Technology Focus: Is HP’s Whitman Up to the Job?

Five months into her tenure, is new Hewlett-Packard CEO Meg Whitman really up to the job? Chances are no and the indications she gave last week are that she may never measure up.

Whitman, 55, spent more than $178.5 million, including $144 million of her own cash, as the 2010 Republican candidate for governor of California, outspending Democrat Jerry Brown 6 to 1. To no avail. She lost big, winning only 41.7 percent of the vote.

Of course, running HP in Palo Alto may be easier than running California. But Jerry Brown was a successful chief executive once before. To her credit, so was Whitman, who made her pile as CEO of eBay, which she transformed into one of the top e-commerce sites.

The value of eBay now is about $46.8 billion compared with HP's $52.7 billion. Considering how much intellectual property and technology prowess has gone into HP since David Packard and Bill Hewlett founded it in 1939, the shares are true underperformers.

To be sure, that's not all Whitman's fault. She was brought in as the company's third boss in two years after Mark Hurd and Leo Apotheker were ousted. Rather than take someone from its bench, the HP board reached out to Whitman, who'd only been a director for nine months.

She promised to take a top-to-bottom look at the company and rely on her executive chairman, former Oracle President Ray Lane, for help, especially on software.

Last week, discussing HP's mediocre first-quarter results, Whitman didn't promise investors much. The kind of turnaround that we're leading HP through right now, these things are not quick. It took us a while to get into this situation in which we find ourselves. It's going to take us a little while to get out, she said.

Sensible. But then Whitman said the shift could take as many as five years. By then the world could change and even Apple could collapse!

In 1993, after CEO John Akers nearly ran IBM into bankruptcy, another outsider came in and saved the company: Louis V. Gerstner. Not a technologist, Gerstner was pulled in from RJR Nabisco and previously been head of American Express.

In Tampa, Fla., at his first annual meeting days into his tenure, Gerstner said he would adopt the approach of a longtime IBM customer and promised a comprehensive review within a quarter.

Gerstner was cheered. Shareholders jeered the board of directors. Within a quarter, Gerstner decided to take the biggest charge in IBM's history as he exited low-margin businesses and set the Armonk, N.Y., company on a services model. Gerstner and his successor, Samuel Palmisano, did a good job with it. New CEO Virginia Rometty hasn't indicated she'll scrap it.

IBM, which has about $20 billion less in annual revenue than HP, is valued at $233 billion. Its shares have gained 23 percent over the past year while HP shares have dropped 37 percent.

Where will HP go next? For now, it won't jettison its PC business, the world's largest, an outgrowth of old HP plus Compaq. It will need to refresh its imaging and printing business, also the world's largest, for the era of the smartphone and tablet.

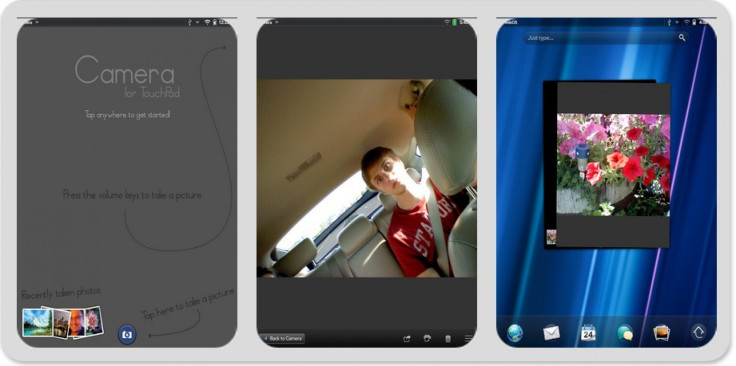

And HP will need a tablet or something better than last year's TouchPad, which got clobbered by the iPad2 and Samsung's Galaxy Tab. The old HP would have had a hit product by now, if Hewlett, Packard or retired CEO John Young had to design it themselves.

So let's give Whitman time. She was handed a damaged asset and probably has the brains to set it right. The question is whether she has the knack.

© Copyright IBTimes 2024. All rights reserved.