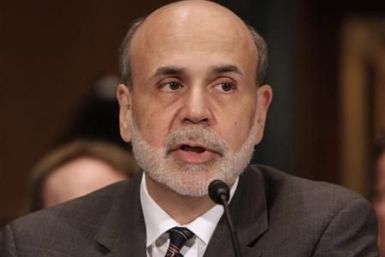

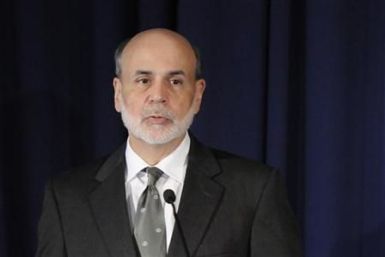

With the economy slowing and the markets crashing, Federal Reserve Chairman Ben Bernanke put the burden squarely on Congress to act.

The Federal Reserve is prepared to take further steps to help an economy that is close to faltering, Fed chairman Ben Bernanke said on Tuesday in his bleakest assessment yet of the fragile U.S. recovery.

The Federal Reserve is prepared to take further steps to help a fragile economic recovery held back by a weak job market and financial stresses in Europe, Fed Chairman Ben Bernanke said on Tuesday.

Tuesday’s early morning drop has taken the S&P 500 Index down over 20 percent from its May 2 high. Although there is no official definition of a bear market, one commonly accepted metric is falling 20 percent over an extended period.

Although the global economy is struggling to avert a recession, we also know that central banks are working very hard to provide sufficient liquidity to ensure a smooth ride through year-end.

Ben Bernanke put markets on notice this week: Despite already having spent trillions of dollars to stimulate growth, the Federal Reserve would do more if inflation falls too far and the threat of deflation grows.

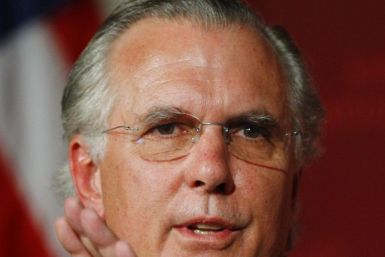

The Federal Reserve's new Operation Twist drew a number of objections from Richard W. Fisher, president of the Federal Reserve Bank of Dallas, who explained his opposition to the move in a speech Tuesday.

Just days after the Federal Reserve launched a new round of unconventional monetary policy easing, a top Fed official with a record of supporting such moves on Friday questioned how effective the latest move will be.

The Dow Jones Industrial Average (DJIA) is on track to record a weekly decline of more than 800 points -- its worst weekly swoon in two years. But the important question for the typical investor is, 'Where's the Dow likely to head in the next six months?'

The U.S. Federal Reserve intervened in the U.S. economy Thursday – the central bank did what investors thought they would do, but the Dow Jones Industrial Average still fell more than 270 points. What’s going on?

Global Economic Crisis: Are we Better or Worse off than 2008? The Greek economic crisis is at the heart of the problems of the world economic crisis and for as long as France and Germany continue to ignore the realities that Greece must be allowed default on its debts, the European and world economies will suffer the consequences.

The Federal Reserve on Wednesday warned of significant risks to the already weak U.S. economy and launched a new plan to lower long-term borrowing costs and bolster the battered housing market.

The Federal Reserve on Wednesday moved to counter what it said were significant risks to the U.S. economy with an effort to lower long-term borrowing costs and bolster housing.

After the Federal Reserve announced its Operation Twist, bank stocks plunged.

What is Operation Twist, the Federal Reserve's latest move to boost the economy?

The U.S. Federal Reserve Wednesday announced it will sell $400 billion worth of short-maturity bonds and reinvest in bonds with maturities of 6 to 30 years by the end of June 2012, in a program commonly referred to as Operation Twist.

Gold fell on Wednesday as investors booked profits on the metal's rally earlier in the day ahead of the outcome of a Federal Reserve policy meeting that many hope will confirm the central bank's strategy to kick-start U.S. growth.

Top Congressional Republicans on Tuesday took the unusual step of telling the Federal Reserve to refrain from further intervention in the economy on the eve of the central bank's policy decision.

Gold held steady above $1,800 an ounce on Wednesday ahead of the outcome of a Federal Reserve policy meeting at which the U.S. central bank is expected to unveil its next steps to revive the world's largest economy.

Gold held steady on Tuesday, after Standard and Poor's downgrade of Italy's credit rating, while a stronger dollar weighed on sentiment ahead of a key U.S. Federal Reserve policy meeting.

Gold rallied 1 percent on Friday in volatile trade, as the safe-haven bid for precious metals returned when a survey showed U.S. consumers gloomy about the economic outlook.

Gold slipped more than 1 percent on Friday, heading for its biggest weekly drop since March 2009, as stock markets gained and the euro rose after major central banks around the world strived to fight the debt crisis in Europe.