European shares hit a one-week closing high on Tuesday after encouraging comments from some leading U.S. companies and hopes for more policy easing in China gave cyclical stocks a boost, with autos and miners among the top sectoral gainers.

European shares rose on Tuesday, with miners gaining after aluminum producer Alcoa got the U.S. reporting season off to a positive start, with its top line indicating strong demand for commodities.

Germany and France warned Greece on Monday it will get no more bailout funds until it agrees with creditor banks on a bond swap and pressed for an early deal to avert a potential default in the Eurozone's most debt-stricken nation.

Samsung Electronics (005930.KS), the world's top maker of memory chips and smartphones, reported a record quarterly profit on Friday, aided by one-off gains and best-ever sales of high-end phones.

Europe's market slid on Thursday, with banks the biggest fallers on worries that some of them will have to follow UniCredit and offer deep share price discounts when they recapitalize to shore up ravaged balance sheets.

European governments have agreed in principle to ban imports of Iranian oil, EU diplomats said Wednesday, dealing a new blow to the Islamic Republic.

The largest shareholders of Middle East jeweller Damas International have appointed a financial adviser ahead of a potential sale of some of their shares, the firm said in a regulatory filing on Wednesday.

Samsung Electronics, the world's top maker of memory chips and smartphones, is set to report a robust quarterly profit rise on Friday, starting 2012 on an upbeat note aided by record-smashing sales of smartphones.

European stocks were higher early Tuesday afternoon, hitting a two-month high on sharp gains in cyclical mining shares, while simmering concerns over the Eurozone crisis sent French and Spanish markets lower.

Out with the old year, in with the new and for investors uncertainty is likely to be the only certainty once more.

South Korea's Samsung Electronics aims to raise its global handset sales by 15 percent next year by boosting its smartphone sales, putting it in a closer race with bigger rival Nokia.

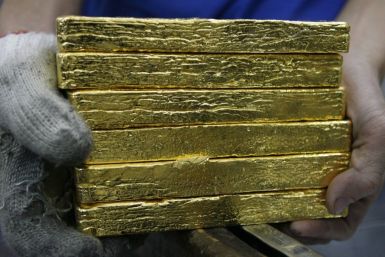

The inflows into gold-backed exchange-traded funds that helped drive bullion demand sharply higher during the financial crisis have more than halved this year, according to Reuters data, and are unlikely to recover in 2012 as appetite grows for other assets.

Nokia's long-awaited Windows phones may be too little, too late in the smartphone war dominated by Apple and Google, despite positive reviews by handset critics.

Bank of Nova Scotia has applied to re-establish a presence in Cuba and a report says rival Royal Bank of Canada is considering a similar move in the wake of Cuban reforms and a thawing of the country's icy relationship with the United States.

Europe's banks borrowed nearly €490 billion or $637 billion from the European Central Bank at its first-ever offer of three-year loans on Wednesday, encouraging demand for the euro and stocks on hopes the funding will ease the two-year old debt crisis. On Wednesday at mid-day, London's FTSE 100 was down 25 points to 5,393, Germany's DAX was down 29 points to 5,819, and France's CAC 40 was off 22 points to 3,033.

At a time of daily stock-market seizures, weekly bank and sovereign debt downgrades and monthly central bank interventions, most people are seeing the glass half empty, and have forecasted bearish -- if not downright abysmal -- market conditions for next year. A look at some of the more salient predictions.

Shares of gold and silver miners soared Tuesday after a surprisingly strong U.S. housing report sparked a global move toward risky assets that lifted equities, commodities and the euro.

European stocks edged up in thin pre-holiday trade on Tuesday at mid-day, boosted by a successful Spanish debt auction and a sharp rise in German business sentiment, though strategists said the continuing euro zone debt crisis would limit any gains.

European markets recorded their worst weekly loss since late November on Friday in a choppy session, as multiple equity derivative contract expiries added to market volatility.

European shares were slightly higher on Friday at mid-day amid thin trading as miners tracked rising metal prices, offset by lingering concerns over the Eurozone debt crisis and reservations ahead of U.S. inflation data.

World stocks rose on Friday after upbeat U.S. data and corporate results, while concerns over the European banking sector and nervousness about potential ratings downgrades in European sovereign debt underpinned German government bonds.

Fitch Ratings, the third-biggest of the major credit rating agencies, downgraded seven global banks based in Europe and the United States, citing "increased challenges" in the financial markets.