Caterpillar Inc. (NYSE: CAT), the world's largest maker of construction and mining equipment, is expected to report strong second-quarter profit as resurgent sales of construction machinery in the U.S. and ongoing global demand for mining equipment offset weakening sales in Europe, China and Brazil. The impact of acquisitions will also play a part.

Fushi Copperweld, Bank of America, Banco Santander, Caterpillar, Citigroup, Research In Motion, Nike and Infosys Ltd are among the companies whose shares are moving in pre-market trading Friday.

So the financial crisis, Europe's inability to act in a big way to address its fiscal issues, and endless partisan bickering in Washington between Democrats and Republicans have prompted you to swear off stocks? Well, one school of thought argues, Panicking never made anyone a dime.

That massive pile of cash corporate America has been sitting on for years is shrinking, and the reason it's declining bodes well for the nation's economy.

Research In Motion's appointment of bankers to advise on drastic options, including an outright sale of the BlackBerry maker, may only hasten moves by major customers to offer their employees smartphones produced by rivals.

European stocks lost big Thursday as Greek banks were cut loose from European Central Bank support and Spain's borrowing costs kept skyrocketing. The head of the International Monetary Fund, Christine Lagarde, also warned today of the extremely expensive consequences of Greece leaving the currency bloc.

Caterpillar Inc. (NYSE: CAT), the largest maker of construction and mining equipment, reported a 29 percent jump in its first-quarter profit that topped analysts' estimates and boosted its full-year outlook, as U.S. builders replaced their aging machinery and demand for mining equipment boomed.

Futures on major US stock indices point to higher opening on Wednesday ahead of the US Federal Reserve?s meeting and durable goods order data.

Caterpillar Inc. (NYSE: CAT), the world's largest maker of construction and mining equipment, is expected to report strong first-quarter profit on mining company demands and consumers' need to replace aging equipment.

General Electric Co topped Wall Street's profit and revenue forecasts for the first quarter, helped by strong demand for energy equipment and railroad locomotives.

Stock index futures pointed to a higher open on Wall Street on Thursday, with futures for the S&P 500 up 0.55 percent, Dow Jones futures up 0.42 percent and Nasdaq 100 futures up 0.59 percent at 3:34 a.m. EDT (0734 GMT).

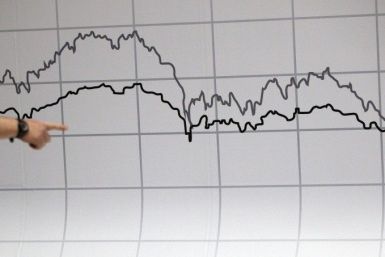

Wall Street felt tremors Tuesday afternoon as the S&P 500 Index, Nasdaq Composite Index and Dow Jones Industrial Average both dropped precipitously following declines in European equity markets.

Stocks fell Wednesday as investors were disappointed by a weaker-than-expected reading on durable goods orders, while a plunge in oil prices dragged energy and material shares lower.

Heavy equipment maker Caterpillar Inc. (NYSE: CAT) is expanding a Chinese manufacturing facility by 80 percent, the U.S. company said Wednesday.

Stocks shot up Tuesday, propelled by a strong U.S. retail sales report, a German investor confidence survey and a statement by the Federal Open Market Committee noting improvement in household and business spending as well as job creation.

The global markets tumbled this week, due in part to concerns about China's slowed economic growth. There are several reasons, however, why China's economic slowdown could actually benefit the U.S., despite the market's immediate reaction. One reason is the possible return of jobs to the United States' manufacturing sector.

U.S. stocks finished Tuesday with the worst one-day decline so far in 2012 as a sell-off spread from Europe driven by fear of a disorderly default in Greece and a slowdown in global economic growth.

U.S. equities sank, mirroring falls across Asia and Europe Monday after China cut its growth target. Worries over whether Greece can entice enough private investors to participate in a bond swap deal also dampened investors' sentiment.

Caterpillar Inc. (NYSE: CAT), the world's biggest heavy machinery maker, will pay about $447 million to Mitsubishi Heavy Industries Ltd. to gain sole control of their joint venture, Caterpillar Japan Ltd.

Borrowing by U.S. companies to buy equipment jumped in January from a year ago, though it slid from December's rush to close loans before year-end, and credit quality improved to pre-recession levels, the Equipment Leasing and Finance Association said on Friday.

Stocks gave up gains on Wednesday as the S&P 500 hit a technical barrier near a nine-month high and Apple shares erased a 3 percent advance.

U.S. stocks gave up gains on Wednesday as the S&P 500 hit a technical barrier near a nine-month high and Apple shares erased a 3 percent advance.