China's securities regulator will begin a trial programme that allows local fund houses to raise money offshore for investment in the domestic financial market, two sources said on Monday.

PRC property developer Evergrande Real Estate Group made history last week with a Rmb9.25bn (US$1.4bn) synthetic renminbi bond - the biggest to date in the fast-growing market.

Hong Kong stocks are expected to edge higher on Monday to a near two-month high, as the appetite for risky assets stays steady after JP Morgan's quarterly earnings report lifted Wall Street on Friday.

Gold rebounded slightly on Monday from a one-percent fall in the previous session, after China further tightened its monetary policy to curb inflation, and holdings in the gold-backed exchange-traded fund continued falling.

Li Ning Group Ltd (2331.HK) said on Monday that same-store sales growth of its L-Ning brand products increased 3.6 percent in the fourth quarter and about 3.9 percent for the full year.

Shanghai hopes to encourage foreign companies to raise capital through stock and bond issuance in Shanghai this year, Mayor Han Zheng said on Sunday, while also confirming the city plans a trial property tax during 2011.

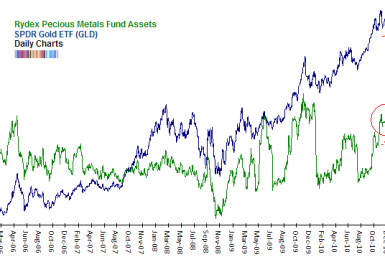

An upward sloping consolidation in Gold that began in October has, despite a lack of any real losses, been enough to improve various sentiment indicators.

Stocks rose modestly, boosted by strong corporate earnings from J.P. Morgan (NYSE: JPM) and Intel Corp. (Nasdaq: INTC), allowing the S&P 500 index to score its seventh consecutive week of gains.

The U.S. economy closed out 2010 on a softer note than expected, with rising gasoline prices eroding consumers' purchasing power in December even as they helped lift retail sales.

U.S. stock index futures pointed to a lower open on Friday after weak retail sales and a mixed reaction to JPMorgan Chase & Co's quarterly earnings.

U.S. December retail sales rose slightly less than expected, but retail sales for all of 2010 reversed two years of contraction and posted the biggest gain in more than a decade.

U.S. stocks are down slightly in Friday morning trading after the release of U.S. retail sales data and news of further monetary tightening from China.

Sales at U.S. retailers rose slightly less than expected in December while underlying inflation remained calm, government reports showed on Friday.

Retail sales in the U.S. rose marginally in December as well as for the year 2010, according to a report by the U.S. Commerce Department.

U.S. stocks fell on Friday after retail sales rose less than expected and on a mixed reaction to JPMorgan Chase & Co's quarterly earnings, though the S&P was on track to notch a seventh straight week of gains.

Starbucks Corp unveiled a deal that sets the stage for the world's largest coffee company to bring its iconic cafes to India, where Western-style coffee shops are increasingly popular.

The BSE Sensex fell 0.4 percent in early trade on Friday, with financials leading the decline ahead of December inflation data.

The embattled Congress-led coalition government failed to announce major policy decisions on Thursday to tackle soaring food prices after days of wrangling, taking only minor measures seen as unlikely to make a major impact.

U.S. jobless claims jumped unexpectedly last week to their highest level since October, suggesting the labor market is still in a rut despite signs of improvement in the economy.

Companies will no longer be able to force staff to retire at 65, Britain's government said on Thursday in a move to boost the number of older people staying on at work as the population ages.

Ethiopia has penalised retailers and suppliers in the capital who raised the prices of consumer goods such as bread by amounts higher than caps set in January, authorities said on Thursday.

Spain and Italy staged successful bond sales on Thursday, easing concerns about an escalation of euro zone debt strife and buying the bloc's leaders more time to come up with a new package of anti-crisis measures.