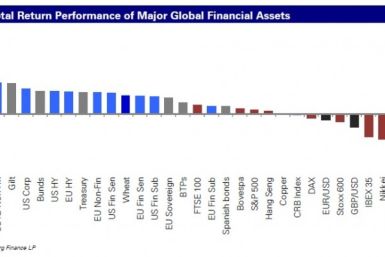

A report out Thursday morning by Jim Reid, head of Global Fundamental Credit Strategy, noted the global financial crisis is five years old today, tracing the beginning of the world's economic troubles to August 9, 2007.

European markets fell Wednesday as investors remained concerned that there were no monetary easing measures from policymakers to boost the economy even after the increasing debt burden faced by the euro zone.

In a press conference Thursday, European Central Bank President Mario Draghi warned "it's pointless to go short on the euro." The suggestion was lampooned. It turns out, Draghi isn't the only one with that recommendation

ECB President Mario Draghi was in policy hell Thursday after disappointing market-watchers at what was the most anticipated and important press conference of his career as a monetary policy leader.

Most of the European markets rose Thursday amid hope that the European Central Bank would announce stimulus measures later in the day to boost the faltering euro zone economy.

Most of the European markets rose Wednesday amid optimism among investors that the European Central Bank would announce bold stimulus measures to rejuvenate the economy and regain growth momentum.

Most of the European markets fell Tuesday but investors remained cautious with the hope that the central banks all over the world would soon announce stimulus measures to tackle the weakening global economy.

Most European markets rose Monday amid expectations that the European Central Bank would announce stimulus measures to rejuvenate the euro zone economy.

Next week could see some major worldwide financial implications, depending on what three of the world's largest central banks do at their scheduled meetings.

Most European markets fell Monday amid continuing concerns about the deepening economic conditions in Spain and Greece.

Most European markets rose Wednesday but investors remained cautious as there were no strong hints that the U.S. Federal Reserve will announce more stimulus measures to boost the economic growth.

Tata Motors Ltd. (Bombay: 500570) is looking to its UK luxury car unit, Jaguar Land Rover, to drive global sales growth particularly in emerging markets like Brazil by shifting production of the Freelander out of the UK to free up assembly line space for the popular premium model, the Range Rover Evoque.

Gold experts have further cut back price forecasts for the metal this year after a sluggish first half, a quarterly Reuters poll showed on Monday, while gains in the dollar and a dearth of physical demand are likely to clip any attempted return to last September's record high for the rest of the year.

Most European markets rose Tuesday as investors continued to have hopes that the U.S. Federal reserve will announce more stimulus measures to boost the economic growth.

In long forgotten days, before most bank profits came from risky speculation and taxpayer bailouts and those institutions still lived or died by their ability to attract depositors, customers who opened new checking accounts were often given toasters as tokens of appreciation.

Asian shares crawled higher on Tuesday after sharp losses the day before but gains were limited as investors, worried about a global economic deceleration, waited for Chinese trade data due later in the day that could set the tone for risk appetite.

European markets fell Wednesday, but investors continued to expect that the central banks would coordinate to announce stimulus measures to regain the growth momentum.

The whirlpool created by the European financial crisis is finally dragging American down. That?s the conclusion of some economists, after disappointing manufacturing activity data showed a slight contraction in June.

Most European markets rose Monday as investors were encouraged by the hopeful economic indications from Asia and also the measures taken at the EU summit last week.

European markets rose Friday following encouraging announcements at the European Union summit in Brussels, where EU leaders are tackling the debt crisis threatening the financial union.

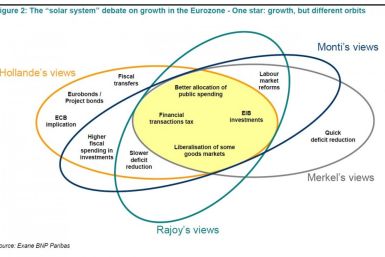

An eye-catching illustration included in a report by BNP Paribas Exane explains why the Continent's leader seem unable to solve the ever-worsening eurozone crisis: in spite of being ostensibly committed to the same goals, top policy-makers disagree on the more aggressive policies most experts believe are needed. It's almost like they're on different planets.

Thursday's downgrade contained a veiled threat that pointed at politicians in Germany, the United Kingdom, France and the United States and plainly stated, Stop talking about making the banks responsible for their own follies -- or else.