Copper prices have outperformed the overall metals market as traders have closed short selling in expectation of government intervention to boost growth, but the metal may still be slightly overvalued, according to a Monday report by Barclays.

U.S. stock index futures point to a higher open Tuesday as investor sentiment turned positive on expectations for new U.S. Federal Reserve stimulus measures.

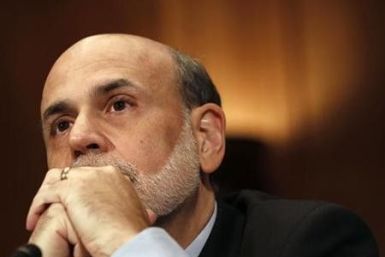

Asian stock markets advanced Tuesday as investor await Federal Reserve Chairman Ben Bernanke's semi-annual testimony before Congress for hints about further easing.

Crude oil prices slightly advanced Tuesday as investors awaited testimony from Federal Reserve Chairman Ben Bernanke for hints about further easing.

Most European markets rose Tuesday as investors continued to have hopes that the U.S. Federal reserve will announce more stimulus measures to boost the economic growth.

Asian markets were rose Tuesday as investors continued to be hopeful that central banks all over the world would soon announce stimulus measures to tackle the weakening global economy.

Asian shares paused Tuesday as investors awaited Federal Reserve Chairman Ben Bernanke's view on the U.S. economy later in the day, after weak U.S. retail sales and a lower International Monetary Fund global growth forecast raised hopes of more stimulus from the Fed.

The chief executive of New York-based Citigroup Inc. (NYSE:C) had a surprisingly confident outlook for his bank's future business prospects during a conference call with analysts Monday.

U.S. stock index futures point to lower opening Monday as investor sentiment was dragged down by worries of global economic growth continuing to falter.

Dennis Lockhart, president of the Federal Reserve Bank of Atlanta, said Friday he might support more central bank attempts to stimulate the nation's moribund economy.

Emails and phone communications released by the Federal Reserve on Friday show that an economist with the central bank who was told as August 2007 that one of the world's most important interest rates was being manipulated did not understand that rate.

U.S. wholesale prices unexpectedly rose in June for the first time in four months, as higher food costs offset another big drop in energy prices.

Asian stock markets plunged Thursday as unexpected interest rate cut in South Korea fueled concerns over global economic slowdown and the Federal Reserve offered no strong hints about another round of quantitative easing.

U.S. stock index futures pointed to a lower opening Thursday as investor sentiment continued to be dragged down by weak global economic conditions.

Most European markets fell Thursday as investor sentiment continued to be negative over increasing concerns of the faltering global economic situation and deepening debt burden of the euro zone.

Crude oil prices lowered slightly and hovered above $85 a barrel in Asian trade Thursday, as investors opted for caution ahead of the Chinese GDP data.

Asian shares barely budged Thursday as the U.S. Federal Reserve appeared to put off taking more aggressive stimulus steps until economic conditions worsen, offering investors few reasons to take risks with second-quarter earnings painting a globally gloomy picture.

Newly released minutes of the U.S. Central bank's June 19-20 Federal Open Market Committee meeting were being taken by the stock market as indicating unwillingness to engage in further monetary easing.

U.S. stock index futures point to higher opening Wednesday, but investors remain watchful amid concerns that the sluggish global economy and the euro zone debt burden will hurt the earnings of companies.

It's going to be very, very dovish.

The Federal Reserve Bank of New York may have known as early as August 2007 that the setting of global benchmark interest rates was flawed. Following an inquiry with British banking group Barclays Plc (NYSE: BSC) in the spring of 2008, it shared proposals for reform of the system with British authorities.

Most Asian markets rose this week as investor confidence was boosted by expectations of stimulus measures from central banks globally to regain the economic growth momentum.