Exxon Mobil Corporation (NYSE: XOM), the world's largest publicly traded oil company, said Thursday its second-quarter profit rose 49 percent, helped by a gain related to divestments and tax items.

Based on a median estimate among analysts polled by Thomson Reuters, ExxonMobil will report earnings of $1.96 a share on revenues of about $115.08 billion -- a decline of 8.3 percent from the year before. The company will post its second-quarter earnings on Thursday at 10 a.m. EDT.

Next week's barrage of earnings releases offers further guidance on the health of U.S. companies.

Next week's barrage of earnings releases offers further guidance on the health of U.S. companies.

China's double-digit growth rate during the financial crisis has been the envy of the world and most people agree that we may have seen the last of the country's miraculous growth. So yes, China's growth is slowing. However, it's too early to get all pessimistic.

China and India are set to sink billions of dollars into Afghanistan, perhaps the world's last great untapped center for natural resources. Where is the U.S.?

With all of its contradictions, Azerbaijan is a complex country to fully figure out: Its tangled friendships and autocratic policies are often puzzling as are its relations with the West. But its obsession with oil is as undiluted and unwavering as anything the country has ever done.

The Exxon Mobil Corp. will abandon its shale gas exploration projects in Poland because the company's test wells did not produce commercial quantities of gas, the daily newspaper Gazeta Wyborcza reported, according to Bloomberg News.

Once reserved for boutique funds catering to religious investors opposed to profiting from weapons, gambling, tobacco or alcoholic beverages, socially responsible investing today has a larger presence, with more assets under management than ever before.

Poland looks to shale exploration, despite concerns over fracking.

Iraqi officials on Tuesday said their country's next oil lease auction will not allow companies to sign contracts with Iraq's semi-autonomous northern region of Kurdistan.

Turkey signed the pipeline deal with the Kurdistan Regional Government (KRG) on Sunday, bypassing the central government in Baghdad.

A month ago, shares of Apple (Nasdaq: AAPL), the world's most valuable technology company, closed at their record high of $628.64. On April 10, they hit their all-time high of $644. Now they are at $570.

The Obama administration will reportedly restrict hydraulic fracturing, or fracking, by promulgating a set of rules governing such practices on federal land.

BP Plc (BP.L) reported a bigger-than-expected profit drop on the back of a fall in production prompted by the need to sell oil fields to pay for the Gulf of Mexico disaster, raising concerns about the oil group's turnaround plan.

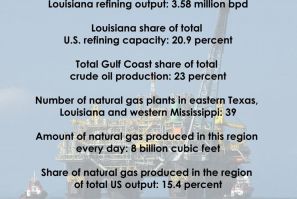

Exxon Mobil Corp has shut the 160,000 barrel-per-day (bpd) North Line crude oil pipeline in Louisiana after a leak spilled 1,900 barrels of crude oil in a rural area over the weekend, affecting a conduit that supplies the nation's third-largest refinery.

Stocks advanced in choppy trade on Thursday as another batch of positive earnings and a strong housing report put equities on track for a third straight day of gains.

Chesapeake Energy (NYSE: CHK), the second-largest producer of natural gas in the United States, announced on Thursday that it was stopping a controversial program that gave its chief executive officer a stake in the company's wells.

Exxon Mobil Corp, the world's largest publicly traded oil company, posted a lower first-quarter profit on Thursday as its oil and natural gas production slumped more than 5 percent, pushing its shares down 1.1 percent premarket.

Natural gas producer Chesapeake Energy Corp said on Thursday it would halt a controversial program that gave company founder and chief executive Aubrey McClendon an ownership stake in its wells.

Exxon Mobil Corporation (NYSE: XOM) will increase its quarterly dividend 21 percent to become the largest corporate dividend payer, according to Standard & Poor's on Wednesday.

According to a survey released this week, oil and natural gas executives and investors think the price of natural gas will remain below $2.50 per 1,000 cubic feet for the rest of the year -- a level that is too low for the industry's growth.