Exxon Mobil CEO Rex Tillerson says his company will invest $185 billion to develop new energy sources intended to help meet growing demand.

Crude oil prices gained in European trade Thursday as better-than-expected ADP jobs report in the U.S. and the progress in the Greek debt swap deal boosted sentiment.

Iran may be cleaning up a suspected nuclear-weapons development site to fool U.N. inspectors, Western officials briefed on satellite intelligence said Wednesday.

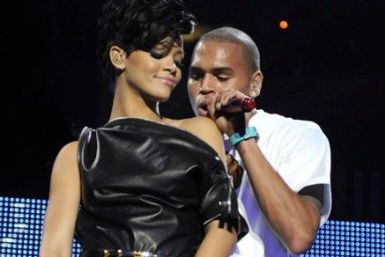

Rihanna and Chris Brown have been making headlines ever since RiRi was spotted exiting her abusive ex-boyfriend's dressing room at the Grammys, looking disheveled and sporting a coy smile.

Futures on major U.S. indices point to a higher opening on Wednesday ahead of economic data including ADP national employment report and non-farm productivity.

Gold regained some ground Wednesday as jewellers in Asia snapped up the metal after prices dropped 2 percent in the previous session, but investors were cautious because of lingering fears about a possible Greek default.

The U.S. Energy Information Administration believes there are 4 billion barrels of proven reserves of oil within U.S. waters of the Gulf of Mexico and more than 12,000 billion cubic feet of natural gas.

U.S. equities sank, mirroring falls across Asia and Europe Monday after China cut its growth target. Worries over whether Greece can entice enough private investors to participate in a bond swap deal also dampened investors' sentiment.

Vladimir Putin declared victory in Sunday's election, but it remains to be seen how much power he'll wield over his country's vast stockpiles of oil and natural gas when he returns to the presidency in May.

South Korea, which has been under U.S. pressure to diversify away from Iranian crude oil, won the right to explore for oil in three undeveloped fields off the United Arab Emirates coast.

The nationwide average of gasoline prices are going north moving towards $4 mark per gallon.

Asian stock markets declined Monday as concerns over the impact of a slowing Chinese economy and tough speech by U.S. President Barack Obama over Iran nuclear program weighed on the sentiment.

Gas prices are a potent weapon in an election year. TransCanada Corp's proposed $7-billion Keystone XL pipeline, which would move 800,000 barrels of oil a day from Alberta, Canada, to the Texas Gulf, has suddenly become an inalienable part in the election rhetoric.

BP and three other energy companies late Friday reached a settlement with thousands of individuals and businesses affected by the 2010 Deepwater Horizon spill that killed 11 workers and fouled the Gulf of Mexico with millions of gallons of oil.

Stocks have proven the naysayers wrong so far in 2012. And the February employment situation summary on Friday could be just the ticket to keep the bulls going next week. Besides the jobs report on Friday, next week brings an ADP private-sector employment report on Wednesday.

Rising liquidity on both sides of the Atlantic boosted global bond prices Friday but equities took a breather after climbing in recent months, in one case to a four-year high, on light volume.

Stocks ticked lower in early trading on Friday in a light day on the economic calendar, but the S&P 500 and Nasdaq were on track to close their eighth positive week in the last nine.

Bank of Japan Governor Masaaki Shirakawa said on Friday he expects consumer prices to gradually rise in the coming years as the economy recovers with support from a pickup in global demand.

Gas prices have risen to above $4 per gallon in many parts of the United States, sending economists into a tizzy about its impact on consumer spending, consumer confidence and the effects it will have on the housing market.

Iran, faced with global trade embargoes and a possible attack by Israel on its nuclear installations, has threatened to close the Strait of Hormuz.

Gold rose 1.5 percent on Thursday, rebounding above $1,700 an ounceas the previous session's 5 percent plunge induced investors to buy at lower prices on hopes the tumble was a healthy correction rather than the start of a bear market.

India's exporters have begun receiving the first rupee payments from Iran, Indian government and trade sources said on Thursday, kicking off a mechanism to skirt Western sanctions which have made doing business with Tehran tougher.