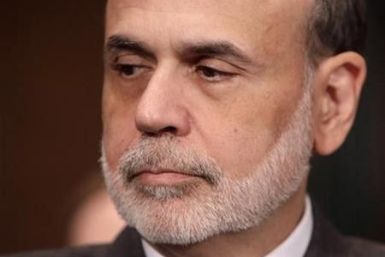

Stock index futures pointed to a lower open on Friday as investors found few reasons to buy following a volatile week and ahead of a speech from Federal Reserve Chairman Ben Bernanke on the economy.

The U.S. economy grew at a worse-than-expected 1.0 percent rate in the second quarter, the U.S. Commerce Department announced Friday, in its second estimate for the quarter, as lower export growth and a slowdown in inventory build-up braked the world's largest economy to near-stall speed.

The economy grew much slower than previously thought in the second quarter as business inventories and exports were less robust, a government report showed on Friday, although consumer spending was revised up.

The economy grew much slower than previously thought in the second quarter as business inventories and exports were less robust, a government report showed on Friday, although consumer spending was revised up.

Those expecting Federal Reserve Chairman Ben Bernanke to pull a rabbit from his hat at a retreat for central bankers here on Friday may be in for a letdown.

Gold and silver rose Friday in electronic trading as investors returned to the precious metals on concerns over soverign debt worries on both sides of the Atlantic, weakness in the banking sector and sluggish growth in the U.S. and Europe.

Stock index futures were little changed on Friday as investors hesitated to make bets on when Federal Reserve Chairman Ben Bernanke would announce a new stimulus plan as a volatile week drew to a close.

Gold prices arrested this week's slide on Friday to rise nearly 1 percent ahead of a speech from Federal Reserve chairman Ben Bernanke in Jackson Hole, Wyoming, later, which will be closely watched for hints on the outlook for Fed monetary policy.

Spot gold was steady on Friday, but was likely to register its first weekly drop after seven straight weeks of gains as investors awaited a speech by U.S. Federal Reserve Chairman Ben Bernanke later in the day.

Republican presidential candidate Michele Bachmann's strategy for dealing with rival contender Rick Perry is: do more of the same and bank on a misstep by the Texas governor.

Stock futures pointed to a slightly higher open for equities Friday after declines in the previous session, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 all up 0.2 percent.

Spot gold lost 0.4 percent Friday, on course for its first weekly drop after seven straight weeks of gains, as investors awaited a speech by U.S. Federal Reserve Chairman Ben Bernanke later in the day.

Asian shares edged up marginally on Friday as investors waited for a speech by Federal Reserve Chairman Ben Bernanke later in the day, while nervousness about the U.S. economic outlook sent the dollar higher.

Spot gold lost 0.4 percent on Friday, on course for its first weekly drop after seven straight weeks of gains, as investors awaited a speech by U.S. Federal Reserve Chairman Ben Bernanke later in the day.

Spot gold steadied on Friday after rebounding in the previous session, as investors awaited a speech by U.S. Federal Reserve Chairman Ben Bernanke later in the day.

Facing pressure to keep money printing in check, U.S. central bankers are mulling a modest approach to stimulus that would give the struggling economy only a tiny boost -- if it helps at all.

Striking workers at Verizon Communications pushed up new U.S. jobless claims last week, but there was little evidence the recent stock market turmoil had spooked businesses enough for them to cut workers.

Gold fell for a third consecutive session on Thursday, as funds liquidated positions due to CME Group's second margin hike this month, technical weakness and jitters on the eve of Federal Reserve Chairman Ben Bernanke's speech to central bankers.

Gold prices fought off an early drop to post modest gains Thursday as investors thought better of the yellow metal's value as a safe haven.

Gold rose on Thursday after two days of sharp declines, as tumbling European and U.S. equity markets on talk that Germany might enact a short-selling ban prompted investors to buy bullion as a safe haven.

The U.S. economy will continue to grow at a modest pace as consumers and businesses pare back excessive amounts of debt, a top Federal Reserve official said.

Fed Chairman Ben Bernanke's much-anticipated speech Friday will likely disappoint investors and policy makers hoping for signs the central bank will try to rev up the weak economy, but the speech is likely to relieve gold investors who have booked big profits from that same economic malaise.