Stocks jumped at the open on Thursday after China's central bank cut bank lending and deposit rates, fueling hopes of simultaneous action to aid a flagging global economy.

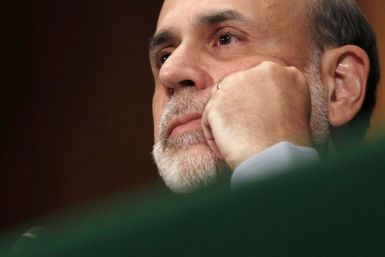

Futures on major U.S. indices point to a slightly higher opening Thursday ahead of the report on weekly jobless claims and Fed Chairman Ben Bernanke?s congressional testimony.

Asian markets rose Thursday amid hopes that the U.S. Fed would announce another round of monetary easing and European policy makers would take concrete measures to tackle the debt crisis looming over the euro zone.

Asian shares nudged up Wednesday but were capped by concerns that Europe's financial strains could intensify without a global response, as Spain warned that it was being shut out of credit markets.

The April trade data is likely to garner the most market attention, while the Fed Beige Book will set the tone for the upcoming Federal Open Market Committee (FOMC) meeting. On Thursday, markets will also be watching Fed Chairman Ben Bernanke's testimony to Congress, which could provide clues on whether the Fed is ready to take additional steps to support growth.

A third straight month of disappointing job data clearly suggests that the U.S. labor market conditions are deteriorating again, which economists say will undoubtedly prompt more speculation that a third round of quantitative easing by the U.S. Federal Reserve is coming soon.

One month of lackluster job growth can be blamed on the weather, but two or even three is dangerously close to a trend. Unfortunately, we might be in for another month of slower job growth in May.

You can't blame investors for feeling a bit squeamish regarding deploying new money in the U.S. stock market these days, with the Dow Jones Industrial Average?s (DJIA) recent slide from 13,300 to 12,450 unnerving even the most experienced institutional investors. Where?s the market headed in the next six months?

U.S. mortgages rates have dropped to record lows for four consecutive weeks, but that doesn't mean more homes will be sold. In fact, at least one housing expert argues that extremely low rates are causing banks to be even more stringent with underwriting approvals, turning away more prospective buyers and hurting the national housing market.

The U.S. economy will likely dip into another recession in the first half of 2013 if planned tax increases and spending cuts are allowed to go into effect in January, the Congressional Budget Office said.

Consumer prices in the U.S. were flat in April amid signs that a spike in gasoline costs was ebbing, according to government statistics released on Tuesday, supporting the Federal Reserve's view that the jump in fuel costs is only temporary.

U.S. wholesale prices edged down in April as energy costs declined, pushing the measure of inflation to its lowest annual rate in two and a half years, supporting the Federal Reserve's view that the jump in fuel costs is only temporary.

Ron Paul ate with Ben Bernanke, chairman of the Federal Reserve, on Wednesday, and after their meal Paul joked that he's for the gold standard now.

Federal Reserve Chairman Ben Bernanke, speaking via teleconference to a Chicago bankers' conference, took an uncharacteristic swipe at community banks on Thursday, suggesting that those institutions might not be as sure-footed as their balance sheets would have them appear.

The U.S. economy added far fewer jobs than expected in April, while the unemployment rate edged down as more people gave up hope of finding jobs, reinforcing the fear that the job market recovery could be losing steam.

Employers likely increased hiring in April, although not enough to lower the country's 8.2 percent jobless rate, keeping pressure on President Barack Obama ahead of his November re-election bid.

Nonfarm productivity fell in the first quarter as companies hired more workers to maintain output, but a moderate rise in wages suggested little pressure on company profits and inflation.

Hiring in the U.S. probably picked up somewhat in April after a disappointing showing in March renewed fears of another spring slump in the labor market, economists said in anticipation of the April non-farm payroll report due Friday.

Gold touched two-week highs on Tuesday, set for its longest stretch of daily gains in eight months, after a rally in the dollar fizzled out as investor concern escalated over the resilience of the U.S. and euro zone economies.

Americans spent their hard-earned money a bit more cautiously in March while personal income rose by the most in three months, according to government data released Monday.

The U.S. economy expanded at a slower-than-expected pace in the first quarter, reflecting a deceleration in inventories and nonresidential fixed investment that was partly offset by the biggest gain in consumer spending in more than a year.

The bond market focused Thursday on weak economic data while equity investors responded to news that an unexpectedly high number of people sought first-time jobless benefits, leaving both types of securities higher.

![Maine Republican Caucus 2012: Ron Paul's Speech [FULL TEXT & VIDEO]](https://d.ibtimes.com/en/full/34527/maine-republican-caucus-2012-ron-pauls-speech-full-text-video.jpg?w=385&h=257&f=4dfc2ecd4916406e88674e66007c4615)