Federal Reserve Chairman Ben Bernanke, in a speech in Indiana, went back to explaining why the Fed is good for us.

U.S. Federal Reserve Chairman Ben Bernanke Monday robustly defended the bank's unconventional program to stimulate the U.S. economy, quantitative easing.

The U.S. stock index futures point to a higher open Friday amid investor hopes that the stimulus measures announced this month by policymakers around the world will be able to rejuvenate global economic growth momentum.

While the financial markets have improved substantially, the labor market has proven to be lackluster.

In the statement released with the initiation of the new program, it was obvious the Fed hoped to stimulate the economy while lowering unemployment and boosting the housing market.

The Bank of Japan unexpectedly boosted its asset-buying program by ¥10 trillion ($126.7 billion), following similar easing steps by the U.S. Federal Reserve and the European Central Bank.

Three key U.S. housing reports Wednesday are expected to show small improvements in the market.

Asian shares retreated from four-month highs Tuesday as markets paused from last week's rallies, calculating the impact on growth from the Federal Reserve's aggressive stimulus and eyeing whether Spain will request a bailout to ease its fiscal strains.

London copper slipped on Monday, but still retained most of the previous session's steep climb to a 4-1/2 month top as a new round of

U.S. monetary stimulus measures and a weak dollar continued to support prices.

With the Bank of Korea unexpectedly holding its policy rate at 3 percent, market participants feel that stimulus measures will be urgently needed to reinvigorate the country?s weakening economy.

Most of the Asian markets gained in the week as investor confidence was lifted following the announcement of another round of quantitative easing by the U.S. Federal Reserve which is expected to rejuvenate the economic growth.

Ron Paul's campaign against the Federal Reserve had made some headway last summer, but even Republicans who dislike the Fed's decision to start a new round of easing aren't as drastic as him in attacking the central bank

Asian stock markets rallied to a four-month high Friday after the U.S. Federal Reserve launched another large scale of asset purchase program overnight to stimulate the world's largest economy.

U.S. stock index futures pointed to a higher open Friday as investors kept up a buoyant mood following the announcement of quantitative easing measures by the Federal Reserve, which is expected to boost economic growth.

European markets rose Friday as investor sentiment turned positive following the announcement of another round of quantitative easing by the U.S. Federal Reserve.

Crude oil prices advanced in Asian trading Friday, extending overnight rally after the U.S. Federal Reserve launched another round of quantitative easing to rejuvenate the economic growth.