U.S. Stocks Fall - Did the Federal Reserve Provide Enough Stimulus?

ANALYSIS

The U.S. Federal Reserve intervened in the U.S. economy Wednesday -- the central bank did what investors thought they would do, but the Dow Jones Industrial Average still fell more than 270 points. What's going on?

What did the U.S. Federal Reserve do Wednesday? The central bank, also known as the Fed, started a program to sell $400 billion in short-term government securities -- maturities less than three years and buy an equal amount of long-term government securities -- maturities in the six- to 30-year range. The intervention has been dubbed Operation Twist by economists and Wall Street professionals.

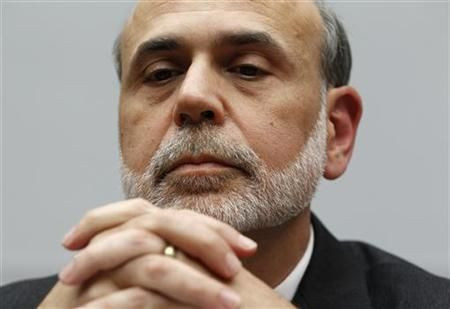

Why is the Fed doing this? Fed Chairman Ben Bernanke and the other Fed members are concerned that the U.S. economic recovery will slow even more, perhaps to the point of a stall, i.e. tip back into a recession. The Fed's action, along with earlier interventions, called quantitative easing and quantitative easing II (QE, QE2) are providing stimulus to the U.S. economy.

Stimulus to the economy? I thought the U.S. Congress was providing stimulus? Isn't that Congress' job? The Congress was providing stimulus, and yes, economic stimulus is primarily the job of the U.S. Congress. However, the GOP was returned to power in the U.S. House in the 2010 election, and a Tea Party-dominated Republican House caucus has won in their effort to cut federal spending -- reducing the amount of fiscal stimulus applied to the U.S. economy. Those cuts are one reason the U.S. economy has slowed.

In fact, if the Tea Party-faction had its way, they'd cut federal spending even more - and they'd probably reduce/shorten unemployment compensation benefits and other social safety net programs -- taking even more demand out of the economy and slowing it even more. In a nutshell, one reason the Fed has to act is because the Congress isn't acting.

But aren't we supposed to cut the budget deficit? Yes, long-term, the deficit must be cut, then eliminated. However, cutting fiscal stimulus amid weak demand conditions makes little sense, from a macroeconomic standpoint -- as noted, it will slow the U.S. economy even more, which is what happened when the Republican Party did the same thing in 1937 -- it slowed a U.S. economy that was recovering under President Franklin D. Roosevelt's New Deal economic program. The Republican action is known as The Mistake of 1937.

But the Fed acted Wednesday, yet the Dow Jones Industrial Average still fell 284 points to 11,125. Why would the market drop if the Fed did the right thing? The U.S. stock market's bears -- those who think the market is likely to decline -- argue that U.S. GDP will strain to get above two percent this year and next year, and when combined with a high 9.1 percent unemployment rate, will put downward pressure on corporate revenue and earnings. As a resut, many bears are reducing their positions in stocks, which drove the Dow lower.

Are the bears right? And what should I do with my U.S. stock investments? The stock market's bears very well could be right, particularly if Congress doesn't pass a jobs bill that would provide much-needed stimulus to the U.S. economy.

On the other hand, if the Fed's Operation Twist lowers long-term interest rates, businesses large and small may view the lower-cost money as too cheap to pass up, and move forward with plans to launch new projects and hire employees. If that occurs, the U.S. economy will strengthen, benefiting corporate revenue and earnings, and the stock market will likely rise, and the bulls will be right.

I'm invested in about 10 stocks and two blue-ship stock mutual funds. What should I do? The keys are your investment horizon and your risk tolerance.

If you plan to retire in one year, now would be a good time to consider taking some profits off the table, and to reduce your exposure to stocks.

If you plan to invest for only one to two years more, and retire in, for example, late 2013, likewise, it makes sense to take some profits and reduce your stock exposure.

If you plan to invest for longer than two years, sit tight. Long-term investors shouldn't run for cover every time the market hiccups. If you sit tight, bargains -- stocks selling for a low price -- will appear, and you can benefit from that pullback. (Assuming you have the money to invest.)

Blue-chip companies like General Electric, Boeing, Caterpillar, United Technologies and Coca-Cola are already at bargain levels, and there are dozens of others.

© Copyright IBTimes 2024. All rights reserved.