With a massive rally marking the end of his latest long-shot presidential bid, the Texas Republican demonstrated that his supporters will be making their presence known at the Republican National Convention in Tampa.

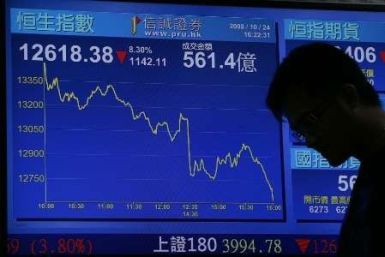

Asian stock markets ended lower Monday as concerns over the Chinese economic slowdown offset the expectations for more stimulus measures from the policy makers around world.

U.S. stock index futures point to a mixed open Monday as investors remained cautious waiting for the Federal Reserve to announce monetary easing measures to revive economic growth momentum.

Most of the European markets fell Monday as investors remained watchful waiting for policymakers around the world to announce stimulus measures to boost the faltering global economy.

Most of the Asian markets fell Monday as investors' concerns about the faltering global economy undermined the expectations for stimulus measures from China and the U.S. Federal Reserve.

Most Asian markets ended on a negative note last week as disappointing economic reports on China and the euro zone revived concerns over the floundering global economy while the lack of stimulus measures from policymakers also weighed.

Most of the Asian markets fell in the week as investor confidence was dragged down by the lack of stimulus measures from policymakers to support the global economy and regain growth momentum.

Each week, we pick the biggest, most dramatic, or most interesting winners and losers in money and business. Our picks for Aug. 19-24 include the Federal Reserve Bank of New York and Eli Lilly & Co. on one side, and ZeekRewards and Best Buy Co. Inc. on the other side.

The Federal Reserve has room to deliver additional monetary stimulus to boost the U.S. economy, Fed Chairman Ben Bernanke told a Congressional oversight panel in a letter.

Asian stock markets declined Friday as hopes for a strong policy action from the U.S. Federal Reserve faded and disappointing economic reports on China and the euro zone revived concerns over the faltering global economy.

Asian shares retreated from a two-week high Friday on scaled back expectations of more stimulus from the U.S. Federal Reserve and growth concerns after manufacturing surveys from the euro zone and China depicted a bleak outlook.

Lubbock County Judge Tom Head became the talk of the Internet on Thursday, warning of a civil war if President Barack Obama is re-elected. But he isn't the only Texas official to have made an outrageous statement. President George W. Bush and Rick Perry are loaded with some of their own.

An unofficial gauge of human misery in the U.S. is now sitting at its lowest level in three years. Not four. In other words, while conditions have improved somewhat, Americans are still feeling miserable under President Barack Obama's watch and that obviously doesn't bode well for Obama's re-election chances.

Most of the Asian markets rose Thursday amid hopes that the U.S. and China would soon announce stimulus measures to tackle the weakening global economy.

The U.S. stock index futures point to a higher open Thursday as investor sentiment was lifted by expectations that policy makers around the world would announce monetary easing measures to regain the economic growth momentum.

The top after-market NYSE gainers Wednesday were Western Asset Mortgage, SunTrust Banks, Best Buy Co, Trinity Industries and Krispy Kreme Doughnuts. The top after-market NYSE losers were Guess?, Inc, International Rectifier, Hewlett-Packard, Big Lots and Whitestone REIT.

Asian stock markets were mostly higher Thursday after details from the Federal Reserve's most recent policy meeting suggested that the central bank might act again to bolster the U.S. economy.

Asian shares rose and the euro hit a seven-week high Thursday as the Federal Reserve's minutes raised the prospect for more U.S. stimulus while uncertainty continued over progress in Europe's debt crisis, including the European Central Bank's bold action.

The RNC's 2012 platform calls for annual audits of the Federal Reserve, bans all legal recognition of same-sex couples, and prohibits abortion in cases of rape and incest.

Is the U.S. economy headed for a recession before it fully recovers from the last one? There's no better indicator to watch than trash.

Gold on Wednesday hovered near a 3-1/2 month high hit in the previous session, as investors remained hopeful the European Central Bank would soon take action to contain the region's debt crisis.

Ben Bernanke received an unlikely defense of his work at the U.S. Federal Reserve by a top Mitt Romney adviser, who said on Tuesday that he should be considered for a third term as chairman