China's central bank chief poured cold water on Thursday on talk that Beijing could make the yuan fully convertible as soon as 2015.

China's central bank chief poured cold water on Thursday on talk that Beijing could make the yuan fully convertible as soon as 2015.

Britain's central bank left interest rates at a record low 0.5 percent for the 30th straight month on Thursday, leaving open the possibility that it may restart its quantitative easing program should the economy weaken further.

The outlook for economic growth in developed countries has got much worse in the last three months, the OECD said on Thursday and urged central banks to keep rates low and be ready to pursue other forms of easing.

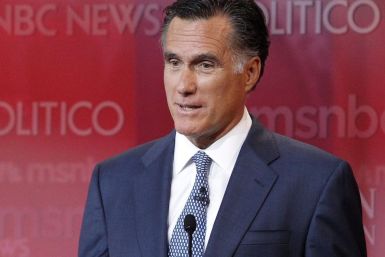

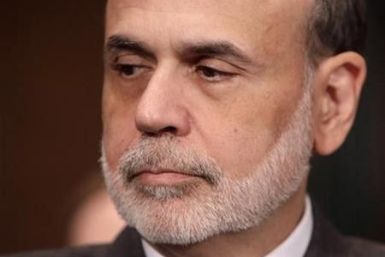

Republican presidential hopeful Mitt Romney said on Wednesday that if he were elected president, he would not keep Ben Bernanke as chairman of the Federal Reserve.

The sluggish U.S. recovery failed to gain speed in recent weeks and softened in some areas of the country, as volatile stock markets and sputtering factory activity weighed on growth, the Federal Reserve said on Wednesday.

Brazil vowed on Tuesday to defend its domestic industry against unfair competition and slapped import tariffs on select Chinese steel products.

China's economic growth may ease to below 9 percent in 2012, partly due to a weak global economy, a senior Chinese foreign exchange official said on Tuesday, backing market expectations that the world's No. 2 economy is set for a mild easing.

The Bank of Japan is expected to refrain from easing monetary policy this week, with the yen's retreat from its record high and a resilient stock market allowing it to save for later its limited options to support the fragile economy.

Friday's jobs report that showed hiring in the United States unexpectedly ground to a halt in August is increasing speculation the U.S. Federal Reserve will move to stimulate the economy. But will it help stocks?

August is over and it actually was not as bad for stocks as widely advertised.

U.S. government bond investors see Federal Reserve action to boost the flagging economy as practically a done deal after Friday's dismal jobs report.

Gold rose to a 1-1/2 week high on Friday as investors sought refuge in safe haven assets after a disappointing labour market report from the United States added to mounting fears about the pace of recovery in the world's largest economy

The great August stock selloff has been far from uniform. Some sectors are now pricing in a far bigger risk of recession than others, leaving islands of potential value for the brave.

The U.S. economy created no net new jobs in August -- a disappointing report that will likely increase pressure on the U.S. Federal Reserve to deploy additional monetary tactics to help rev-up GDP growth to create the millions of jobs the nation needs. Also, the unemployment rate remained the same, at an eye-sore level of 9.1 percent.

Gold rose to a 1-1/2 week high on Friday, benefiting from caution about the euro zone debt crisis and ahead of the key U.S. non-farm payrolls data which is likely to underscore the frail state of the world's largest economy.

European shares fell sharply on Friday, snapping a four-session rally, as traders feared U.S. non-farm payrolls numbers could signal a return to recession.

The pace of U.S. private sector job growth slowed in August for the second month in a row, but factory activity in the Chicago area continued to expand, suggesting the economy would dodge a recession.

Gold fell on Wednesday after a near 3 percent rally the day before sparked by Federal Reserve comments on possible measures to boost U.S. growth, and the bullion price is still set for its biggest monthly gain in nearly two years.

Brent crude hovered at $114 a barrel Wednesday, after posting six days of gains, on expectations the United States will act again to try and boost growth and increase demand for oil.

The U.S. Federal Reserve could embark on a third round of quantitative easing depending on upcoming economic data but should first confirm that inflation has eased, a senior Fed official said in the Asahi newspaper on Wednesday.

The biggest impact from QE3 could come from Ben Bernanke announcing it rather than it actually going into effect.