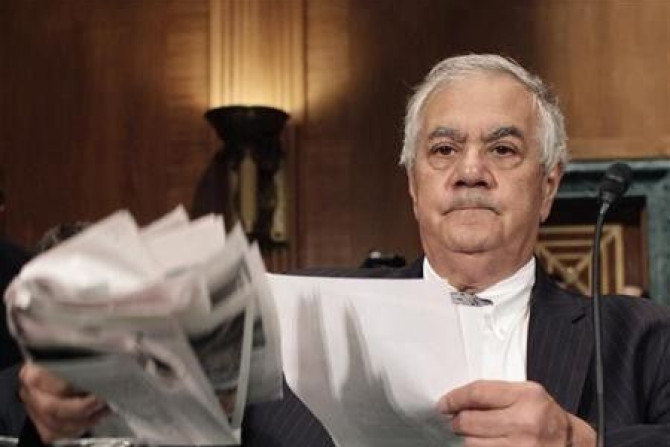

Real estate mogul Sam Zell's Equity Residential is the lead bidder to buy 53 percent of rival company Archstone for over $2.5 billion, the Wall Street Journal reported.

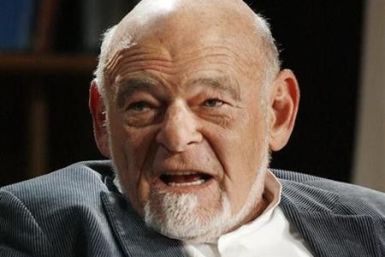

Newt Gingrich earned between $1.6 million and $1.8 million as a consultant for the government-sponsored mortgage company Freddie Mac, far more than the $300,000 contract he disclosed in a recent debate, according to a Bloomberg News investigation. The advice he reportedly gave them contradicts his recent criticisms of the company.

FBR Capital Markets said the broad changes to the Home Affordable Refinance Program (HARP) were outlined by U.S. President Barack Obama's administration on Oct. 24. However, the release of most of the technical details was delayed until Nov. 15.

The Federal Housing Administration, which guarantees around a third of U.S. mortgages, faces dwindling cash reserves and could require a taxpayer bailout, according to a forthcoming study by Joseph Gyourko, a professor at the Wharton School.

Fannie Mae reported a $5.1 billion loss in the third quarter on Tuesday, up from a $2.9 billion loss in the second quarter of 2011, and a $3.5 billion loss in the third quarter of 2010.

The California attorney general on Thursday called on Fannie Mae and Freddie Mac to cut mortgage debt on the loans they own, a suggestion the government entities have long resisted.

FBR Capital Markets believes the amendment to re-raise the loan limits at Fannie Mae and Freddie Mac in high-cost areas will be in the final bill and be enacted into law later this month.

Freddie Mac reported a $4.4 billion loss in the third quarter on Thursday and requested $6 billion in additional aid from the U.S. Treasury Department.

Prosecutors have filed a lawsuit against Allied Home Mortgage Capital Corp and its executives, Jim Hodge and Jeanne Stell, claiming that the company misled the federal Department of Housing and Urban Development (HUD) with bad mortgages.

Fannie Mae's and Freddie Mac's regulator on Saturday rejected criticism he was obstructing a housing recovery by taking too narrow a view of his mission to protect the financial health of the two massive, taxpayer-supported mortgage firms.

The White House said Friday it would conduct an independent review of the U.S. Energy Department's loan portfolio following the collapse of Solyndra, the solar-panel maker that went bankrupt last month after receiving a hefty federal loan guarantee.

A controversial weapon could be deployed soon in the U.S. fight against the housing crisis as states and top banks near a deal in their dispute over mortgage abuses -- cutting the mortgage debt owed by homeowners.

Charles Haldeman Jr., CEO of mortgage giant Freddie Mac, will resign by the end of the year, the organization said on Wednesday.

New single-family home sales rose at their fastest pace in five months in September, a government report showed on Wednesday, but sustained price declines indicated the housing market is far from recovery.

The U.S. government announced Monday that it will revise the Home Affordable Refinance Program (HARP) which would allow underwater homeowners to refinance their mortgages. But will the HARP overhaul affect the housing market and the economy at a whole? Here are 5 things you need to know about HARP.

U.S. homeowners who owe more than their properties are worth got new help on Monday when a U.S. regulator expanded a government program in a step that could help up to one million borrowers.

President Barack Obama will tout newly unveiled measures on Monday aimed at aiding struggling homeowners and easing the U.S. housing crisis on the first leg of a campaign-style swing through western states crucial to his re-election in 2012.

A leading housing regulator on Monday announced changes to a government refinancing program that could help up to one million homeowners whose homes are worth less than their mortgage.

President Barack Obama will unveil new measures to help struggling homeowners on Monday in the first leg of a campaign-style swing through western states that may be crucial to his re-election in 2012.

President Barack Obama this week will announce a series of actions to help the economy that will not require congressional approval, including an initiative to make it easier for homeowners to refinance their mortgages, a White House official said.

Homeowners who owe more than their houses are worth will get new help to refinance in a government plan to be unveiled as early as Monday to support the battered housing sector, sources familiar with the effort said.

Under the proposed terms of the settlement -- which could total $25 billion -- banks would get a broader relief from potential state civil lawsuits in exchange for refinancing underwater loans, those mortgages where borrowers owe more than their homes are worth, sources said.