Gold jumped more than 1 percent on Friday after Germany's approval for expanding the euro zone bailout fund offered temporary relief to investors, but the precious metal was heading for its worst monthly decline in three years.

Workers at Freeport-McMoRan's Cerro Verde mine in Peru went on strike for better pay on Thursday, but the company said there was no disruption from the mine that supplies 2 percent of the world's copper.

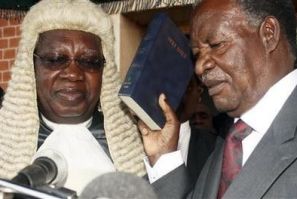

New Zambian President Michael Sata fired his respected central bank governor on Thursday and his new mines minister floated plans to boost tax receipts from mining companies, rattling investors in Africa's biggest copper producer.

Gold prices rose on Thursday in choppy trade, with strong physical demand and gains in the euro lending support, but investors remained cautious towards the precious metal after this month's intense volatility.

Up to 1,500 striking workers at Freeport McMoRan Copper & Gold Inc.'s giant gold and copper mine in Indonesia's remote Papua province protested outside a government office on Thursday, urging authorities to help end a dispute over pay.

Mongolia's quest to renegotiate a 2009 deal to develop the giant Oyu Tolgoi copper-gold deposit might create a crisis of trust for foreign investors, but analysts said the decision could help it through a difficult legislative session starting next week.

Interest in the London Metal Exchange as a takeover target has snowballed and the number of suitors has risen to double digits because business is booming with volumes at record levels, its chief executive Martin Abbott said.

Ardent Mines Ltd. expects to buy mineral rights in north-central Brazil next month, the U.S.-based company said Wednesday.

Caution ahead of an audit of Greece's finances drove major world stock markets lower on Wednesday, while prices of commodities like oil and copper fell.

Mexican miner Minera Frisco, owned by the world's richest man Carlos Slim, said on Tuesday it was cutting its silver and copper hedges for this year and next, citing a significant decline in metals prices.

Gold rose on Wednesday, gaining from investor unease over the lack of a solution to the European debt crisis that dented other more industrial raw materials, such as crude oil and copper, ahead of further possibly weak U.S. data.

Asian stocks edged higher and a rally in the euro stalled on Wednesday, as investors looked for more signs that European leaders were tackling a debt crisis that threatens the financial system before committing bolder market bets

Gold slipped 1 percent in volatile trade on Wednesday as the U.S. dollar regained strength on doubts over the progress of Europe's efforts to tackle the region's debt crisis, while this week's brutal correction also kept investors at bay.

Stocks extended a recent rally and rose more than 2 percent on Tuesday on euro- zone officials' efforts to solidify the region's rescue fund in an attempt to alleviate the debt crisis.

Stocks extended their rally on Tuesday, sparked by Eurozone officials' efforts to solidify the region's rescue fund in an attempt to alleviate the debt crisis.

The top after-market NYSE gainers on Monday are: iSoftStone Holdings, Flotek Industries, Ivanhoe Mines, Chicago Bridge & Iron and Freeport-McMoran Copper & Gold. The top after-market NYSE losers are: CoreSite Realty, Accuride, Carbo Ceramics, RPC and Oil States International.

European stock index futures rose sharply on Tuesday, after Asian shares rebounded from multi-month lows and as the euro clung to gains on hopes that euro zone officials will act to corral Greece's debt woes and prevent a financial meltdown.

Asian shares rebounded and the euro clung to gains on Tuesday on hopes that euro zone officials will act to corral Greece's debt woes and prevent another full-blown banking crisis.

Asian shares rose on Tuesday on hopes that euro zone officials will act to corral Greece's debt woes and prevent another full-blown banking crisis, but the euro failed to hold on to all its gains.

Shares of Ivanhoe Mines fell more than 12 percent on Monday after Mongolia said it plans to renegotiate a landmark deal related to the development of the huge Oyu Tolgoi copper-gold project.

Commodities bounced off lows on Monday after one of the biggest sell-offs since the 2008 financial crisis turned into cautious buying on hopes that Europe would prevent its debt crisis from dragging down the global economy.

Gold will continue to serve as a hedge against risk on a longer-term basis despite recent falls, given the lack of other safe-haven assets to protect investors against global economic uncertainty, a manager at Stenham Asset Management said.