The shares of Bank of America Corp (BAC.N), Citigroup Inc (C.N), Goldman Sachs Group Inc (GS.N) and Morgan Stanley (MS.N) skidded on Wednesday, renewing evidence that when the market sneezes financial stocks get pneumonia.

Fear returned to Wall Street on Wednesday, sending the S&P 500 to another 4 percent decline, triggered by worries that Europe's debt crisis could engulf French banks and spill onto the U.S. financial sector.

Gold is set to widen its premium over platinum after hitting parity for the first time in 2-1/2 years this week, with no end yet in sight to the potent cocktail of fear factors that are benefiting safe havens at the expense of cyclical assets.

Bank of America Merrill Lynch?s Global Commodity Research team announced that they?ve rebalanced their actively managed commodity indices in favor of non-cyclical commodities such as gold.

Wall Street economists see odds of around one-in-three the United States will slip back into recession, heightening expectations the Federal Reserve will launch another round of unconventional credit easing.

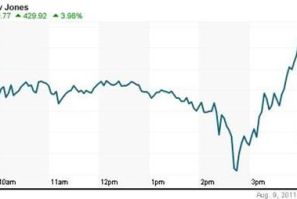

U.S. stocks rebounded sharply on Tuesday after a major sell-off, but markets remained vulnerable to selling if the Federal Reserve fails to ease fears of a double-dip recession.

The Dow Jones Industrial Average and Bank of America both bounced back from disastrous Mondays to steady gains during Tuesday trading.

All eyes are on Bank of America (NYSE: BAC) ahead of Tuesday's opening bell after the banking giant suffered a 20 percent loss on Monday's trading.

The companies whose shares are moving in pre-market trade on Tuesday are: MetroPCS Communications, Bank of America, NYSE Euronext, AK Steel Holding, Regions Financial, Regions Financial, MEMC Electronic Materials, Halliburton, Duke Energy, Bristol Myers Squibb and Plum Creek Timber.

U.S. markets were poised to open higher Tuesday as futures rose based on anticipated action from the Fed.

Stock index futures rose on Tuesday, indicating a partial rebound from the previous session's nosedive, as investors looked to a Federal Reserve statement for clues on how it may combat the growing perception the nation was headed for recession.

The Dow Jones Industrial Average was rocked by investor fear on Monday, dropping 634 points during trading.

Investors fled stocks on Monday in the first session since Standard & Poor's cut the AAA credit rating of the United States, adding to worry about the economic outlook and Washington's ability to meet the challenges.

Amidst the slaughter in equities, Treasuries rallied and gold soared to a new all-time high.

U.S. stocks plummeted for the second straight session, driving the S&P 500 and the Nasdaq down 6 percent on Monday in the first session since Standard & Poor's cut the nation's perfect AAA credit rating.

As the Dow Jones Industrial Average dropped more than 500 points on Monday, banking giant Bank of America saw its share price get hammered.

Call it downgradeageddon, the fear sending U.S. markets sharply lower.

The Dow lost four percent in trading mid-day Monday, while the Nasdaq and S&P lost five percent. President Barack Obama addressed downgrade Monday, but the markets dropped further after his comments.

Bank of America Corp (BAC.N) shares fell as much as 9.5 percent to their lowest level since April 2009 on Monday morning over fears of a slowing U.S. economy and challenges to a multi-billion dollar mortgage settlement.

American International Group Inc is suing Bank of America Corp to recover more than $10 billion over a "massive fraud" on mortgage debt, deepening the litigation morass facing the largest U.S. bank.

Bank of America's stock tumbled Monday, down 16 percent as investors reacted to a lawsuit filed against the bank by AIG.

Some investors, who were already jittery about the European debt crisis, and continued bad news on the US economic front, appear to have thrown in the towel.