The U.S. debt deal means that federal spending will now generate even less demand in the quarters ahead, in an economy that?s already weak, and with an unemployment rate at 9.2 percent. To say the Fed has been monitoring the situation would be an understatement.

New U.S. claims for unemployment benefits were little changed last week, a government report showed on Thursday, pointing to a marginal improvement in the labor market.

The European Central Bank signaled on Thursday that it was buying government bonds in response to a deepening debt crisis as it also offered a new round of liquidity to banks.

The global economy is more sluggish than first thought, government bonds offer no real return, gold is super expensive and stock markets sell off at the slightest setback.

The yen tumbled from near record highs on Monday after Japan intervened to curb the currency's export-damaging strength, while world stocks held above 2011 lows as expectations grew for more policy action in developed countries.

A Beijing-based ratings agency on Wednesday downgraded the U.S. sovereign debt rating, while Western agencies such as Fitch and Moody?s reaffirmed their AAA rating, following Congressional approval of a plan to raise the debt ceiling.

Japan kept markets on guard for currency intervention and more monetary easing on Wednesday, with the finance minister vowing to stem the yen's rise and the prime minister calling for central bank action to protect the economy.

Pressure will build among Federal Reserve policymakers at a meeting next week for measures to pep up a stumbling recovery with a stronger commitment to rock-bottom interest rates.

The increase in the debt ceiling is only half of what President Obama was asking for and will therefore create another round of default trauma when the next debt ceiling is reached. I

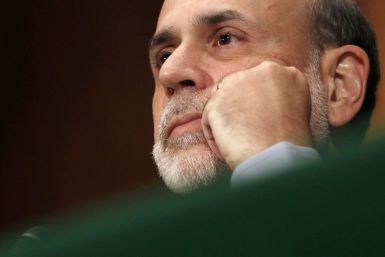

Anemic U.S. growth is not enough to prompt Federal Reserve Chairman Ben Bernanke to call for a new round of monetary stimulus.

Fading hopes the Congress will strike a deal in debt talks any time soon have left investors scrambling to position themselves for what many now view as an inevitable downgrade of the U.S

There may be a point at which global investors get indigestion from U.S. money printing.

U.S. money managers sitting on piles of cash are sniffing out opportunities to make a killing on the political circus in Washington over raising the nation's debt ceiling.

The U.S. Federal Reserve's much criticized bond buying spree had only mild side-effects on other economies but the process of tightening monetary policy eventually may reverberate more harshly, an IMF report said on Monday.

A top Federal Reserve official said on the Thursday the U.S. economy should grow at a modest pace for the next several years, but issued a harsh criticism of the U.S. central bank's just-concluded bond buying program.

The Federal Reserve faces a high bar for further monetary stimulus in the absence of deflation risks, but could maintain rock-bottom borrowing costs for a long time, a top central bank official said on Monday.

Spot gold prices touched a new record high of $1598.41 on Monday, extending the longest rally in about 40 years. The latest wind in the tail came from worsening worries of a European sovereign crisis and the painful stalemate in the US debt ceiling talks that has raised the specter of an unprecedented Treasury default.

If the Fed wades further into muddy stimulus waters, that will set the stage for a certain gold boom in the short to medium term. Historically, a dollar sell-off has been the biggest force behind a gold boom. If the Fed takes recourse to another round of easing in pursuit of its goal of propping up job creation and real growth, it will inadvertently cause a dollar sell-off and trigger, in turn, a gold super rally.

The setting is perfect for another gold boom cycle to kick in, perhaps pushing the yellow metal into a super cycle. There are several factors aiding gold's further push into higher price records, greater investment worth and long-term reign as a de facto currency. There are all sorts of classic factors supporting gold all the way, like the demand from China and India bursting at seams, continued worries for the US dollar and the worrisome prospect of sovereign default in some European countri...

The US economy is at an inflection point after the end of the second round of Quantitative Easing (QE2). Two rounds of monetary and fiscal stimulus since 2008 have had only limited impact on growth or unemployment. The question is,'What next?' will there be another round of monetary and fiscal policy easing? Analysts at American Enterprise Institute for Public Policy Research (AEI) are of the opinion that fiscal and monetary policies have reached their limits.

U.S. Federal Reserve Chairman Ben Bernanke said on Wednesday that the Fed was prepared to take action to reverse any slowdown in the economic recovery, including another round of quantitative easing.

Wall Street stocks rebounded from a three-day selloff on Wednesday as comments from Federal Reserve Chairman Ben Bernanke raised hopes for further stimulus of the U.S. economy if needed.