Gold traded lower on Tuesday, under pressure from a stronger dollar, but a surprisingly weak read of U.S. factory activity enabled the euro to claw back some gains, thereby helping the bullion price pare earlier losses.

Congolese state mining firm Gecamines has refused a request from the mines ministry to publish all revised contracts, saying it cannot do so without the permission of firms involved, according to a letter from Gecamines published on the ministry website.

Zambia's central bank slashed its reserve ratios on Tuesday to cut the cost of borrowing for commercial banks and consumers in a bid to stimulate economic growth in Africa's biggest copper producer.

Congolese state mining firm Gecamines has refused a request from the mines ministry to publish all revised contracts, saying it cannot do so without the permission of firms involved, according to a letter from Gecamines published on the ministry website.

President Ollanta Humala, who took office in July, is trying to ramp up social spending to fight poverty without scaring away investors in Peru, one of the world's fastest-growing economies.

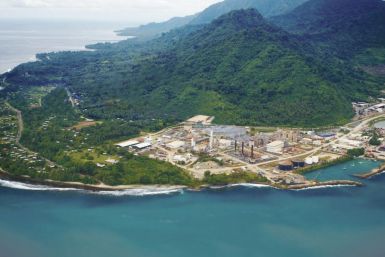

Freeport-McMoRan Copper & Gold Inc said on Tuesday that production and processing rates at its strike-hit Grasberg nine in Indonesia have fallen below levels needed to meet fourth-quarter sales targets.

Stock index futures tumbled on Tuesday as the deal to rescue Greece and prevent a wider sovereign debt crisis faced a new hurdle and as Asian economic data reignited fears of a slowdown in global growth.

Freeport Indonesia will take a month to fix its main sabotage-hit pipeline to take concentrate from the world's second-biggest copper mine to its port, where there are no stockpiles left for shipping.

Researchers found dangerous levels of metals - iron, magnesium, copper, zinc, cadmium, chromium, nickel and lead - across Accra removed from the Agbogbloshie scrap yard where residents burn away plastic to extract metals.

Stocks fell more than 1 percent on Monday as enthusiasm over the agreement to tackle the Eurozone debt crisis waned and a spike in the U.S. dollar hurt commodity-related shares.

Stocks fell at the open on Monday as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

Stocks fell at the open on Monday as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

Stock index futures fell in lackluster volume on Monday, following four weeks of equities gains, as a spike in the U.S. dollar weighed on commodity prices and dried up bids on other risky assets.

Canadian stocks edged higher in early action on Friday, led by a rise in shares of gold and base metal miners, even as fading optimism over a European debt deal weighed on the broader market.

Peru's government will broker talks on Friday between townspeople and U.S.-based miner Newmont in a bid to solve a conflict over the planned $4.8 billion Minas Conga gold mine, officials said.

Andean American Gold Corp., a Toronto-based gold and copper miner, said it was looking to sell or enter into partnerships for some of its properties.

Pay talks between Freeport-McMoRan Copper & Gold and a union representing striking workers at its Indonesia mine are deadlocked after a week of negotiations, the union said on Friday.

Canadian stocks looked set to open lower on Friday after rallying more than 2 percent on Thursday, as the investor optimism that followed Europe's latest debt crisis plan began to fade.

Barrick Gold Corp. said Thursday its third-quarter profit jumped 52 percent as higher prices offset lower production. The world's biggest gold miner also increased its dividend.

World stocks and the euro rose to their highest levels in nearly two months on Thursday after European leaders struck a deal to resolve a two-year-old sovereign debt crisis, which threatens the survival of the single currency.

World stocks and the euro rose to their highest levels in nearly two months on Thursday after European leaders struck a deal to resolve a two-year-old sovereign debt crisis, which threatens the survival of the single currency.

Argentina's oil, gas and mining companies must start repatriating all export revenue, according to an order by President Cristina Fernandez de Kirchner's administration, which is struggling to halt capital flight from the inflation-plagued economy.