Tesla-SolarCity Merger Goes To Shareholder Vote, Might Affect Solar Energy's Future

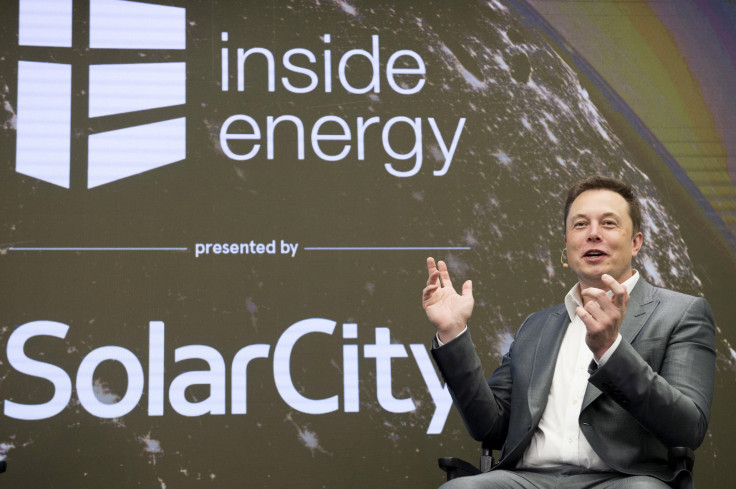

Whether Elon Musk's gamble of trying to buy out America's largest provider of solar energy, SolarCity, has paid off, will be decided Thursday — shareholders will vote to decide the fate of the Tesla-SolarCity merger.

If the merger goes through, it will bring Musk's “Master Plan, Part Deux” one step closer to realization. Musk declared in July his plans to create a solar energy for the masses. Musk has already succeeded in implementing a part of his plan of creating a solar roof, by launching solar roof tiles and Powerwall 2 in October.

What the merger represents is a transition in battery design and innovation. The product, which has had an almost similar design for around 200 years, will be, for the first time, up for a redesign. Tesla's batteries will provide advanced energy generation and storage. Up till now, just four conglomerates controlled most of the world's battery supply. Recode estimates that battery prices and consumption will double by 2020. This makes it crucial for new players to step in and provide new solutions to consumers. Tesla's batteries, designed with SolarCity's technology, are expected to be more affordable.

But the merger isn't going through without any jitters. Elon Musk owns 20 percent of both companies and has removed himself from being a voting member on the deal to avoid a conflict of interest.

“We’ve tried to do this in a way that’s as fair as possible, and really going beyond what’s legally required to make it not just legally correct, but morally correct,” Musk told Fortune in June.

Despite this, analysts such as Credit Suisse's Patrick Jobin have given the deal a 20-40 percent probability of going through. Tesla's shares suffered a 10 percent drop Wednesday, just before voting happens. In fact, Jesse Pichel, an investment banker at Roth Capital partners called it a “bailout” from Tesla for SolarCity.

It remains to be seen if the deal goes through. Under the agreed terms, SolarCity will have a 45-day period to seek better offers, while Tesla will have one more opportunity to sweeten its offer if SolarCity obtains a higher bid. If SolarCity does accept a better deal during the 45 days, the company would pay Tesla a $26.1 million fee for breaking away from the deal.

© Copyright IBTimes 2024. All rights reserved.