With the S&P 500 about to end its best month in almost 40 years, many would be happy to cash in gains and start packing for the ski slopes.

With the S&P 500 about to end its best month in almost 40 years, many would be happy to cash in gains and start packing for the ski slopes.

Europe has staved off an imminent financial crisis and fears of a U.S. double-dip recession may have been overblown. With the Federal Reserve already lowering long-term interest rates through Operation Twist, it seems QE3 is not likely to come.

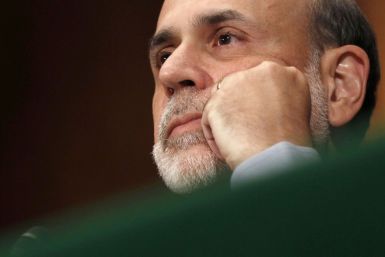

The ink is barely dry on European leaders’ plan to resolve the Greek / Europe debt crisis, and attention has already turned to the U.S. Federal Reserve. Is there enough liquidity in the global financial system or will Fed Chairman Ben Bernanke need to deploy more monetary stimulus to grease the wheels of commerce?

The Bank of Japan eased monetary policy on Thursday by boosting purchases of government bonds and warned of risks posed by a strong yen and Europe's debt crisis in a sign it would act again if recovery in the world's third-largest economy falters.

Despite an elevated level of risk aversion – and the fact that the source of the risk is the European debt crisis – the euro remains “surprisingly resilient” against the safe-haven U.S. dollar, said Samarjit Shankar, managing director at Bank of New York Mellon

The Bank of England got it about right when it opted to inject another 75 billion pounds into the financial system, a move that will help fend off the risk of deflation, a top policy maker said on Wednesday.

The Bank of England got it about right when it opted to inject another 75 billion pounds into the financial system, a top policymaker said on Wednesday, adding the move will help fend off the risk of deflation.

European leaders are negotiating with Greek bondholders, publicly stating investors will have to take substantial losses. Their stance is in stark contrast to the way debt holders have been coddled in programs managed by the U.S. Federal Reserve

The Bank of Japan will likely debate easing monetary policy further on Thursday given the yen's renewed spike to record highs and growing doubts that European leaders will calm markets with a clear plan to rein in the region's debt crisis.

Another round of quantitative easing is a possible option for the central bank as it attempts to boost the slow U.S. economic recovery, one of the most influential Fed officials said on Monday.

A third round of quantitative easing (QE3) is still on the table, said New York Federal Reserve President William Dudley.

If Thomas Hoenig, retired chairman of Federal Reserve Bank of Kansas City, becomes the new vice chairman of the Federal Deposit Insurance Corporation, will the era of big banks come to an end?

Two top Federal Reserve officials are arguing the U.S. central bank should consider resuming controversial large-scale mortgage bond purchases to support a fragile economic recovery.

No need to repeat all of the bad news about the U.S. economy. Further, as the stock market's bulls point out, that's history. Looking forward, the picture brightens, and accordingly here's why the bulls think the Dow Jones Industrial Average (DJIA) is headed higher in the next six months.

The Bank of Canada will keep rates on hold until the third quarter of next year amid slow global growth and the risk that Europe's debt crisis will linger on, according to a Reuters survey released on Tuesday.

Fissures at the Federal Reserve over the correct course of future monetary policy were on display Monday, with one top policymaker calling for further easing even as another suggested tighter policy may be needed.

The Federal Reserve's latest effort to push down long-term borrowing costs is likely to push inflation higher with little benefit to economic growth, a top central bank official said on Monday.

Some members of the Federal Open Market Committee (FOMC) were not quite satisfied with Operation Twist, the tool the Fed ultimately decided to announce in its September statement.

China's purchases of beaten-down bank shares may be one of several baby steps along an easing path that eventually leads to interest rate cuts.

The risk of U.S. inflation is minor compared with an ongoing morass in the jobs market, two top Federal Reserve officials said after the government reported a steady 9.1 percent jobless rate.

Job creation accelerated more than expected in September, easing the risk of a new recession, although the economy still created too few positions to heal the labor market much.