The Republican presidential nomination race is starting to take shape as one of the most captivating competitions and reality shows we've seen in years. Think America's Biggest Loser meets Extreme Makeover meets Jon and Kate Plus 8.

Stock markets surged Monday as investors awaited a Federal Reserve meeting, which will take place later this week, when a new stimulus plan may be announced. The gains were also enabled by gains in European markets.

Stocks surged more than 1 percent in early trading on Monday following four weeks of equity losses as stocks rebounded globally.

The Republican presidential nomination race is starting to take shape as one of the most captivating competitions and reality shows we've seen in years. Think America's Biggest Loser meets Extreme Makeover meets Jon and Kate Plus 8. Mitt Romney as a front-runner didn't do much for ratings, but Rick Perry and his Perryisms changed that. Now, Sarah Palin appears set to come on board as a leading cast member, and we already know from previous experience she's rarely a dull momen...

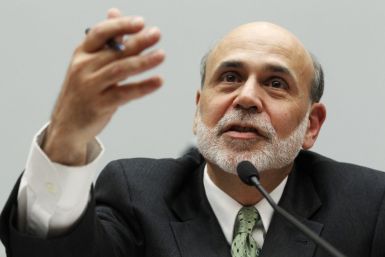

With the U.S. recovery having slowed considerably, and Europe debt woes persisting, investors will look to Fed Chairman Ben Bernanke's Jackson Hole, Wyo. speech later this week to provide clues regarding the central bank's evaluation of the economy, and at what point it thinks additional stimulus would be needed.

Stock index futures pointed to a market rise of more than 1 percent at the open on Monday following four weeks of equity losses as stocks rebounded globally, led by defensive shares.

Investors tucked into beaten down oil stocks, helping lift Europe's leading shares on Monday after a sharp retreat the previous week, while gold issues drew interest amid lingering worries about global growth.

U.S. stock index futures were more than 1 percent higher on Monday following four weeks of equity losses as stocks rebounded globally, led by defensive shares.

Hurricane Irene hits Puerto Rico and approaches Florida, rebels take over Libya's capital, charges may be dropped against Dominique Strauss-Kahn and more in Monday's daily scoop.

Now that her wedding is over, Kim Kardashian might do the nation a favor and advise Obama on how to get the country out of its economic slump.

Miners helped Britain's bruised FTSE 100 stage a recovery on Monday, with Randgold Resources boosted by bullish gold prices and broker comment, and Anglo American up as it considered a bid for Australia's Macarthur Coal.

Gold prices rallied toward $1,900 an ounce on Monday as concerns over the global economic outlook fueled interest in the precious metal as a haven from risk and due to talk that weak U.S. growth could spark a further round of monetary easing.

Brent crude fell almost $2 on Monday toward $106 a barrel with traders and investors anticipating the resumption of oil exports from OPEC-member Libya as a six-month civil war there appeared close to an end.

Japan will take decisive action against any speculative moves in the currency market, Finance Minister Yoshihiko Noda said, signaling Tokyo's readiness to intervene to stem further yen rises after its spike to a record high last week.

Brent crude dropped more than $3 on Monday to below $106 a barrel, while U.S. oil fell more than a dollar to below $82, on the potential for a resumption of exports from OPEC-member Libya as a six-month civil war there appeared close to an end.

Brent crude dropped more than $3 on Monday to below $106 a barrel, while U.S. oil fell more than a dollar to below $82, on the potential for a resumption of exports from OPEC-member Libya as a six-month civil war there appeared close to an end.

World stocks fell toward a recent 11-month low on Monday while the euro and oil prices slipped as concerns about a global economic downturn prompted investors to sell risky assets.

European stocks extended four weeks of losses on Monday, tracking jittery Asian shares lower, while gold shot to new highs as investors worried about the sluggish U.S. economic outlook and Europe's festering debt crisis.

European stocks looked set to extend four weeks of losses Monday, tracking jittery Asian shares lower, while gold shot to new highs as investors worried about the sluggish U.S. economic outlook and Europe's festering debt crisis.

European stocks looked set to extend four weeks of losses on Monday, tracking jittery Asian shares lower, while gold shot to new highs as investors worried about the sluggish U.S. economic outlook and Europe's festering debt crisis.

Brent crude dropped by more than $2 on Monday to around $106 a barrel on the potential for a resumption of exports from OPEC member Libya as a six-month civil war there appeared close to an end.

Jittery Asian stocks surrendered early gains and turned lower on Monday, adding to last week's steep losses, while gold shot to new highs as investors worried about the sluggish U.S. economic outlook and Europe's festering debt crisis.