Gold prices fell on Thursday to their lowest level in nearly six months as tight liquidity in the euro zone forced investors to sell the metal, but strong U.S. economic data prompted a stock rally on Wall Street.

European shares advanced on Thursday as upbeat data from the United States helped fuel a low-volume rally in the afternoon, although volatility also rose as investors hedged against lingering uncertainty in the Eurozone.

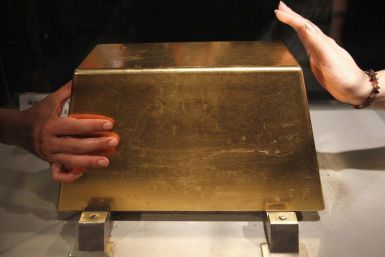

Gold prices Thursday tumbled to levels not seen since last summer, slashing what just weeks ago had been a gain of more than 20 percent this year to less than 10 percent.

European shares steadied on Thursday in low volume as investors remained wary after Italian 10-year bond yields stayed near 7 percent, deemed by many analysts as unsustainable, following a disappointing debt auction.

Japan's benchmark Nikkei slipped on Thursday ahead of an Italian debt sale that could prove challenging in thin volumes, while the euro's tumble against the yen to a 10-year low pressured exporters. Meanwhile, most other Southeast Asian bourses edged higher on Thursday, helped by late bargain-hunting in big caps and dividend-yielding stocks

Italy's borrowing costs fell from recent record highs at a bond auction on Thursday but cautious investors still demanded a near 7 percent yield to buy 10-year debt, a level seen unsustainable over time for the Eurozone's third-largest economy.

Gold prices plunged 1.7 percent Thursday on a strengthening dollar, which was rising ahead of a crucial auction of Italian bonds and fresh worries about Eurozone banks.

Asian stocks fell on Thursday, taking cues from weak U.S. and European shares, as players cut positions heading into the year end with an Italian debt auction later in the day keeping markets nervous.

Gold fell 2 percent to a three-month low on Wednesday, hit by a dollar rally against the euro, a technical sell-off and losses in U.S. equity and commodity markets.

Gold fell more than 1 percent in choppy trade on Wednesday, on track for its biggest one-day decline in two weeks, as a stronger dollar and risk-averse selling across the board also sent equities lower.

Stocks fell about 1 percent on Wednesday on concerns about the economy in early 2012 while the euro hit a fresh 11-month low against the dollar before a key auction of long-dated Italian debt on Thursday.

European shares rose on Wednesday in a low volume rally after investor sentiment was given a boost as short-term debt costs halved at a debt auction in Italy and improved confidence about demand for Thursday's Italian long-term bond sale.

Gold extended its record bull run in 2011 for an 11th year as confidence in the world's financial leaders and their stewardship of fiat currencies plummeted.

With less than two weeks left in 2011, investors are looking at challenges and opportunities ahead to better position themselves for the coming year.

European stocks rose to their highest in two weeks on Friday, tracking Wall Street gains as the U.S., the world's biggest economy, showed further signs of recovery, especially in the labor market.

European shares rose on Thursday, helped by mostly upbeat U.S. economic data, and with banks gaining after taking advantage of cheap finance offered by the European Central Bank.

European shares were higher early Thursday afternoon in low volume that exaggerated movements, with investors hoping a batch of U.S. data would confirm an improving economic picture.

Japan's blue-chip index snapped a two-day winning run on Thursday and met strong resistance near its 25-day moving average, with the machine tools sector weighed down by a brokerage downgrade.

Rising European stocks and a weaker dollar supported gold Thursday, but the yellow metal remained tethered to the previous day's closing price on light volume and a lack of anything that encouraged risk taking.

Technology shares slumped on Wednesday and pushed the Nasdaq down 1 percent after Oracle reported results that cast doubts on the sector's health, even as broader markets closed mostly flat in a thinly traded day.

Gold lost early gains Friday, along with stocks and the euro, as an unexpectedly high number of Eurozone banks queued up for low-interest loans reminded investors of just how widespread Europe's sovereign debt crisis has become.

Europe's markets fell on Wednesday after the large take up rate by banks for cheap European Central Bank loans worried investors about the banks' funding needs and raised doubts they would use the money to buy the region's peripheral debt.