The British pound strengthened on Tuesday on a higher-than-expected inflation reading for November, with the sentiment also supported by a view that the US Federal Reserve may expand its bond buyback program at its monetary policy later in the day, supplying more dollars into the system.

The EUR/USD distanced itself from a falling channel ahead of the Fed policy and rose to a three-week high on Tuesday. The single currency, however, pared some of its gains after data at 10:00 am GMT showed the region's industrial output rose at a lower-than-expected pace in October.

Stock index futures were little changed on Tuesday as investors awaited the Federal Reserve's assessment of the economy.

Futures on major U.S. stock indices point to a modestly lower opening on Tuesday as investors awaited a wave of economic data including the US Federal Federal Open Market Committee statement (FOMC)

USD/CHF fell below a channel support as concerns of the US Fed expanding its $600 billion bond buyback at a policy announcement later Tuesday. The pair extended its losses to hit its lowest in more than a month early in the day in Europe before recovering partly.

The industry had the highest proportion of women in boardrooms in 2010 - at 18.1 percent.

Galileo Global Advisors CEO Georges Ugeux speaks to IBTimes about investing in Asia outside the scope of public markets.

U.S. stocks advanced in early trade on Monday, following the gains in global equities, after Chinese policymakers refrained from raising interest rates over the weekend.

Paul Myners, the former Financial Services Secretary during the Labour government of Prime Minister Gordon Brown, has called for the break-up of UK partly-nationalized banking giants Lloyds Banking Group (NYSE: LYG) and Royal Bank of Scotland (NYSE: RBS).

GBP/USD that rose above the key 1.5838 level to a 2-week high of 1.5860 on Friday slipped on Monday despite a stronger-than-expected data and is now targeting 1.5649 as immediate support (S1).

The outage suffered by Amazon.com's European websites was due to a hardware failure but not due to hacking attacks, according to the company. The websites Amazon.co.uk, amazon.de, amazon.fr and amazon.es were down for almost half an hour late on Sunday night. Hackers have not made any claims of the attack so far.

USD/CHF is currently testing the 50-day SMA at 0.9784 and targeting the 1.0064-81 region (R1) immediately on the upside. If the uptrend continues, 1.0331-1.0434 region (R2) will form next key resistance level for the pair.

There are many things weakening the single currency. Concerns over a lack of consensus on euro-area bonds, dollar-positive data from the US, fears about China being forced to cool down its economy and now, an ascending channel clearly shaping up on the 60-minute EUR/USD chart.

Wal-Mart Stores Inc is in advanced talks with New York's construction unions to get their backing for its entry into New York City's retail market, The Wall Street Journal reported on Sunday.

At the Video Games Awards, release of 'Mass Effect 3' was announced, and winners declared. While just hours ahead of the 2010 ceremony, Microsoft delayed the news on much-awaited 'Gears of War 3'.

Chronology: Key events that highlight Apple's march this year

Sprint Nextel, the third largest wireless carrier in the United States, could acquire Ntelos Holdings' wireless business.

A strong turnout by shoppers for Black Friday boosted U.S. video game sales 8 percent last month, marking the strongest November on record, but sales for the whole year are likely to be flat at best, according to retail research firm NPD Group.

In its war against rampant piracy, Ubisoft has chosen an unusual weapon. The French game publisher has installed the sound of ear-splitting vuvuzela horns, which was popularized at the World Cup 2010 in South Africa, to annoy away the pirates.

She is the queen of retail fashion with sales expected to go up to $ 1billion

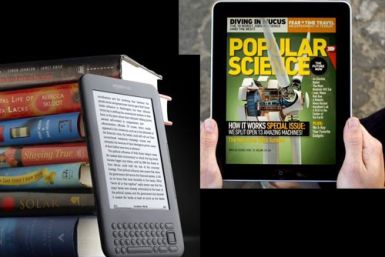

Google's launch of e-book store has put the search giant in direct rivalry with market leader Amazon, unfolding an interesting battle on cards in the coming days.

The United States is expected to see weak employment prospects though employers expect the modest hiring pace to continue in the first three months of the year, a survey reported.