Sen. Bob Casey (D-Pa.) will chair a Congressional hearing next month to examine the effect closing of several refineries serving the East Coast has on gas prices.

Gold edged up on Monday, aided in part by evidence of investor and central bank demand, after having posted its largest weekly fall last week in three months, although greater optimism in the markets over global growth could temper gains in the longer-run.

Gold steadied above two-month lows on Monday, following its largest weekly fall last week in three months, as evidence of investor and central bank demand in recent weeks helped offset the negative impact of a weaker euro.

Consumers didn't get the escape velocity memo, the one that says economic and financial things are getting better and better. A Thomson Reuters/Univ. of Michigan survey released Friday found consumer sentiment down, especially on expectations for the next six months.

Venezuela's state-run oil company will terminate all ventures with Exxon Mobil (NYSE: XOM), the biggest U.S. oil company, when arbitration proceedings conclude, Oil Minister Rafael Ramirez said.

Given the lack of sufficient infrastructure and endless political instability, Sudan’s energy sector faces many monumental challenges.

David Cameron and Barack Obama agree deal to release strategic oil supplies from government-controlled reserves in UK and US.

Stocks surged Thursday, with the S&P 500 topping the 1,400 mark for the first time in nearly four years, propelled by firm readings on the jobs market and manufacturing activities.

The move comes amid a new wave of sanctions designed by the U.S. and EU to further pressure Tehran to halt its alleged development of nuclear weapons.

Britain has decided to cooperate with the United States in a bilateral agreement to release strategic oil stocks, two British sources said, in an effort to prevent high fuel prices from derailing economic growth in an election year.

Surging gasoline prices raised wholesale prices in February by 0.4 percent, less than economists expected but generally in line with the U.S. central bank's broader outlook for inflation, the Commerce Department said Thursday.

President Barack Obama and British Prime Minister David Cameron discussed the possibility of releasing emergency oil reserves during a meeting Wednesday, two sources familiar with the talks said.

Whatever buzz came from the post-FOMC statement and catapulted stocks up on Tuesday turned into a hush Wednesday afternoon. Equities started strong but ended with a whimper.

Stocks shot up Tuesday, propelled by a strong U.S. retail sales report, a German investor confidence survey and a statement by the Federal Open Market Committee noting improvement in household and business spending as well as job creation.

The Federal Reserve officials decided to keep the near-term interest rates unchanged at ultra-low levels but offered few clues about plans for further easing, as highly anticipated, while the Fed noted recent strength in the labor market and that strains have eased in global financial markets.

The U.S. is seeking additional oil output from Saudi Arabia to fill a lack of supply arising from upcoming Iranian sanctions, but likely won't need the boost until July, when the EU plans to embargo Iranian crude oil.

A full-text of the Federal Open Market Committee's statement from March 13 meeting.

The United States is pressing Saudi Arabia to boost oil output to fill a likely supply gap arising from sanctions on Iran, Gulf oil officials said, adding that an increase in production is unlikely to be needed before July.

Stock index futures pointed to a higher open on Wall Street on Tuesday, with futures for the S&P 500 up 0.56 percent, Dow Jones futures up 0.45 percent and Nasdaq 100 futures up 0.54 percent at 0949 GMT.

Amid mounting speculation of potential oil reserves in Sri Lanka's seawaters, Indian media reports have suggested that India might be looking for a greater involvement overstepping China and Russia, who are also believed to be interested in oil exploration deals with the island nation.

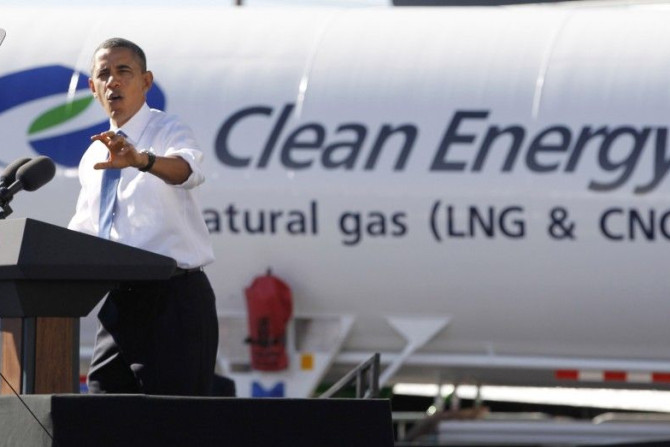

In a presidential progress report published Monday, the U.S. seems poised to meet President Barack Obama's future energy plans as outlined in March of last year.

China's surprisingly big February trade deficit numbers Monday cut into commodity prices and other growth-sensitive securities.