The U.S. central bank lowered its forecast for economic growth this year, but it reiterated its expectations for unemployment. Further, the bank said it now expects the Fed's first interest rate hike to take place in 2015.

The Federal Reserve will begin buying more than $80 billion of securities per month in the third attempt at stimulating the U.S. economy by boosting the central bank's balance sheet.

In the statement, the Federal Reserve announced Thursday it will buy $40 billion per month of mortgage-backed securities, the start of the so-called third round of quantitative easing, QE3. The Fed also said it will continue 'Operation Twist,' bringing total securities purchased per month to $85 billion.

Here are two places to get a live stream of the news conference that Ben Bernanke, the chairman of the Federal Reserve, will hold today following the conclusion of a two-day meeting by the central bank's rate-setting committee.

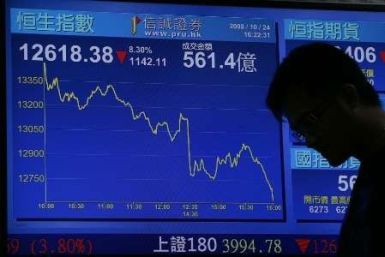

Asian stock markets were mixed Thursday as investors opted for caution ahead of the U.S. Federal Reserve's policy announcement later in the day.

The U.S. stock index futures point to a lower open Thursday as investors maintained a cautious mode ahead of the Federal Reserve meeting in which there is the likelihood of another round of quantitative easing measures to be announced to invigorate the economy.

Most of the European markets fell Thursday as investors remained watchful waiting for the U.S. Federal Reserve to announce stimulus measures to revive the economic growth.

Most of the Asian markets made gains Thursday as investors remained hopeful waiting for the policymakers in the U.S. to announce monetary easing measures to boost the global economy and rejuvenate the economic growth momentum.

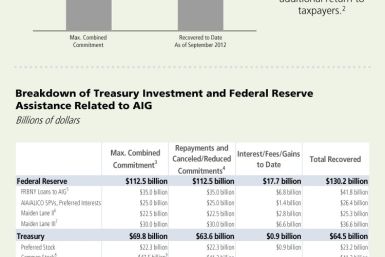

The U.S. government went into a full-throated propaganda offensive Tuesday in an effort to show that the highly controversial 2008 bailouts of American International Group, Inc. (NYSE: AIG) were profitable.

Market bulls charged on Wednesday -- running U.S. stock futures, European stocks, the euro, oil and gold higher -- in the wake of a German court ruling that backs the country's participation in the euro zone's new bailout fund created to prevent the weakest euro economies from going bust. However, some economists warn that it's too early to sound the all-clear on the fate of the single currency bloc.

Markets have been talking about QE3 for two years. Now, after a sovereign credit downgrade, the near collapse of the European financial system, and facing an anemic recovery that has only marginally helped heal the carnage in the labor and housing markets, the vast majority of financial pundits believe QE3 this week is "pretty much a given."

The U.S. stock index futures point to a higher open Wednesday as investor confidence was underpinned by expectation that the Federal Reserve will announce stimulus measures this week to invigorate the economy and boost growth.

Asian stock markets rose Wednesday as investors remained hopeful that policymakers in the U.S. and China would announce monetary easing measures to boost the global economy and rejuvenate economic growth momentum.

Asian shares edged higher Wednesday as investors remained cautiously optimistic that a German court would approve the legality of the euro zone's bailout fund later in the day and the U.S. Federal Reserve may deliver further stimulus measures this week.

If, as one analyst expects, Apple sales of its new iPhone 5 -- estimated to cost about $600 each -- reaches 8 million, it could boost the GDP of the U.S. by half a percentage point.

Foreclosed properties in the U.S. cause only a modest decline on the home prices of nearby properties, and the effects go away a year after the distressed property is resold, according to a working paper by the National Bureau of Economic Research.

Asian stock markets declined Tuesday as investors opted for caution ahead of key events including German court ruling on ESM constitutionality and the U.S. Federal Reserve policy meeting later this week.

The U.S. stock index futures pointed to a higher open Tuesday as investor sentiment turned positive amid hopes that the Federal Reserve would announce monetary easing measures this week to revive the economic growth momentum.

The twin towers of New York's World Trade Center destroyed on Sept. 11, 2001 were designed by Japanese-American architect Minoru Yamasaki. Just before he started work on it, he designed Robertson Hall, home of the Woodrow Wilson School, on the Princeton University campus. which has an uncanny resemblance to its former associates.

Asian stock markets ended with gains last week after the European Central Bank (ECB) announced plan to reduce borrowing costs of struggling euro zone countries’ and news that Chinese regulators had approved another batch of infrastructure projects, which should stabilize and restore growth in the world's second largest economy. Market participants’ are likely to focus on Federal Open Market Committee (FOMC) interest rate decision on September 13th.

Paul Volcker, the former Federal Reserve chairman and a great proponent of new bank regulations, was a key enabler in the rise and eventual collapse of Fannie Mae, the government-sponsored enterprise focused on mortgage financing, according to a new book.

It's been three years since the Great Recession technically ended, and still, unemployed Americans are struggling to find work.